filmov

tv

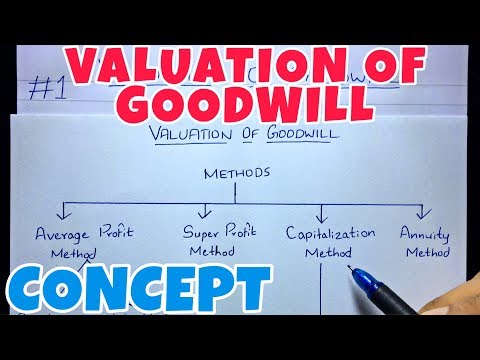

What is Goodwill? | Understanding Intangible Assets

Показать описание

In this one I answer a subscriber question which was to explain what Goodwill is, how it fits within the category of intangible assets and how to approach it as a long term investor.

If you have any topics you’d like me to cover in an upcoming video, then leave your suggestions down below!

-------

YOUNG INVESTORS PODCAST

-------

WANT TO SUPPORT THE CHANNEL?

-------

WANT SOME READING MATERIAL?

-------

FOLLOW ME ON INSTAGRAM

LIKE ME ON FACEBOOK

FOLLOW ME ON TWITTER

EMAIL ME

-------

MICROPHONE

CAMERA

LIGHTING

-------

Disclaimer:

The information in this video is general information only and should not be taken as constituting professional advice from Hamish Hodder.

Hamish Hodder is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information relates to your unique circumstances.

Hamish Hodder is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this video.

Комментарии

0:06:24

0:06:24

0:09:11

0:09:11

0:04:52

0:04:52

0:05:44

0:05:44

0:05:16

0:05:16

0:01:53

0:01:53

0:02:31

0:02:31

0:00:54

0:00:54

0:05:35

0:05:35

0:14:50

0:14:50

0:00:58

0:00:58

0:01:00

0:01:00

0:11:00

0:11:00

0:10:08

0:10:08

0:12:35

0:12:35

0:27:30

0:27:30

0:22:53

0:22:53

0:00:17

0:00:17

0:01:16

0:01:16

0:04:28

0:04:28

0:17:29

0:17:29

0:00:41

0:00:41

0:00:59

0:00:59

0:01:07

0:01:07