filmov

tv

Derivatives Expert Reveals How To Profit Huge From A Market Crash

Показать описание

Derivatives Expert Reveals How To Profit Huge From A Market Crash

INTERVIEW: Derivatives Expert Reveals Shocking Market Risks CNBC Ignores

Derivatives Expert Gives Dire Stock Market Warning

Derivatives EXPERT Reveals Simplification Secrets

Calculus Experts Reveal the Best Way to Learn Derivatives Fast

BingX Derivatives Expert Shares Top Futures Trading Secrets

The Reality of the Derivatives Market

2 Game Changing Derivative Rules & How to Remember Them | Outlier.org

SMIFS Limited Expert Reveals Daily Market Outlook | November 25 2024!

How To Do Derivatives Trading On BYBIT (The Complete Guide For Beginners)

SMIFS Limited Expert Reveals Daily Market Outlook | November 26 2024!

SMIFS Limited Expert Reveals Daily Market Outlook | November 27, 2024!

L5.4 (Optional) Calculus Refresher I: Derivatives

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

Navigating Market Waves: Insights from Cboe's Derivatives Expert

How Can You Trade Profitably In This Market? | Derivatives Trader Siva Explains | Traders Edge

AI's Game-Changing Role in Derivatives Trading: Expert Insights Revealed

Understand The Basics Of Commodity Derivatives With Expert - Vinit Kaler (Sr. Mgr, MCX) | TradeSmart

The Barclays Trading Strategy that Outperforms the Market

Are Retail Traders Losing the Derivatives Game? SEBI's Bold New Rules Explained | Value Researc...

How to be a git expert

Step-by-Step Guide: Activating Derivatives Privileges on HDFC securities

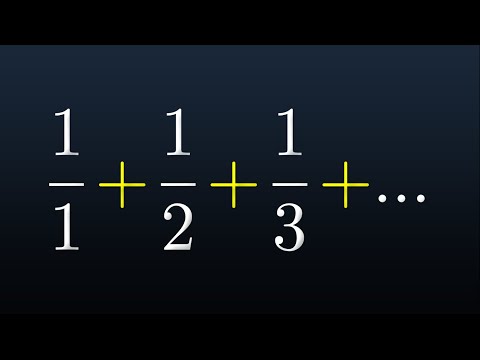

Every Student Should See This

The Magic of Derivatives Explained Simply

Комментарии

0:48:26

0:48:26

1:10:59

1:10:59

0:48:15

0:48:15

0:13:01

0:13:01

0:00:59

0:00:59

0:05:53

0:05:53

2:39:06

2:39:06

0:10:40

0:10:40

0:01:38

0:01:38

0:30:19

0:30:19

0:01:38

0:01:38

0:01:38

0:01:38

0:17:37

0:17:37

0:00:39

0:00:39

0:23:07

0:23:07

0:30:21

0:30:21

0:09:01

0:09:01

0:59:16

0:59:16

0:09:30

0:09:30

0:05:07

0:05:07

0:46:26

0:46:26

0:01:25

0:01:25

0:00:58

0:00:58

0:56:01

0:56:01