filmov

tv

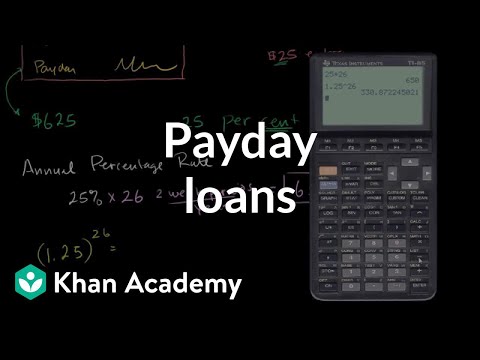

How Payday Loans Work - Payday Loans Explained

Показать описание

Call: (844) 707-8254

How Do Payday Loans Work : 00:00

How Does a Payday Loan Work : 01:00

How Can Payday Loans Work : 02:00

How Payday Loans Can Work : 03:00

HowDoes Payday Loans Work : 03:40

Payday loans are temporary cash advances secured with a customer's individual pay-check held for future payment or on electronic access to the customer's checking account for automatic repayment.

Customers borrow a pre-agreed amount , plus interest, from a payday lender and then receive a payday loan based on that amount.

Sometimes, borrowers can transfer funds digitally to their bank accounts to receive and also pay off a payday advance loan.

Lenders hold the checks till the customer's following payday when the loan as well as the interest fee must be paid in one full lump amount.

To pay off a payday loan, consumers can redeem the check by paying the financing with money, allow the check to be transferred at the bank, or simply pay the money charge to roll the loan over for an additional pay duration.

Some cash advance lenders additionally use longer-term cash advance installment loans and demand authorization to online withdraw several settlements from the borrower's checking account, generally due on each pay day.

Cash advance loans range in size from $100 to $1,000, relying on state lawful optimums.

The industry standard payday loan term is two weeks.

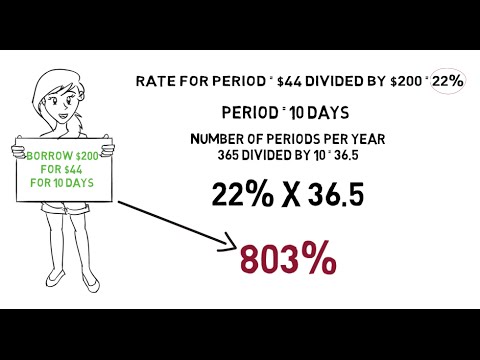

Interest rates can commonly set you back 200% yearly rate of interest (APR) of 200% or more.

The money charge ranges from $15 to $30 to borrow $100.

For two-week loans, these finance fees cause passion prices from 390 to 780% APR.

Much shorter term loans have higher APRs.

Prices are greater in states that do not cap the maximum price.

Requirements to Get a Payday Loan

All a customer requires to get a payday advance is an open bank account in relatively good standing, a steady source of income, as well as recognition.

Lenders do not carry out a full credit report check or ask concerns to determine if a borrower can pay for to settle the lending.

Because payday loans are made based upon the borrowers ability to pay, and not primarily the borrower's credit, these types of loans can often be an attractive option to people with poor credit but steady employment.

CFPB discovered that 80 percent of payday debtors tracked over 10 months rolled over or reborrowed car loans within 30 days.

Debtors default on one in five cash advances.

On-line customers get on worse.

CFPB located that over half of all on-line cash advance instalment finance series default.

Cash advance Lenders

Cash advance loans are made by payday advance loan shops, or at shops that offer various other economic solutions, such as check paying, title car loans, rent-to-own and also pawn, relying on state licensing needs.

Payday loans are also made made via websites as well as mobile phones.

CFPB discovered 15,766 cash advance shops running in 2015.

Legal Status of Payday Lending

High expense payday financing is accredited and controlled by state laws or laws in thirty-two states.

Fifteen states as well as the District of Columbia shield their consumers from high-cost cash advance lending with practical small finance price caps or other prohibitions.

Three states established reduced rate caps or longer terms for rather cheaper car loans.

On the internet payday loan providers are normally subject to the state licensing regulations and also price caps of the state where the consumer obtains the payday loan.

To learn more, check our website for the Legal Status of Payday Loans by State.

Call Now: (844) 707-8254

#howpaydayloanswork

-~-~~-~~~-~~-~-

Please watch: "Instant Cash Advance | (844) 707-8254 | Instant Cash Advances "

-~-~~-~~~-~~-~-

How Do Payday Loans Work : 00:00

How Does a Payday Loan Work : 01:00

How Can Payday Loans Work : 02:00

How Payday Loans Can Work : 03:00

HowDoes Payday Loans Work : 03:40

Payday loans are temporary cash advances secured with a customer's individual pay-check held for future payment or on electronic access to the customer's checking account for automatic repayment.

Customers borrow a pre-agreed amount , plus interest, from a payday lender and then receive a payday loan based on that amount.

Sometimes, borrowers can transfer funds digitally to their bank accounts to receive and also pay off a payday advance loan.

Lenders hold the checks till the customer's following payday when the loan as well as the interest fee must be paid in one full lump amount.

To pay off a payday loan, consumers can redeem the check by paying the financing with money, allow the check to be transferred at the bank, or simply pay the money charge to roll the loan over for an additional pay duration.

Some cash advance lenders additionally use longer-term cash advance installment loans and demand authorization to online withdraw several settlements from the borrower's checking account, generally due on each pay day.

Cash advance loans range in size from $100 to $1,000, relying on state lawful optimums.

The industry standard payday loan term is two weeks.

Interest rates can commonly set you back 200% yearly rate of interest (APR) of 200% or more.

The money charge ranges from $15 to $30 to borrow $100.

For two-week loans, these finance fees cause passion prices from 390 to 780% APR.

Much shorter term loans have higher APRs.

Prices are greater in states that do not cap the maximum price.

Requirements to Get a Payday Loan

All a customer requires to get a payday advance is an open bank account in relatively good standing, a steady source of income, as well as recognition.

Lenders do not carry out a full credit report check or ask concerns to determine if a borrower can pay for to settle the lending.

Because payday loans are made based upon the borrowers ability to pay, and not primarily the borrower's credit, these types of loans can often be an attractive option to people with poor credit but steady employment.

CFPB discovered that 80 percent of payday debtors tracked over 10 months rolled over or reborrowed car loans within 30 days.

Debtors default on one in five cash advances.

On-line customers get on worse.

CFPB located that over half of all on-line cash advance instalment finance series default.

Cash advance Lenders

Cash advance loans are made by payday advance loan shops, or at shops that offer various other economic solutions, such as check paying, title car loans, rent-to-own and also pawn, relying on state licensing needs.

Payday loans are also made made via websites as well as mobile phones.

CFPB discovered 15,766 cash advance shops running in 2015.

Legal Status of Payday Lending

High expense payday financing is accredited and controlled by state laws or laws in thirty-two states.

Fifteen states as well as the District of Columbia shield their consumers from high-cost cash advance lending with practical small finance price caps or other prohibitions.

Three states established reduced rate caps or longer terms for rather cheaper car loans.

On the internet payday loan providers are normally subject to the state licensing regulations and also price caps of the state where the consumer obtains the payday loan.

To learn more, check our website for the Legal Status of Payday Loans by State.

Call Now: (844) 707-8254

#howpaydayloanswork

-~-~~-~~~-~~-~-

Please watch: "Instant Cash Advance | (844) 707-8254 | Instant Cash Advances "

-~-~~-~~~-~~-~-

Комментарии

0:01:54

0:01:54

0:06:39

0:06:39

0:00:36

0:00:36

0:03:42

0:03:42

0:05:27

0:05:27

0:08:28

0:08:28

0:17:38

0:17:38

0:02:23

0:02:23

0:05:08

0:05:08

0:03:17

0:03:17

0:01:26

0:01:26

0:10:26

0:10:26

0:05:18

0:05:18

0:09:51

0:09:51

0:04:20

0:04:20

0:03:17

0:03:17

0:01:55

0:01:55

0:05:15

0:05:15

0:05:20

0:05:20

0:02:38

0:02:38

0:05:37

0:05:37

0:10:05

0:10:05

0:03:27

0:03:27

0:10:39

0:10:39