filmov

tv

The Theory of Banking (by Hans-Hermann Hoppe) - Introduction to Austrian Economics, 4of11

Показать описание

Recorded September 2005, Klampenborg - Denmark.

Courtesy of Copenhagen Institute and Liberator.

Download podcasts of this lecture series:

Hans-Hermann Hoppe

Ludwig von Mises Institute

--

Courtesy of Copenhagen Institute and Liberator.

Download podcasts of this lecture series:

Hans-Hermann Hoppe

Ludwig von Mises Institute

--

The Theory of Banking.

Banking Explained – Money and Credit

Three Theories of Banking

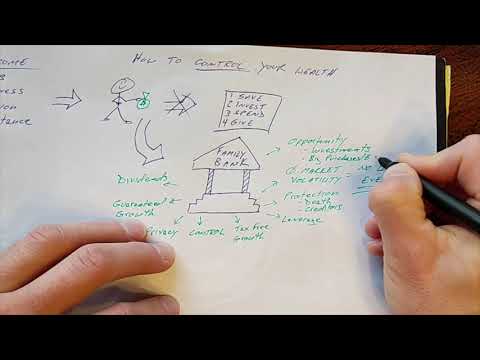

The Infinite Banking Concept explained

The Theory of Banking (by Hans-Hermann Hoppe) - Introduction to Austrian Economics, 4of11

Banking 1 | Money, banking and central banks | Finance & Capital Markets | Khan Academy

Colloquium on the future of central banking - Session 1: Macro-finance theory and models

How the Banking System Really Works - Joe Rogan

Cooperative Banks vs Commercial Banks | UKSSSC ADO Commerce | Theory + MCQ | Part-1 (Unit-3) |

How do banks actually create money? We explain

Economics of Money and Banking, Lectures 1-6 of 12

This Is How Banking System Works !

How Banks Create Money - Macro Topic 4.4

The Theory of Central Banking | Robert P. Murphy

How Commercial Banks Really Create Money (the Money Multiplier is a MYTH).

History of Banking: From Origins to Evolution

Economics of Banking - 1

A Deeper Look Into The Infinite Banking Concept

Banks don't lend money, they create it: Demystifying monetary and banking terminology

Theory & Banking Lesson 1

The Credit Creation Theory of Banking & Inflation.

The Mystery of Banking | Joseph T. Salerno

Money and Banking - Monetary Policy Theory

My IBPS clerk 2024 SCORECARD 🥲💔 #ibps #ibpsclerk #ibpsclerkexam #ibpsclerkmains #ibpsclerkpre #bank...

Комментарии

0:40:20

0:40:20

0:06:10

0:06:10

0:05:26

0:05:26

0:04:27

0:04:27

1:07:13

1:07:13

0:11:49

0:11:49

0:42:48

0:42:48

0:00:55

0:00:55

0:42:34

0:42:34

0:01:00

0:01:00

6:19:07

6:19:07

0:00:55

0:00:55

0:04:12

0:04:12

1:33:40

1:33:40

0:13:18

0:13:18

0:00:53

0:00:53

1:31:31

1:31:31

0:59:33

0:59:33

0:27:43

0:27:43

0:08:56

0:08:56

0:00:49

0:00:49

0:03:04

0:03:04

0:27:30

0:27:30

0:00:11

0:00:11