filmov

tv

Child Tax Credit: What it Means for Your Taxes This Year

Показать описание

The Child Tax Credit is one of the most valuable tax credits available to

taxpayers with children. In this informative video, Mark Steber (Jackson

Hewitt’s Chief Tax Information Officer) breaks down everything families

need to know before they file their federal income tax return this year.

Here's what we cover in this video:

00:24 What the Child Tax Credit is

01:06 What you need to know about the Child Tax Credit for this

tax season

01:56 What the financial benefits of the Child Tax Credit are

02:23 Who qualifies to claim the Child Tax Credit

03:42 How the Child Tax Credit is calculated

04:39 How to claim the Child Tax Credit

05:11 The Additional Child Tax Credit

06:25 The Child and Dependent Care Credit

07:00 Frequently asked questions about the Child Tax Credit

Don’t get overwhelmed, watch this video and you’ll gain the knowledge

and strategies you need to help you file your tax return this year.

#TaxTips #TaxSeason #childtaxcredit #Families #taxcredits

taxpayers with children. In this informative video, Mark Steber (Jackson

Hewitt’s Chief Tax Information Officer) breaks down everything families

need to know before they file their federal income tax return this year.

Here's what we cover in this video:

00:24 What the Child Tax Credit is

01:06 What you need to know about the Child Tax Credit for this

tax season

01:56 What the financial benefits of the Child Tax Credit are

02:23 Who qualifies to claim the Child Tax Credit

03:42 How the Child Tax Credit is calculated

04:39 How to claim the Child Tax Credit

05:11 The Additional Child Tax Credit

06:25 The Child and Dependent Care Credit

07:00 Frequently asked questions about the Child Tax Credit

Don’t get overwhelmed, watch this video and you’ll gain the knowledge

and strategies you need to help you file your tax return this year.

#TaxTips #TaxSeason #childtaxcredit #Families #taxcredits

What the Child Tax Credit is and who qualifies for it

What is the Child Tax Credit? How does it work? | Dollars and Sense

Child Tax Credit Explained: Guide to IRS Eligibility, Benefits & Payments | 2024 Update

What is the child tax credit and how does it work?

Child Tax Credit: What it Means for Your Taxes This Year

Child Tax Credit Explained.

What Is A Child Tax Credit EXPLAINED 👉🏾

2023 Child Tax Credit Simplified

Child Tax Credit 2021: What You Need to Know

Is There a New $300 Child Tax Credit in July 2024? Update

Child tax credit change leaves parents owing the IRS for first time

How C0V1D Changed The Child Tax Credit 👉🏾

Here's a breakdown of what the child tax credit is

What an expansion of the Child Tax Credit could mean for parents

Child Tax Credit (2021-2022) Explained and What It Means for Your Taxes - TheStreet + TurboTax

$300 Monthly Child Tax Credit Payments in August? Here's the Truth | 2024 Update

Biden economic adviser on Child Tax Credit: 'Goal is to support American families'

What you need to know about the child tax credit in 2022

Expanding The Child Tax Credit | Harris-Walz 2024

Child tax credit: How to know if you qualify, how much you'll get paid | Just the FAQs

Child Tax Credit

Study reveals benefits generated by expanded child tax credit

WTForm? Child Tax Credit Letter 6419 Explained

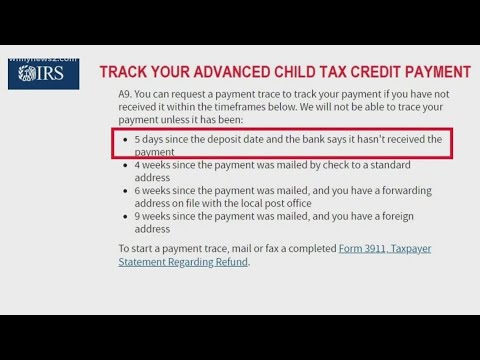

Where is your Child Tax Credit payment?

Комментарии

0:03:22

0:03:22

0:03:02

0:03:02

0:05:58

0:05:58

0:01:29

0:01:29

0:08:08

0:08:08

0:09:30

0:09:30

0:00:36

0:00:36

0:12:52

0:12:52

0:01:14

0:01:14

0:04:10

0:04:10

0:02:17

0:02:17

0:00:43

0:00:43

0:01:20

0:01:20

0:03:01

0:03:01

0:03:43

0:03:43

0:04:43

0:04:43

0:06:28

0:06:28

0:01:59

0:01:59

0:00:56

0:00:56

0:01:29

0:01:29

0:13:16

0:13:16

0:02:40

0:02:40

0:00:56

0:00:56

0:01:52

0:01:52