filmov

tv

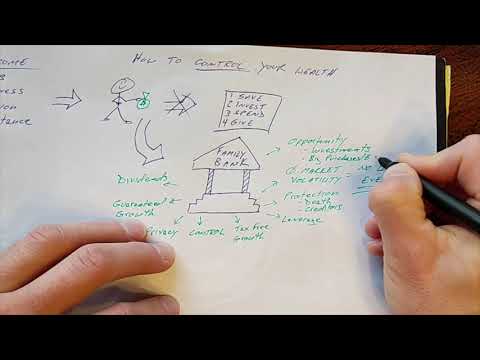

Infinite Banking Strategy | The Money Multiplier

Показать описание

We’re excited to present this informative video from The Money Multiplier’s Hannah Kesler. Hannah Kesler is the daughter of The Money Multiplier’s founder Brent Kesler. Hannah shares her father’s passion for helping people map out the journey to wealth. In this video Hannah lays out some best practices for designing a policy that are important to understand when using the Infinite Banking Concept and becoming your own banker.

00:08 Premiums

00:20 Banking Concept

00:32 Compounding Interest

1:16 Growth

How long do I have to pay my premium for?

It’s a question we get all the time. Our first answer is this: why would you ever want to? With the power of uninterrupted compound interest, the money you can take out of your policy as a loan grows every year! It’s like handing someone ten dollars and they hand you back fifteen. Our advice? Never stop making that exchange. Over time your amount available for loan is going to far exceed the amount you put into the policy as a base premium. We encourage you to just keep going.

If you want to keep your policy open, you are required to pay the base premium. However, there are options if you want to stop putting money into the policy. With a Reduced Paid Up policy, you can keep your same level of death benefit and the cash value in the policy simply rolls over and pays for your base premium itself. It’s like putting your policy on autopilot. Doing this ensures that your policy stays open and that the base premium is covered without you having to continually deposit money into the policy. If you have a term rider, paying for that is also required.

With the Infinite Banking Concept, you can own your own system of privatized banks. You do this by investing in dividend paying whole life insurance policies with mutual companies. Don’t worry, it’s not as confusing as it sounds. With this system of Becoming Your Own Banker, instead of depositing money into a traditional bank, you deposit it into your own banking system that you’ve created using whole life insurance policies. When you need to make a purchase, instead of borrowing form the bank, you borrow against the cash value of your policy.

Not sure? The Infinite Banking Concept is a tried and true practice. It’s been around for over 200 years and has been used by individuals and companies for a long, long time. The Infinite Banking Concept isn’t something The Money Multiplier came up with. It’s been used and discussed by the wealthy for years, and as popularized by Nelson Nash. With the Money Multiplier, we take the tools that already exist and teach you how to use them to grow your wealth. We show you how to control your own money, build a legacy, keep money in the family, and achieve complete financial freedom.

00:08 Premiums

00:20 Banking Concept

00:32 Compounding Interest

1:16 Growth

How long do I have to pay my premium for?

It’s a question we get all the time. Our first answer is this: why would you ever want to? With the power of uninterrupted compound interest, the money you can take out of your policy as a loan grows every year! It’s like handing someone ten dollars and they hand you back fifteen. Our advice? Never stop making that exchange. Over time your amount available for loan is going to far exceed the amount you put into the policy as a base premium. We encourage you to just keep going.

If you want to keep your policy open, you are required to pay the base premium. However, there are options if you want to stop putting money into the policy. With a Reduced Paid Up policy, you can keep your same level of death benefit and the cash value in the policy simply rolls over and pays for your base premium itself. It’s like putting your policy on autopilot. Doing this ensures that your policy stays open and that the base premium is covered without you having to continually deposit money into the policy. If you have a term rider, paying for that is also required.

With the Infinite Banking Concept, you can own your own system of privatized banks. You do this by investing in dividend paying whole life insurance policies with mutual companies. Don’t worry, it’s not as confusing as it sounds. With this system of Becoming Your Own Banker, instead of depositing money into a traditional bank, you deposit it into your own banking system that you’ve created using whole life insurance policies. When you need to make a purchase, instead of borrowing form the bank, you borrow against the cash value of your policy.

Not sure? The Infinite Banking Concept is a tried and true practice. It’s been around for over 200 years and has been used by individuals and companies for a long, long time. The Infinite Banking Concept isn’t something The Money Multiplier came up with. It’s been used and discussed by the wealthy for years, and as popularized by Nelson Nash. With the Money Multiplier, we take the tools that already exist and teach you how to use them to grow your wealth. We show you how to control your own money, build a legacy, keep money in the family, and achieve complete financial freedom.

0:04:27

0:04:27

0:23:07

0:23:07

0:21:22

0:21:22

0:09:17

0:09:17

0:07:29

0:07:29

0:47:24

0:47:24

0:12:04

0:12:04

2:15:24

2:15:24

0:00:52

0:00:52

0:58:10

0:58:10

0:11:28

0:11:28

0:10:19

0:10:19

0:05:42

0:05:42

0:56:42

0:56:42

0:40:28

0:40:28

0:12:33

0:12:33

0:05:16

0:05:16

0:43:35

0:43:35

1:35:01

1:35:01

0:01:28

0:01:28

1:12:09

1:12:09

0:04:09

0:04:09

0:05:38

0:05:38

0:00:16

0:00:16