filmov

tv

💰GET IN EARLY! 8 Best ETFs Under $100 - Ultimate PROFIT 2024

Показать описание

Best Low Cost ETF, Best Cheap ETF, ETF under $100 for your investing portfolio! #etfinvesting #growthetf #dividendetf

Other Videos You'll Enjoy!

*All content on my YouTube channel reflects my own opinions and should NOT be taken as legal advice, financial advice or investment advice. Please be safe and seek out guidance of professionally trained and licensed individuals before making any decisions. DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

Other Videos You'll Enjoy!

*All content on my YouTube channel reflects my own opinions and should NOT be taken as legal advice, financial advice or investment advice. Please be safe and seek out guidance of professionally trained and licensed individuals before making any decisions. DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel so I can continue to provide you with free content each week!

💰GET IN EARLY! 8 Best ETFs Under $100 - Ultimate PROFIT 2024

Get overpowered early in FINAL FANTASY 8 REMASTERED with THIS method!

More POWER in Final Fantasy 8 Remastered - Getting EVEN MORE OP Early! Part 2

[Solo Leveling: Arise] 8 Best Tips for Early game | Beginner's Guide | Improve your Account

8 BEST Armor Sets You Can Get EASY Early Game To Make You OP - Elden Ring Guide

The Best Early Game Power! | All The Mods 8 EP2

Shadow of the Erdtree - Get ALL 8 New Weapons EARLY FAST - Best Weapon Location Guide - Elden Ring!

The Best Starting Locations for Satisfactory 1.0!

Top 8 Purple Luffy Returned?! (OP-7.5!) | Bandai Card Fest Dallas!

Missed Nvidia??? 300% Upside Get In Early! Top 4 Stocks Set To Explode Like Nvidia

Why My Father's Last Words Convinced Me To Retire Early

Overpowering Early in Final Fantasy 8 Remastered with EASY HOLY MAGIC FARMING!

The BEST Single and Combo Uses for MAGIC SNACKS!

REMNANT 2 | Get Your Character “OVERPOWERED” Early On

8 BEST Early Game Starter Farms You WILL NEED! Minecraft Bedrock Edition

The Surge 2 - Overpowered in 8 Minutes - VULTR Armor Set + Best Early Game Weapon

Elden Ring | 8 Awesome Ash of War You Can Get Early!

How to use a Fetal Doppler | Tips & Tricksfinding heartbeat early 8 9 weeks sounds sonoline use ...

Starfield - 8 Best Weapons To Get Early (Highest Damage Guns)

GOT EM EARLY !!! These Jordans Look WAY BETTER in Person !

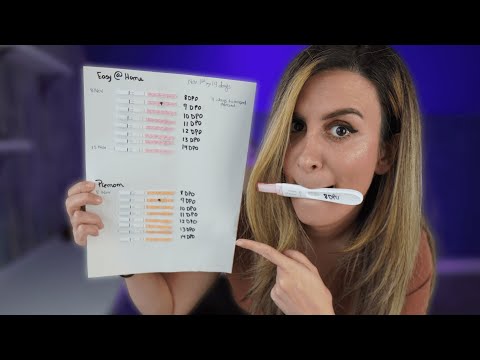

Pregnancy Test Line Progression | Positive at 8 DPO- 14 DPO | Cheapest Early Detection Tests

Top 8 REITs for HUGE DIVIDENDS (Retire Early with Passive Income)

Mbappe Strikes Early: 8 Second Goal Challenge

Elden Ring Easy To Get Somber Smithing Stone 8 Best Early Game Location

Комментарии

0:12:09

0:12:09

0:15:06

0:15:06

0:09:54

0:09:54

![[Solo Leveling: Arise]](https://i.ytimg.com/vi/5mTvvr2xNso/hqdefault.jpg) 0:11:21

0:11:21

0:21:56

0:21:56

0:20:04

0:20:04

0:10:29

0:10:29

0:09:11

0:09:11

0:12:17

0:12:17

0:10:17

0:10:17

0:11:43

0:11:43

0:05:08

0:05:08

0:08:35

0:08:35

0:12:28

0:12:28

0:09:48

0:09:48

0:08:28

0:08:28

0:07:24

0:07:24

0:09:53

0:09:53

0:07:07

0:07:07

0:08:01

0:08:01

0:04:54

0:04:54

0:13:10

0:13:10

0:00:14

0:00:14

0:03:06

0:03:06