filmov

tv

ITC is to be reversed on Financial Credit Note or Not? Legal view point and Important Advance Ruling

Показать описание

AUTHORITY FOR ADVANCE RULING, ANDHRA PRADESH

IN RE: M/S. VEDMUTHA ELECTRICALS INDIA PRIVATE LIMITED

Dated: - 26-5-2023

#Reversal #credit #GST credit #Tax invoice #supplier #commercial #requirement #gst

#ITC proportionately #commercial #discount #recipient #supply #taking ITC #

IN RE: M/S. VEDMUTHA ELECTRICALS INDIA PRIVATE LIMITED

Dated: - 26-5-2023

#Reversal #credit #GST credit #Tax invoice #supplier #commercial #requirement #gst

#ITC proportionately #commercial #discount #recipient #supply #taking ITC #

8 Situation for ITC ( Input Tax Credit ) Reversal in GST | ITC Reversal in GST

ITC Reversal under GST | ITC Reverse kab karni hoti he? ITC Reversal Statement in GST

Important Case -Interest & Penalty not leviable on wrongly availed ITC, reversed without utiliza...

GSTR 9 - How to fill Table 7 for FY 2023 24 | Details of ITC reversed and Ineligible ITC for the FY

What is the rule for the reversal of ITC on capital goods? |input tax credit | #gst #inputtaxcredit

ITC Reversal & Re-Claim Statement | Understand the New GST Ledger and its impact on GST Filing

ITC reversal in gstr 9 | ITC reversal in annual return | return extra amount of ITC in gstr9

ITC in special cases | Reversal of ITC | GST #viral #trending

Final Paper 5: ITL | Topic: Input Tax Credit | Session 2 | 28 Dec, 2024

ITC Reversal is required on discounts | commercial credit note | kya ITC reverse ho sakta hai

GST LESSON - WHAT IS ITC REVERSAL AND INELIGIBLE ITC?

New Report ITC reversal Opening Balance in GST | How to add opening balance of ITC in new ledger

How I reverse excess ITC in gst?

Changes in Table 4 of GSTR 3B Reporting of ITC availment, Reversal and Ineligible ITC wef Aug 2022

ITC ko without interest kab or kaise reverse Kiya ja sakta hai ❓❓ #itc #interest #credit

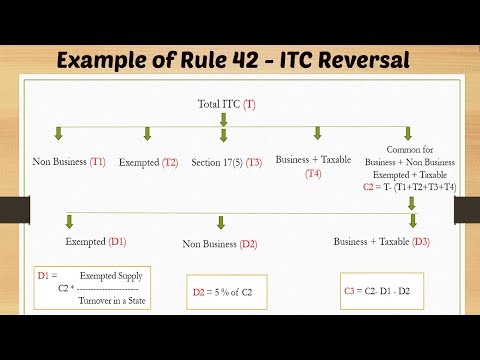

Examples of Rule 42- ITC Reversal

35. GST - ITC - ITC on Capital Goods and its reversal

GST ITC 180 REVERSAL EXCEL TRACKER / GST ITC NOT PAID 180 DAYS REVERSAL CALCULATION IN EXCEL/IF USE

ITC Reversal & Re-Claim Statement | New GST Portal Ledger | ft @skillvivekawasthi

ITC Reversal under GST | Input Tax Credit

How to Handle Reversal of ITC under Rule 42 and 43 of GST with regards to Input & Capital Goods

No need to reverse ITC for non payment within 180 days

ITC is to be reversed on Financial Credit Note or Not? Legal view point and Important Advance Ruling

RCM | ITC in RCM | RCM under GST | Reverse charge mechanism#shorts #youtubeshorts

Комментарии

0:07:46

0:07:46

0:19:45

0:19:45

0:07:45

0:07:45

0:08:35

0:08:35

0:00:45

0:00:45

0:23:04

0:23:04

0:07:28

0:07:28

0:00:59

0:00:59

3:01:29

3:01:29

0:00:58

0:00:58

0:05:12

0:05:12

0:11:22

0:11:22

0:04:35

0:04:35

0:00:11

0:00:11

0:00:45

0:00:45

0:12:31

0:12:31

0:04:37

0:04:37

0:08:43

0:08:43

0:12:52

0:12:52

0:02:53

0:02:53

0:18:02

0:18:02

0:12:07

0:12:07

0:09:09

0:09:09

0:00:49

0:00:49