filmov

tv

ITC Reversal under GST | Input Tax Credit

Показать описание

To know more about ITC reversal and to calculate the ITC reversal under various rules, please click on the below link:

In certain situations, even if the basic conditions for claiming ITC is satisfied, ITC claimed must be reversed. Reversal of ITC means the credit of inputs utilised earlier would now be added to the output tax liability, effectively nullifying the credit claimed earlier. Depending upon when such reversal is done, payment of interest may also be required.

The following are a few special conditions where you have to reverse the ITC, when:

1. Recipient fails to pay consideration to the supplier within 180 2. days from the date of issue of the invoice.

2. Inputs used to make an exempt supply.

3. Inputs used for non-business purposes.

4. GST registration is cancelled

5. ITC availed on ‘blocked credits’.

6. Inputs used in goods were lost, destroyed, stolen, etc.

7. Inputs used in goods given out as free samples

Calculation of ITC reversal under various rules:

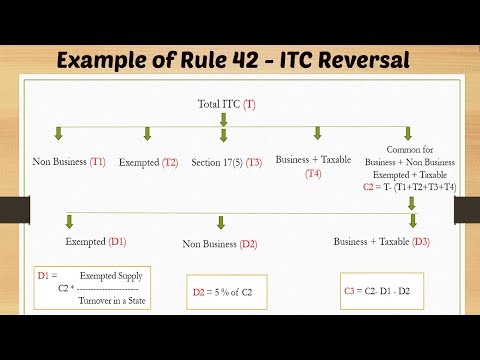

Rule 42: Reversal of ITC on inputs/input services

Rule 43: Reversal of ITC on capital goods

Rule 44: Reversal of ITC in case of cancellation of GST registration or switches to composition scheme

#ITCreversal #InputTaxCredit #CGSTRule42 #CGSTRule43 #CGSTRule44

In certain situations, even if the basic conditions for claiming ITC is satisfied, ITC claimed must be reversed. Reversal of ITC means the credit of inputs utilised earlier would now be added to the output tax liability, effectively nullifying the credit claimed earlier. Depending upon when such reversal is done, payment of interest may also be required.

The following are a few special conditions where you have to reverse the ITC, when:

1. Recipient fails to pay consideration to the supplier within 180 2. days from the date of issue of the invoice.

2. Inputs used to make an exempt supply.

3. Inputs used for non-business purposes.

4. GST registration is cancelled

5. ITC availed on ‘blocked credits’.

6. Inputs used in goods were lost, destroyed, stolen, etc.

7. Inputs used in goods given out as free samples

Calculation of ITC reversal under various rules:

Rule 42: Reversal of ITC on inputs/input services

Rule 43: Reversal of ITC on capital goods

Rule 44: Reversal of ITC in case of cancellation of GST registration or switches to composition scheme

#ITCreversal #InputTaxCredit #CGSTRule42 #CGSTRule43 #CGSTRule44

ITC Reversal under GST | ITC Reverse kab karni hoti he? ITC Reversal Statement in GST

8 Situation for ITC ( Input Tax Credit ) Reversal in GST | ITC Reversal in GST

ITC Reversal & Re-Claim Statement | Understand the New GST Ledger and its impact on GST Filing

New Report ITC reversal Opening Balance in GST | How to add opening balance of ITC in new ledger

How I reverse excess ITC in gst?

ITC Reversal under GST | Input Tax Credit

ITC Reversal & Re-Claim Statement | New GST Portal Ledger | ft @skillvivekawasthi

GST LESSON - WHAT IS ITC REVERSAL AND INELIGIBLE ITC?

Mastering GST Compliance: A Practical Webinar with CA Sachin Jain

Examples of Rule 42- ITC Reversal

GST ITC REVERSAL ON SCRAP U/S 17(5)(h)

GST ITC Reversal and Reclaimed | Electronic Credit Reversal and Re-claimed statement in Tamil| GST

BIG TENSION FOR GST TAXPAYERS IN ITC REVERSAL|GST ITC REVERSAL FOR CAPITAL GOODS

Claim ITC on Capital Goods under GST | Computing Common credits under GST | ITC Reversal | Rule 43

How to calculate ITC Reversal under Rule 42 & 43?

#101. ITC REVERSAL UNDER SEC 42 & 43 IN TALLY PRIME & GST 3B ( IN HINDI)

Reversal of ITC in case of Capital Goods | Loss Assessment | Insurance Claims | CA Varun Soni

ITC Reversal *Shifting to Composition Scheme*

ITC reversal in gstr 9 | ITC reversal in annual return | return extra amount of ITC in gstr9

GSTR 3B Latest Changes Aug-2022 Tamil |ITC Reversal and Reclaim| Rules-38,42,43 & Sec 17(5)16(4)

Retention money | ITC reversal required under Section 16(2) and Rule 37 of GST law | Interpretation

ITC Reversal under GST | Basis and Accounting | RJR Professional Bulletin

Analysis of Audit Observation of GST Department || ITC reversal under rule 37(3) Rule of 180 Days

ITC Reversal As Per Rule 43 | Rule 43 of CGST Rules | Common ITC of Capital Goods Under GST Rule 43

Комментарии

0:19:45

0:19:45

0:07:46

0:07:46

0:23:04

0:23:04

0:11:22

0:11:22

0:04:35

0:04:35

0:02:53

0:02:53

0:12:52

0:12:52

0:05:12

0:05:12

0:48:16

0:48:16

0:12:31

0:12:31

0:11:07

0:11:07

0:11:00

0:11:00

0:05:18

0:05:18

0:04:52

0:04:52

0:12:59

0:12:59

0:02:56

0:02:56

0:08:13

0:08:13

0:21:40

0:21:40

0:07:28

0:07:28

0:11:48

0:11:48

0:02:11

0:02:11

0:09:51

0:09:51

0:08:15

0:08:15

0:08:49

0:08:49