filmov

tv

Current Account in Partnership (General Ledger) | Full Example

Показать описание

In this accounting lesson, we explain what the current account for a partnership is, and why we complete it. We also go through an example of how to do the current account for partners in the general ledger (T Account) of the partnership and how to close off/balance off the account. We calculate interest on capital, interest on current account, interest on drawings, and partner's share of remaining profits in the appropriation account.

Check out other straight-forward examples on our channel.

We also offer one-on-one tutorials at reasonable rates.

Connect with us:

Check out other straight-forward examples on our channel.

We also offer one-on-one tutorials at reasonable rates.

Connect with us:

Current Account in Partnership (General Ledger) | Full Example

INTRODUCTION TO PARTNERSHIP ACCOUNTS

Grade 11 Accounting Exam Paper 1 | Partnership Financial Statements | Current accounts part 1 2024

Partnership Current Accounts Walkthrough with T Accounts ( AAT level 3 ) - AAT financial statements

FINAL ACCOUNTS OF A PARTNERSHIP (PART 1)

Appropriation Account - Partnership (General Ledger) | FULL Example

Financial Accounting N5 Partnerships | Income Statement | Appropriation Statement | Current Accounts

Partnership Appropriation Account

From Divorce Papers to Billionaire Hacker: The Ultimate Revenge Story | Rich Manhwa Recap

Saving account Vs Current account | Difference & Benefits | Hindi

Current Account Vs Savings Account Telugu - Difference Between Current & Savings Accounts | Kows...

FINAL ACCOUNTS OF PARTNERSHIP (PART 2)

REVALUATION OF PARTNERSHIP ASSETS (ADMISSION OF A NEW PARTNER)

How to Prepare Partners' Current Account? | Partner's Current Account Format in hindi

Statement of Changes in Equity for Partnership | FULL EXAMPLE

Fundamentals - Partnership | Capital account | Current Account | Part 5 | CBSE | ISC | State boards

Partnerships 3 - GENERAL JOURNAL ENTRIES

Accounting for IGCSE - Video 31 - Financial statements of Partnerships

Current account note Grade 11

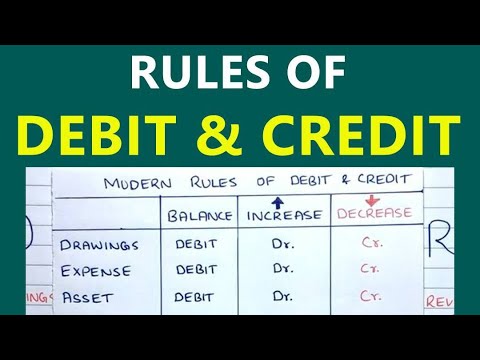

Rules of Debit and Credit - DEALER Trick - Saheb Academy

PARTNERSHIP - FINANCIAL ACCOUNTING(APRIL 2022 Q3)

ADMISSION OF A PARTNER + GOODWILL VALUATION (PART 1)

Partnerships | Appropriation accounts | 14 worked examples | CSEC PoA

Getting a bank account for a general partnership #allupinyobiz #shorts #businesstips #smallbusiness

Комментарии

0:15:44

0:15:44

0:07:02

0:07:02

0:15:26

0:15:26

0:11:16

0:11:16

0:27:34

0:27:34

0:13:35

0:13:35

0:42:30

0:42:30

0:10:14

0:10:14

18:14:28

18:14:28

0:05:52

0:05:52

0:09:03

0:09:03

0:39:06

0:39:06

0:33:21

0:33:21

0:07:47

0:07:47

0:23:46

0:23:46

0:16:44

0:16:44

0:05:36

0:05:36

0:16:35

0:16:35

0:18:26

0:18:26

0:04:14

0:04:14

0:36:05

0:36:05

0:27:30

0:27:30

0:44:41

0:44:41

0:00:34

0:00:34