filmov

tv

Quantum Computing for Finance | D-Wave Webinar

Показать описание

Multiverse Computing worked with major banks like BBVA and Bankia to solve real world problems in finance using a D-Wave quantum computers. In a project with Bankia, they tackled the problem of dynamic portfolio optimization - determining the optimal trading trajectory for an investment portfolio of assets over a period of time, taking into account transaction costs and other possible constraints. This problem, well-known to be NP-Hard, is central to quantitative finance.

Referenced Papers

Referenced Papers

Quantum computing in Financial Services

The Future of Finance: How Quantum Computing is Changing the Game

Quantum Computing for Finance

Michio Kaku: Quantum computing is the next revolution

What is Quantum Computing?

Quantum Computing and Finance with Dr. Thomas Ankenbrand

The Map of Quantum Computing - Quantum Computing Explained

Azure Quantum & Ally Financial: Quantum Computing in the financial sector

Quantum Computing In 5 Minutes | Quantum Computing Explained | Quantum Computer | Simplilearn

Quantum Computing for Finance | D-Wave Webinar

🌐 Quantum Financial System (QFS): Revolutionizing Finance or Conspiracy Theory?

Quantum Computing in Financial Industry | DataHour by Saurabh Pramanick

JP Morgan Chase's Dr. Marco Pistoia at QWC 2023: Quantum Computing for Financial Services

Quantum Computing for Finance with Mphasis | D-Wave Webinar

Quantum Computing for Finance

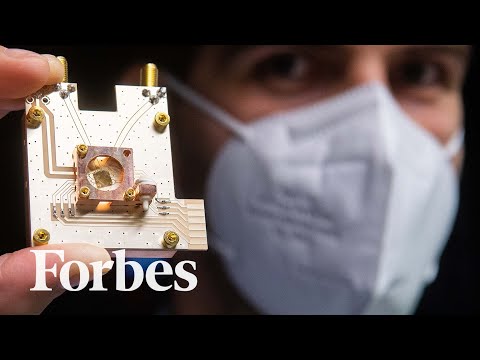

Quantum Computers Could Change Everything - Here's What You Should Know In Under 4 Minutes | Fo...

David Isaac - Quantum Computing In Finance

Quantum Computing for Finance | QuEra Quantum Insights

Quantum Computing Will Be Bigger Than AI! What You Need To Know!

Quantum Computing | Marcos López de Prado | Exponential Finance

Using quantum computers in financial risk analysis | ZDNet

A beginner's guide to quantum computing | Shohini Ghose

Quantum Computing in Finance

Quantum Computing Financial Modeling

Комментарии

0:02:01

0:02:01

0:55:26

0:55:26

1:21:51

1:21:51

0:11:18

0:11:18

0:07:01

0:07:01

0:05:03

0:05:03

0:33:28

0:33:28

0:01:55

0:01:55

0:04:59

0:04:59

0:05:03

0:05:03

1:03:12

1:03:12

0:22:28

0:22:28

1:00:16

1:00:16

0:57:49

0:57:49

0:04:01

0:04:01

0:30:26

0:30:26

0:02:41

0:02:41

0:24:26

0:24:26

0:29:02

0:29:02

0:05:06

0:05:06

0:10:05

0:10:05

0:04:59

0:04:59

0:02:16

0:02:16