filmov

tv

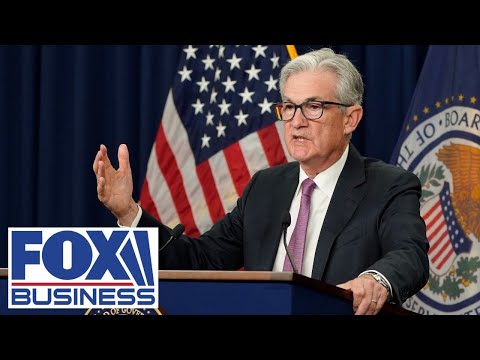

Fed chair Jerome Powell: Not raising interest rates anytime soon

Показать описание

Federal Reserve Chairman Jerome Powell affirmed his commitment to keeping interest rates low for the foreseeable future even as he expressed hope for a strong economic recovery.

“When the time comes to raise interest rates, we’ll certainly do that, and that time, by the way, is no time soon,” the central bank chief said Thursday during a Q&A session presented by Princeton University.

During the wide-ranging discussion, Powell spoke about how the Fed handled the challenges brought on by the Covid-19 pandemic as well as his expectations for what is ahead.

In its most recent policy statement, issued in December, the policymaking Federal Open Market Committee said it would keep an accommodative stance until it sees “substantial further progress” towards is employment and inflation goals.

On the employment mandate, Powell stressed the Fed’s new approach to inflation in which it will not raise rates even if unemployment falls below levels that historically would have been considered a warning sign for pricing pressures ahead.

“That wouldn’t be a reason to raise interest rates, unless we start to see inflation or other imbalances that would threaten the achievement of our mandate,” he said.

One such imbalance would be inflation. In recent days, a few Fed officials have cautioned that inflation could move up sooner than the Fed expects and might force the removal of some policy accommodation sooner than committee members have forecast.

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Комментарии

0:00:33

0:00:33

0:05:59

0:05:59

0:03:15

0:03:15

0:01:29

0:01:29

0:10:22

0:10:22

0:03:03

0:03:03

0:03:29

0:03:29

0:02:29

0:02:29

0:05:09

0:05:09

0:00:32

0:00:32

0:03:50

0:03:50

0:04:16

0:04:16

0:03:57

0:03:57

0:02:21

0:02:21

0:08:19

0:08:19

0:02:41

0:02:41

0:03:09

0:03:09

0:01:36

0:01:36

0:05:16

0:05:16

0:02:21

0:02:21

1:41:56

1:41:56

0:03:41

0:03:41

0:03:12

0:03:12

0:03:01

0:03:01