filmov

tv

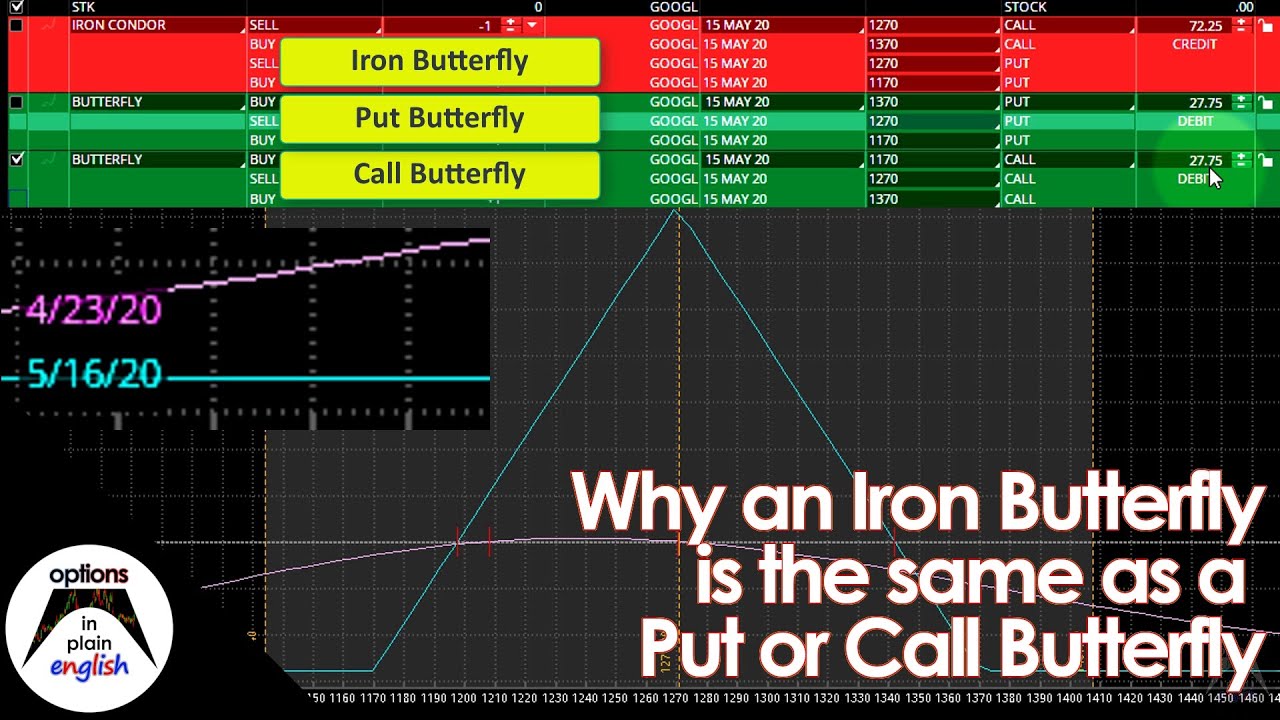

Why an Iron Butterfly is the same as a Put or Call Butterfly

Показать описание

In this lesson we'll analyze an Iron Butterfly, a Put Butterfly and a Call Butterfly on the thinkorswim platform and we'll see how all of them are synthetically equivalent positions.

-------------------------------------

Sign up to my new course: "Advanced Options Trading in plain English" on Udemy.

Take advantage of a special introductory price and start learning advanced options trading concepts and techniques in clear and simple terms.

Also, don't forget to test your progress as you complete the course by taking the related quiz after each section

-------------------------------------

Sign up to my new course: "Advanced Options Trading in plain English" on Udemy.

Take advantage of a special introductory price and start learning advanced options trading concepts and techniques in clear and simple terms.

Also, don't forget to test your progress as you complete the course by taking the related quiz after each section

Iron Butterfly Options Strategy Explained - Full Example on $JPM

What Happened to Iron Butterfly?

How to Trade the Butterfly - The Core Strategy of Our Trading Desk

Why an Iron Butterfly is the same as a Put or Call Butterfly

What's The Difference Between An Iron Butterfly And An Iron Condor? [Episode 372]

Ultimate Guide To Trading And Iron Butterfly Spread

Long Iron Butterfly Option Strategy

Iron Butterfly Trading Strategy / What is an Iron Butterfly?

Yes and the Legacy of Jon Anderson

+99% Profit in 2 Hours with this Options Strategy - IRON BUTTERFLY Options Strategy made easy

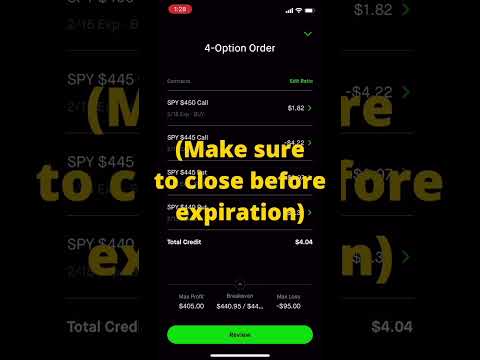

$400 Weekly Income with Iron Butterfly Options Strategy

0-DTE - Exploring the Iron Butterfly Trade

Butterfly Vs. Iron Butterfly

100X Your Money With This Options Strategy | Iron Butterfly

Iron Butterfly Management: Close In Full Or Just Inside Legs? [Episode 520]

How to Trade the Iron Fly Strategy | Options Trading Concepts

AN IRON BUTTERFLY WITH GUARANTEED PROFIT? | EP. 141

Unknown Facts of IRON BUTTERFLY

Reverse Iron Butterfly Options Strategy Explained - Full Example on $AAPL

Why I've Traded A Lot More Iron Butterflies During Low IV Markets [Episode 172]

How To Enter An Iron Butterfly Trade

Short Iron Butterfly Options Strategy (Best Guide w/ Examples)

Iron Butterfly (Ironfly): Theta Gang Strategy #7 I r/wallstreetbets

Iron Condor vs Iron Butterfly - which option trading strategy should you use #shorts #trading

Комментарии

0:11:46

0:11:46

0:11:10

0:11:10

0:10:04

0:10:04

0:13:10

0:13:10

0:03:01

0:03:01

0:09:13

0:09:13

0:14:23

0:14:23

0:19:25

0:19:25

0:03:44

0:03:44

0:08:24

0:08:24

0:00:54

0:00:54

0:05:20

0:05:20

0:06:27

0:06:27

0:06:52

0:06:52

0:05:06

0:05:06

0:11:38

0:11:38

0:12:03

0:12:03

0:17:31

0:17:31

0:11:19

0:11:19

0:06:48

0:06:48

0:05:49

0:05:49

0:20:47

0:20:47

0:12:19

0:12:19

0:01:00

0:01:00