filmov

tv

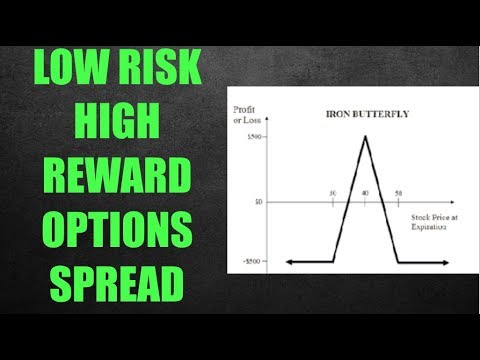

Iron Butterfly (Ironfly): Theta Gang Strategy #7 I r/wallstreetbets

Показать описание

#wallstreetbets #robinhood #stocks #options #wsb #tastytrade

Iron butterflies, also called ironflies, are a great way to take advantage of IV Crush or Theta Decay when the Short Straddle is outside your personal risk tolerance. Iron butterflies offer a great way for even small accounts to get in on the action by using limited-risk credit spreads.

To set an iron butterfly:

Sell-to-open 1x call at an at-the-money strike

Sell-to-open 1x put at an at-the-money strike

Buy-to-open 1x call at a higher strike

Buy-to-open 1x put at a lower strike

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

Bored and dying to trade when the market is closed? Get in on Coinbase Earn for literally free money and to trade on weekends!

_______________________________________________

Get literally free money from Coinbase Earn, up to $186. Support the channel and get free money by using these referrals!

_______________________________________________

My favorite finance and investing books:

Iron butterflies, also called ironflies, are a great way to take advantage of IV Crush or Theta Decay when the Short Straddle is outside your personal risk tolerance. Iron butterflies offer a great way for even small accounts to get in on the action by using limited-risk credit spreads.

To set an iron butterfly:

Sell-to-open 1x call at an at-the-money strike

Sell-to-open 1x put at an at-the-money strike

Buy-to-open 1x call at a higher strike

Buy-to-open 1x put at a lower strike

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

_______________________________________________

Bored and dying to trade when the market is closed? Get in on Coinbase Earn for literally free money and to trade on weekends!

_______________________________________________

Get literally free money from Coinbase Earn, up to $186. Support the channel and get free money by using these referrals!

_______________________________________________

My favorite finance and investing books:

Комментарии

0:12:19

0:12:19

0:12:31

0:12:31

0:17:49

0:17:49

0:09:38

0:09:38

0:12:02

0:12:02

0:14:40

0:14:40

0:08:24

0:08:24

0:15:46

0:15:46

0:05:53

0:05:53

0:21:38

0:21:38

0:28:57

0:28:57

0:16:44

0:16:44

0:10:50

0:10:50

0:10:58

0:10:58

0:05:49

0:05:49

0:06:53

0:06:53

0:03:55

0:03:55

0:16:41

0:16:41

0:01:01

0:01:01

0:07:46

0:07:46

0:03:59

0:03:59

0:07:52

0:07:52

0:06:03

0:06:03

0:04:57

0:04:57