filmov

tv

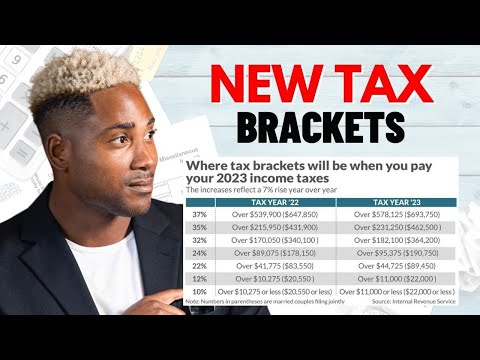

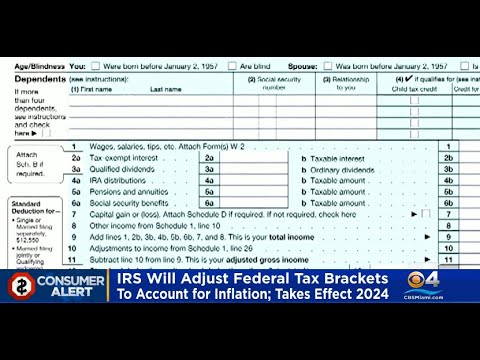

New Inflation-Adjusted Tax Brackets for 2024

Показать описание

Let's look at the IRS’ new inflation-adjusted tax brackets and how to use the changes to optimize your retirement.

Dave Zoller, CFP®

🍀Get The 5-Minute Retirement For Free🍀

❤️[MY FAVORITE RETIREMENT PLANNING SOFTWARE + VIDEO WALKTHROUGH]❤️

Achieve Your Successful & Secure Retirement WITHOUT A Financial Advisor

My Favorite Retirement Calculator w/ no video walk-through

-----------------------

POPULAR RETIREMENT VIDEOS

3 Reasons To Retire ASAP

7 Things Happy Retirees Do Well. Retirement Planning Tips From Recent Retirees

High Net Worth Retirement is Different

3 Lies That Could Delay Your Retirement

3 Must-Have Assets When Retirement Planning.

-----------------------

#retirement #howmuchtoretire #retirementplanning

MUSIC:

Stary Sky- Simon Grob

Disclaimer: Since we don’t know your specific situation, none of this information should be construed as tax, legal, financial, insurance, financial advice, or other advice and may be outdated or inaccurate. It is your responsibility to verify all information yourself. This content is prepared for entertainment purposes only. If you need advice, please contact a qualified CPA, attorney, insurance agent, financial advisor, or the appropriate professional for the subject you would like help with. Streamline Financial Services, LLC or its members cannot be held liable for any use or misuse of this content.

Affiliate Disclaimer: This post may include affiliate links where we may earn a payment when you click on the links at no additional cost to you.

Disclosures: Securities offered through LaSalle St. Securities LLC (LSS), member FINRA/SIPC. Advisory services offered through LaSalle St. Investment Advisors LLC (LSIA), a Registered Investment Advisor. Streamline Financial Services is not affiliated with LSS or LSIA. LSS is affiliated with LSIA.

Dave Zoller, CFP®

🍀Get The 5-Minute Retirement For Free🍀

❤️[MY FAVORITE RETIREMENT PLANNING SOFTWARE + VIDEO WALKTHROUGH]❤️

Achieve Your Successful & Secure Retirement WITHOUT A Financial Advisor

My Favorite Retirement Calculator w/ no video walk-through

-----------------------

POPULAR RETIREMENT VIDEOS

3 Reasons To Retire ASAP

7 Things Happy Retirees Do Well. Retirement Planning Tips From Recent Retirees

High Net Worth Retirement is Different

3 Lies That Could Delay Your Retirement

3 Must-Have Assets When Retirement Planning.

-----------------------

#retirement #howmuchtoretire #retirementplanning

MUSIC:

Stary Sky- Simon Grob

Disclaimer: Since we don’t know your specific situation, none of this information should be construed as tax, legal, financial, insurance, financial advice, or other advice and may be outdated or inaccurate. It is your responsibility to verify all information yourself. This content is prepared for entertainment purposes only. If you need advice, please contact a qualified CPA, attorney, insurance agent, financial advisor, or the appropriate professional for the subject you would like help with. Streamline Financial Services, LLC or its members cannot be held liable for any use or misuse of this content.

Affiliate Disclaimer: This post may include affiliate links where we may earn a payment when you click on the links at no additional cost to you.

Disclosures: Securities offered through LaSalle St. Securities LLC (LSS), member FINRA/SIPC. Advisory services offered through LaSalle St. Investment Advisors LLC (LSIA), a Registered Investment Advisor. Streamline Financial Services is not affiliated with LSS or LSIA. LSS is affiliated with LSIA.

Комментарии

0:11:00

0:11:00

0:08:14

0:08:14

0:02:12

0:02:12

0:12:48

0:12:48

0:11:25

0:11:25

0:00:41

0:00:41

0:12:08

0:12:08

0:12:54

0:12:54

1:12:12

1:12:12

0:03:03

0:03:03

0:01:30

0:01:30

0:02:59

0:02:59

0:14:12

0:14:12

0:01:00

0:01:00

0:08:47

0:08:47

0:03:15

0:03:15

0:17:21

0:17:21

0:01:00

0:01:00

0:00:33

0:00:33

0:08:41

0:08:41

0:00:32

0:00:32

0:00:24

0:00:24

0:03:28

0:03:28

0:05:00

0:05:00