filmov

tv

Accounting for IGCSE - Video 25 - Depreciation on Non-current assets - meaning and calculation

Показать описание

The entire syllabus for IGCSE will be covered through this video series and students can revise using these videos for the forthcoming examination.

Understand the difference between Capital and Revenue expenditure -

All topics ranging from the basic concepts of accounting to the day books and cash books, bank reconciliation, control accounts, year-end adjustments, financial statements of sole traders, partnerships, limited companies and non-profit organisations, correction of errors and interpretation and analysis using accounting ratios will be covered.

If you wish to give any feedback or have any doubts, feel free to get in touch through Whatsapp on +971565325863 or through email.

Understand the difference between Capital and Revenue expenditure -

All topics ranging from the basic concepts of accounting to the day books and cash books, bank reconciliation, control accounts, year-end adjustments, financial statements of sole traders, partnerships, limited companies and non-profit organisations, correction of errors and interpretation and analysis using accounting ratios will be covered.

If you wish to give any feedback or have any doubts, feel free to get in touch through Whatsapp on +971565325863 or through email.

Accounting for IGCSE - Video 1 - Introduction to Accounting

Accounting for IGCSE - Video 2 - Important Accounting Terms

Accounting for IGCSE - Video 5 - Rules of Debit and Credit

ACCOUNTING BASICS: a Guide to (Almost) Everything

ACCOUNTING BASICS: Debits and Credits Explained

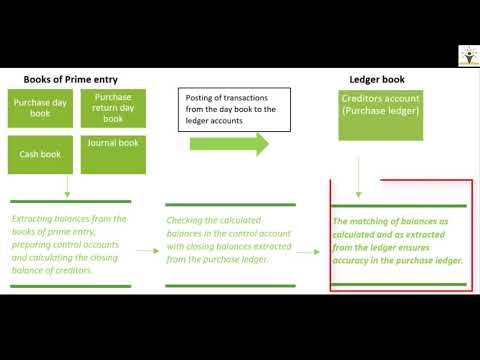

Accounting for IGCSE - Video 19 - Control Accounts (Example)

Accounting for IGCSE - Video 3 - Accounting equation

Accounting Basics Explained Through a Story

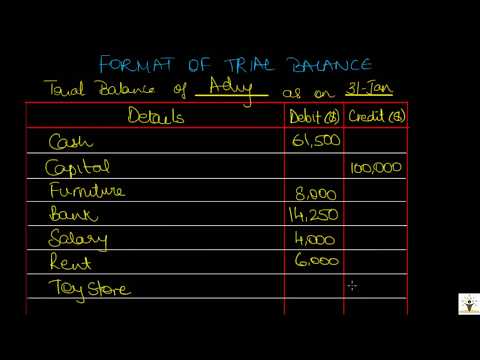

Accounting for IGCSE - Video 10 - Trial Balance

Accounting for IGCSE - Video 13 - Books of Prime Entry 2 - Cash Book

Accounting for IGCSE - Video 18 - Control Accounts - Part 1 (Theory)

Accounting for IGCSE - Video 20 - Income Statement

Accounting for IGCSE - Video 21 - Balance Sheet (SOFP)

Accounting for IGCSE - Video 32 - Correction of Errors and Suspense account

Accounting for IGCSE - Video 38 - Accounting Principles

Accounting for IGCSE - Video 7 - Recording Transactions - Journal

Accounting for IGCSE - Video 6 - Examples on Debit and Credit

Books of Prime Entry Explained | Accounting Recorded Class | IGCSE | O Level

Accounting for IGCSE - Video 35 - Limited companies (Part 1) - Theory

Accounting for IGCSE - Video 37 - Accounting Ratios

Accounting for IGCSE - Video 30 - Manufacturing Account

IGCSE easy accounting | O-Level accounting | IGCSE business study | IGCSE Accounting study

IGCSE Accounts 0452 | Petty cash and Cashbook questions

Accounting for IGCSE - Video 12 - Book of Prime Entries Part 1 - Day Books

Комментарии

0:04:40

0:04:40

0:06:00

0:06:00

0:04:52

0:04:52

0:14:13

0:14:13

0:05:44

0:05:44

0:06:18

0:06:18

0:06:38

0:06:38

0:09:45

0:09:45

0:04:59

0:04:59

0:10:31

0:10:31

0:09:56

0:09:56

0:10:39

0:10:39

0:07:08

0:07:08

0:34:11

0:34:11

0:16:13

0:16:13

0:06:30

0:06:30

0:10:52

0:10:52

0:35:50

0:35:50

0:20:33

0:20:33

0:22:30

0:22:30

0:11:04

0:11:04

0:08:38

0:08:38

0:15:33

0:15:33

0:12:28

0:12:28