filmov

tv

JEPQ vs SCHD: $100k in → Which ETF Is better?

Показать описание

JEPQ vs SCHD: $100k IN → Which ETF Is better?

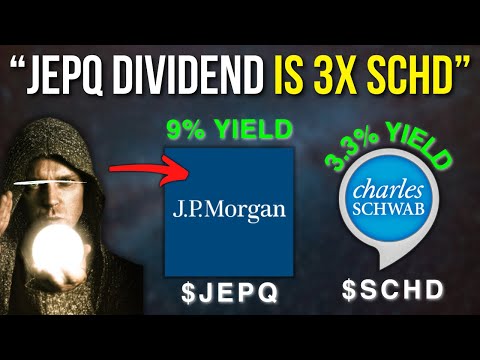

You have $100,000 ready to invest, and the decision comes down to two major ETFs: JEPQ and SCHD. The big question is: which one offers better potential for your investment?

If you liked this video and would like to see more videos like this, we would be happy to welcome you as a subscriber. Thank you very much

👇 subscribe here 👇

Thank you for watching this video: JEPQ vs SCHD: $100k IN → Which ETF Is better?

#SCHD #JEPQ #etf

In this channel, John explores a wide variety of money topics. Join the journey and experience the different money and investment aspects. Let's go 🏁💯

You have $100,000 ready to invest, and the decision comes down to two major ETFs: JEPQ and SCHD. The big question is: which one offers better potential for your investment?

If you liked this video and would like to see more videos like this, we would be happy to welcome you as a subscriber. Thank you very much

👇 subscribe here 👇

Thank you for watching this video: JEPQ vs SCHD: $100k IN → Which ETF Is better?

#SCHD #JEPQ #etf

In this channel, John explores a wide variety of money topics. Join the journey and experience the different money and investment aspects. Let's go 🏁💯

JEPQ vs SCHD: $100k in → Which ETF Is better?

How You Can LIVE OFF DIVIDENDS Much Faster With SCHD + JEPI

SCHD vs JEPI $100k IN → Which ETF Is Better

Live Off Dividends FASTER With SCHD + JEPQ (Secret Strategy)

Should You Buy SCHD ETF Or Buy JEPQ For 3 Times The Yield!

I Put $1,200 Into JEPQ ETF - This is How Much I'm Making in Monthly Dividends

JEPI vs. SCHD $100k IN - Which ETF if Better?

SCHD Over JEPI & JEPQ - Maximizing Returns With Superior Long-Term Cash Flow

VOO vs. SCHD $100k IN → Which ETF Is Better?

$100,000 In SCHD ETF Is ALL You Need To Retire!

BREAKING: SCHD ETF SHARE SPLIT (massive price drop for SCHD and SCHG)

This (NEW) 2 ETF Portfolio DESTROYS ONLY Buying SCHD

What If You Invest $10k in SCHD

JEPI OR SCHD for the BEST Dividend Payouts Long-Term?

$100k SCHD dividends will surpass your full time job

How Long to Reach $1 MILLION with JEPQ 12.49% Reinvested 💰

4 Best ETFs to PAIR with SCHD to Get Rich EASILY!

Making $16,250 Per Month with JEPQ (JP Morgan Nasdaq Equity Premium Income) ETF

$50,000 In SCHD Will Beat Your Full Time Job! 🔥

SCHD RETIREMENT LIES. The Truth About SCHD ETF

50% SCHD & 50% VGT Beats The S&P 500 (VOO) Every Year! | 10 Years & Counting

JEPQ - This Cash Flow Is Amazing | The Best Actively Managed ETF

$100k in SCHD or VOO: Which ETF is Better?

Dividend Growth ETFs vs Covered Call ETFs: Which is Better?

Комментарии

0:20:51

0:20:51

0:09:52

0:09:52

0:15:23

0:15:23

0:11:18

0:11:18

0:08:33

0:08:33

0:04:37

0:04:37

0:20:32

0:20:32

0:11:40

0:11:40

0:17:32

0:17:32

0:09:51

0:09:51

0:12:42

0:12:42

0:14:12

0:14:12

0:12:28

0:12:28

0:10:50

0:10:50

0:00:26

0:00:26

0:08:25

0:08:25

0:11:16

0:11:16

0:06:26

0:06:26

0:13:09

0:13:09

0:08:16

0:08:16

0:17:37

0:17:37

0:08:09

0:08:09

0:08:05

0:08:05

0:22:28

0:22:28