filmov

tv

End of the IRS?! Fair Tax Act EXPLAINED

Показать описание

#FairTaxAct #NationalSalesTax #TaxReform2025 #IRSReplacement #SalesTaxExplained #HR25 #SimplifyingTaxes #IncomeTaxReplacement #FederalTaxReform #TaxSystemAlternatives

End of the IRS?! Fair Tax Act EXPLAINED

Is this the end of the IRS?

End The IRS!

The FAIR TAX ACT | The IRS is About to Be Abolished!!! | @JustJWoodfin | #Shorts

How to Abolish the Income Tax AND the IRS

Is this the end of the Internal Revenue Service (IRS) US tax system

The End Of The IRS As We Know It?

Can Donald Trump End The IRS Without Passing One Law? Yes. Yes, He Can.

Rep. Buddy Carter looks to abolish IRS, tax code with 'Fair Tax Act' | The Hill

A Plan to Abolish the #IRS and Replace the Income Tax - NTD News Today

End of the #IRS? #House #GOP Set to Vote on Consumption Tax Bill #consumptiontax #fairtax #shorts

Republicans Propose Abolishing the IRS and Income Tax #shorts

This BILL abolishes the IRS and Federal Income Taxes PART 5

Trump's Plan to Abolish the IRS (What This Means for Your Money)

Should We Abolish the IRS?

We Beat the Deep State's IRS in Court!

#330 How to Get Rid of the IRS

Trump's 3 policy proposals that could impact your taxes

Expert Tips on IRS Offer in Compromise for 2024 | Tax Advice You Can’t Miss!

Is a 30% National Sales Tax the Solution to Abolishing the IRS?

This BILL abolishes the IRS and Federal Income Taxes PART 1

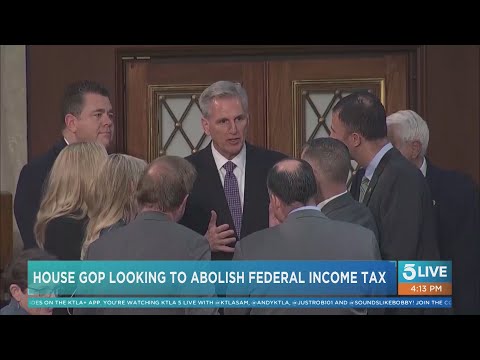

GOP leaders look to abolish the IRS and eliminate federal income tax

GOP Bill Would ABOLISH Income Tax & The IRS, Trump Is WINNING

#54 Here's Why We Must End the IRS!

Комментарии

0:00:57

0:00:57

0:00:42

0:00:42

0:00:31

0:00:31

0:00:56

0:00:56

0:14:13

0:14:13

0:05:11

0:05:11

0:15:41

0:15:41

0:09:22

0:09:22

0:05:07

0:05:07

0:00:59

0:00:59

0:00:59

0:00:59

0:00:39

0:00:39

0:00:39

0:00:39

0:12:02

0:12:02

0:00:58

0:00:58

0:00:59

0:00:59

0:29:50

0:29:50

0:07:19

0:07:19

0:00:42

0:00:42

0:04:41

0:04:41

0:00:53

0:00:53

0:00:57

0:00:57

0:11:35

0:11:35

0:30:01

0:30:01