filmov

tv

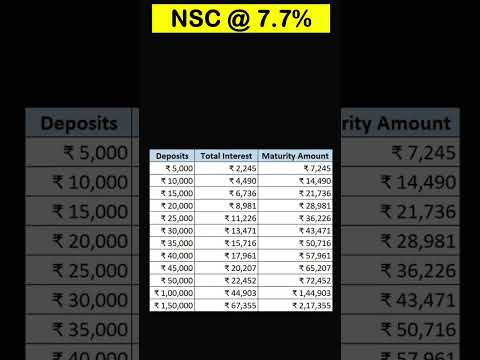

NSC scheme 2022/NSC post office scheme/national savings certificate details/interest rate/calculator

Показать описание

National Savings Certificates (NSC)

5 Years National Savings Certificate (VIII Issue)

Interest rate:

From 01.04.2020, interest rates are as follows:-

6.8 % compounded annually but payable at maturity.

Deposit amount:

INR 1000/- grows to INR 1389.49 after 5 years

Minimum of Rs. 1000/- and in multiples of Rs. 100/- No Maximum Limit

Who can open :-

(i) a single adult

(ii) Joint Account (up to 3 adults)

(iii) a guardian on behalf of minor or on behalf of person of unsound mind

(iv) a minor above 10 years in his own name.

(b) Deposit:-

(i) Minimum Rs. 1000 and in multiple of Rs. 100 , no maximum limit.

(ii) Any number of accounts can be opened under the scheme.

(iii) Deposits qualify for deduction under section 80C of Income Tax Act.

(c) Maturity:-

The deposit shall mature on completion of five years from the date of the deposit.

(d) Pledging of account:-

(i) NSC may be pledged or transferred as security, by submitting prescribed application form at concerned Post Office supported with acceptance letter from the pledgee.

(ii) Transfer/pledging can be made to the following authorities.

The President of India/Governor of the State.

RBI/Scheduled Bank/Co-operative Society/Co-operative Bank.

Corporation (public/private)/Govt. Company/Local Authority.

Housing finance company.

(e) Premature closure:-

NSC may not be prematurely closed before 5 years except the following conditions : -

(i) On the death of a single account, or any or all the account holders in a joint account

(ii) On forfeiture by a pledgee being a Gazetted officer.

(iii) On order by court.

(f) Transfer of account from one person to another person.:-

NSC may be transferred from one person to another person on the following conditions only.

(i) On the death of account holder to nominee/legal heirs.

(ii) On the death of account holder to joint holder(s).

(ii) On order by the court.

(iii) On pledging of account to the specified authority.

Queries solved in this video:

1)NSC scheme 2022

2)NSC post office scheme

3)national savings certificate details

4)NSC interest rate

5) NSC calculator

Key words:

nsc scheme,

nsc scheme in post office,

nsc scheme in post office 2022,

nsc scheme in post office in telugu,

all about nsc scheme,

post office scheme nsc calculator,

post office nsc scheme details,

nsc certificate,

post office new scheme 2022 nse,

nsc scheme post office,

postal nsc scheme,

nsc investment,

nsc saving scheme

Note:

Posting any content from this channel is all are about my personal views.These videos are intended only for informational purpose or educational purpose.This channel do not promote any products discussed herein.Viewers are subjected to use this information on their own risk.Please contact experts before taking any decisions.

Disclaimer :

5 Years National Savings Certificate (VIII Issue)

Interest rate:

From 01.04.2020, interest rates are as follows:-

6.8 % compounded annually but payable at maturity.

Deposit amount:

INR 1000/- grows to INR 1389.49 after 5 years

Minimum of Rs. 1000/- and in multiples of Rs. 100/- No Maximum Limit

Who can open :-

(i) a single adult

(ii) Joint Account (up to 3 adults)

(iii) a guardian on behalf of minor or on behalf of person of unsound mind

(iv) a minor above 10 years in his own name.

(b) Deposit:-

(i) Minimum Rs. 1000 and in multiple of Rs. 100 , no maximum limit.

(ii) Any number of accounts can be opened under the scheme.

(iii) Deposits qualify for deduction under section 80C of Income Tax Act.

(c) Maturity:-

The deposit shall mature on completion of five years from the date of the deposit.

(d) Pledging of account:-

(i) NSC may be pledged or transferred as security, by submitting prescribed application form at concerned Post Office supported with acceptance letter from the pledgee.

(ii) Transfer/pledging can be made to the following authorities.

The President of India/Governor of the State.

RBI/Scheduled Bank/Co-operative Society/Co-operative Bank.

Corporation (public/private)/Govt. Company/Local Authority.

Housing finance company.

(e) Premature closure:-

NSC may not be prematurely closed before 5 years except the following conditions : -

(i) On the death of a single account, or any or all the account holders in a joint account

(ii) On forfeiture by a pledgee being a Gazetted officer.

(iii) On order by court.

(f) Transfer of account from one person to another person.:-

NSC may be transferred from one person to another person on the following conditions only.

(i) On the death of account holder to nominee/legal heirs.

(ii) On the death of account holder to joint holder(s).

(ii) On order by the court.

(iii) On pledging of account to the specified authority.

Queries solved in this video:

1)NSC scheme 2022

2)NSC post office scheme

3)national savings certificate details

4)NSC interest rate

5) NSC calculator

Key words:

nsc scheme,

nsc scheme in post office,

nsc scheme in post office 2022,

nsc scheme in post office in telugu,

all about nsc scheme,

post office scheme nsc calculator,

post office nsc scheme details,

nsc certificate,

post office new scheme 2022 nse,

nsc scheme post office,

postal nsc scheme,

nsc investment,

nsc saving scheme

Note:

Posting any content from this channel is all are about my personal views.These videos are intended only for informational purpose or educational purpose.This channel do not promote any products discussed herein.Viewers are subjected to use this information on their own risk.Please contact experts before taking any decisions.

Disclaimer :

Комментарии

0:09:49

0:09:49

0:06:18

0:06:18

0:07:17

0:07:17

0:08:39

0:08:39

0:09:59

0:09:59

0:07:59

0:07:59

0:06:17

0:06:17

0:05:21

0:05:21

0:05:27

0:05:27

0:05:40

0:05:40

0:08:01

0:08:01

0:09:11

0:09:11

0:05:13

0:05:13

0:08:37

0:08:37

0:00:34

0:00:34

0:08:39

0:08:39

0:11:16

0:11:16

0:11:23

0:11:23

0:04:50

0:04:50

0:03:49

0:03:49

0:16:00

0:16:00

0:03:46

0:03:46

0:05:51

0:05:51

0:08:01

0:08:01