filmov

tv

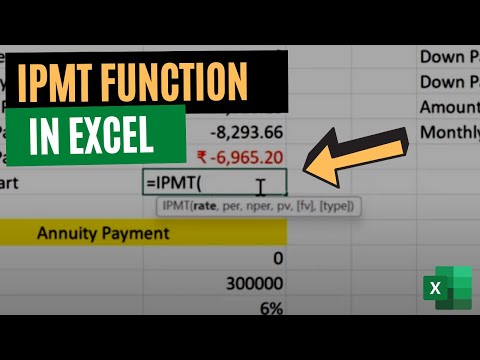

Excel IPMT Function - calculate interest on loan payment | Excel One Minute Quick Reference

Показать описание

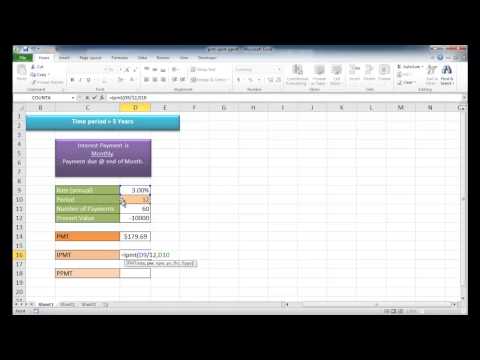

How much of your first mortgage payment is going to interest? What about payment 180? Excel's IPMT function will let you know how much is going to interest payment. IPMT returns the interest payment for a given period for an investment based on periodic, constant payments and a constant interest rate.

You can change the payment from payment 1 to payment 180, or any payment number. The longer you pay on the loan the more money goes to principal and less money to interest.

IPMT has six arguments. Four of the six are required.

* Rate - Required. The interest rate per period.

* Per - Required. The period for which you want to find the interest and must be in the range 1 to nper.

* Nper - Required. The total number of payment periods in an annuity.

* Pv - Required. The present value, or the lump-sum amount that a series of future payments is worth right now.

* Fv - Optional. The future value or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (the future value of a loan, for example, is 0).

* Type - Optional. The number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to be 0.

And make sure you subscribe to my channel!

-- EQUIPMENT USED ---------------------------------

-- SOFTWARE USED ---------------------------------

DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links I provide, I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel, so I can continue to provide you with free content each week!

You can change the payment from payment 1 to payment 180, or any payment number. The longer you pay on the loan the more money goes to principal and less money to interest.

IPMT has six arguments. Four of the six are required.

* Rate - Required. The interest rate per period.

* Per - Required. The period for which you want to find the interest and must be in the range 1 to nper.

* Nper - Required. The total number of payment periods in an annuity.

* Pv - Required. The present value, or the lump-sum amount that a series of future payments is worth right now.

* Fv - Optional. The future value or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (the future value of a loan, for example, is 0).

* Type - Optional. The number 0 or 1 and indicates when payments are due. If type is omitted, it is assumed to be 0.

And make sure you subscribe to my channel!

-- EQUIPMENT USED ---------------------------------

-- SOFTWARE USED ---------------------------------

DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links I provide, I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel, so I can continue to provide you with free content each week!

Комментарии

0:02:22

0:02:22

0:03:58

0:03:58

0:02:19

0:02:19

0:05:43

0:05:43

0:03:10

0:03:10

0:03:56

0:03:56

0:02:55

0:02:55

0:04:10

0:04:10

0:02:57

0:02:57

0:00:58

0:00:58

0:06:05

0:06:05

0:13:27

0:13:27

0:04:44

0:04:44

0:00:54

0:00:54

0:00:51

0:00:51

0:00:55

0:00:55

0:00:20

0:00:20

0:04:40

0:04:40

0:03:10

0:03:10

0:08:06

0:08:06

0:14:46

0:14:46

0:05:37

0:05:37

0:02:00

0:02:00

0:02:22

0:02:22