filmov

tv

Level I CFA: FRA Inventories-Lecture 2

Показать описание

This is Reading 25 for the 2021 exam.

This CFA exam prep video lecture covers:

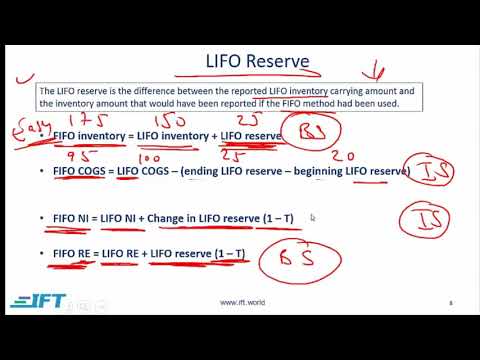

LIFO method

Ratios with LIFO and FIFO

This CFA exam prep video lecture covers:

LIFO method

Ratios with LIFO and FIFO

Level I CFA: FRA Inventories-Lecture 3

Level I CFA: Inventories Lecture 1

Level I CFA: FRA Inventories-Lecture 2

CFA Level I Inventory Video Lecture by Mr. Arif Irfanullah Part 1

CFA Level I FRA - LIFO to FIFO Statement Conversion

CFA Level I - Complete CRASH COURSE - CF + FRA

CFA Level 1 | Inventories | Lec - 1 | FSA

CFA Level I FRA - Inventory expense recognition

Inventory Valuation

CFA Level I Inventory Video Lecture by Mr. Arif Irfanullah Part 2

Introduction to Financial Statement Analysis (2024/2025 CFA® Level I Exam – FSA – Learning Module 1)...

CFA Level 1 Revision Lecture | Financial Statement Analysis - Part I | CA Vikas Vohra | edZeb

CFA L 1 | CFA Level 1 FRA QUESTION SOLVING ON BALANCE SHEET & INVENTORY

Financial Statement Analysis R6 - Inventories

CFA Level 1 | FRA: Measuring Inventory Value IFRS vs US GAAP

Inventories | Part 1 (of 4) | FRA | CFA Level 1 (2020) | Hindi

ALL CFA Level 1 Formulas to Pass! | Tips to Learn, Memorization, Breakdown

LIFO Liquidation: CFA Level 2 FRA Inventory Analysis

Level I CFA: FRA Financial Reporting Quality-Lecture 1

Level I CFA: FRA Financial Analysis Techniques-Lecture 1

FRA @ CFA Level I: FIFO vs. LIFO - the Easy Way

CFA Level 1 | Inventories | Summary Video (2020) | FRA | Hindi

Level I CFA: Understanding Balance Sheets-Lecture 1

CFA Level 1 | Revisionary Lecture | Financial Reporting Analysis | Faculty - Vikas Vohra

Комментарии

0:21:48

0:21:48

0:25:01

0:25:01

0:12:30

0:12:30

0:23:12

0:23:12

0:06:42

0:06:42

11:26:40

11:26:40

0:52:56

0:52:56

0:04:25

0:04:25

0:11:45

0:11:45

0:19:22

0:19:22

0:32:43

0:32:43

10:38:13

10:38:13

1:20:17

1:20:17

1:58:31

1:58:31

0:08:04

0:08:04

0:15:29

0:15:29

0:31:06

0:31:06

0:16:33

0:16:33

0:24:43

0:24:43

0:19:55

0:19:55

0:01:31

0:01:31

0:27:02

0:27:02

0:08:27

0:08:27

11:52:32

11:52:32