filmov

tv

Why Stock Prices Go Up and Down, Explained With Tilray

Показать описание

Pretty much everybody understands the basic premise of investing -- Buy low and sell high. Investors want to buy stocks and sell them for a profit after they move up in price. But why do stock prices move up and down in the first place? If you’ve ever asked that question, this video is for you.

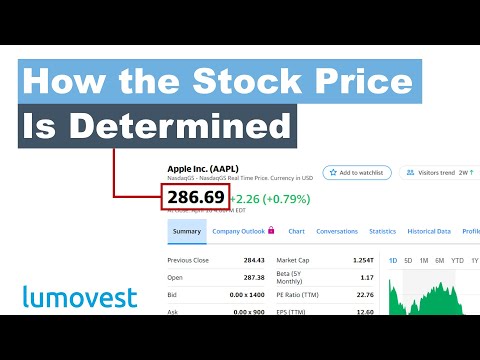

In short, stock prices change because of supply and demand. Think of the stock market as a giant auction, with investors making bids for one another’s stocks and offering to sell their own all at the same time. For example, Apple’s shares trade hands over 28 million times a day on average, which translates to nearly 1,200 accepted bids every second of every trading day!

Because there is a limited supply of shares available for sale, bidders must compete with one another for access to shares. The more intense the interest in a stock, the more bidders there are attracted to it, and the less interested current shareholders are in selling their own stock. As a result, potential buyers must bid higher to buy the stock, and the stock price moves up.

This works the other way as well. When interest in a stock declines, fewer competing bids are entered, holders are more interested in selling their stock, and the lower the winning bid price must be.

But what determines investors’ interest in a stock? In short, information. Information comes in many forms: earnings reports, press releases, news stories, court filings, Tweets, general hype, you name it. Investors, whether consciously or not, incorporate each new piece of information they come across into their impression of a stock.

Of course, every investor reacts to new information differently, and those reactions can range widely from apathy to panic to euphoria. Depending on their reaction, investors may choose to buy more shares, hold the shares they have, or even sell.

In turn, these reactions are incorporated into the share price, causing fluctuations in price. Interestingly, the change in share price itself is information that is incorporated by subsequent bidders, and the cycle of information-reaction-price move-information repeats once again.

When supply of a stock is limited and interest is high, a stock’s price can skyrocket. For a recent example of this, let’s take a quick look at Tilray, the first marijuana company to go public directly on the Nasdaq back in Summer of 2018. After going public at $17, the Tilray’s stock soared, eventually reaching a peak of $300 a share.

Much of this rise was driven by a limited supply of publicly available shares, as most of the company’s stock was still privately held by Peter Thiel’s Privateer holdings, as well as a limited availability of other publicly traded cannabis producers for investors to purchase.

Combining the market’s rabid interest in investing in pot with an artificially limited supply of shares led to Tilray’s rapid ascent. However, as other pot companies began publicly trading, demand waned, and when the lockup for private equity investors expired in January 2019, the number of shares on the public market surged, pushing down the stock. Today, Tilray trades 78% below its highs. The law of supply and demand remains undefeated.

If you can imagine this cycle of supply and demand being repeated over and over again among millions of investors and stocks across the world each and every trading day, you’ll have a working idea of the mechanisms that influence daily fluctuations in stock price. As you can probably guess, investors’ reactions to new information aren’t always rational. As long term investors, we look for opportunities to capitalize on the market’s short term irrationality to create long term wealth.

Thanks for watching guys, if you enjoyed this video please smash the like button down below. We’ve got plenty more like this one on our channel, with more videos being added every week.

------------------------------------------------------------------------

Subscribe to The Motley Fool's YouTube Channel:

Join our Facebook community:

Follow The Motley Fool on Twitter:

In short, stock prices change because of supply and demand. Think of the stock market as a giant auction, with investors making bids for one another’s stocks and offering to sell their own all at the same time. For example, Apple’s shares trade hands over 28 million times a day on average, which translates to nearly 1,200 accepted bids every second of every trading day!

Because there is a limited supply of shares available for sale, bidders must compete with one another for access to shares. The more intense the interest in a stock, the more bidders there are attracted to it, and the less interested current shareholders are in selling their own stock. As a result, potential buyers must bid higher to buy the stock, and the stock price moves up.

This works the other way as well. When interest in a stock declines, fewer competing bids are entered, holders are more interested in selling their stock, and the lower the winning bid price must be.

But what determines investors’ interest in a stock? In short, information. Information comes in many forms: earnings reports, press releases, news stories, court filings, Tweets, general hype, you name it. Investors, whether consciously or not, incorporate each new piece of information they come across into their impression of a stock.

Of course, every investor reacts to new information differently, and those reactions can range widely from apathy to panic to euphoria. Depending on their reaction, investors may choose to buy more shares, hold the shares they have, or even sell.

In turn, these reactions are incorporated into the share price, causing fluctuations in price. Interestingly, the change in share price itself is information that is incorporated by subsequent bidders, and the cycle of information-reaction-price move-information repeats once again.

When supply of a stock is limited and interest is high, a stock’s price can skyrocket. For a recent example of this, let’s take a quick look at Tilray, the first marijuana company to go public directly on the Nasdaq back in Summer of 2018. After going public at $17, the Tilray’s stock soared, eventually reaching a peak of $300 a share.

Much of this rise was driven by a limited supply of publicly available shares, as most of the company’s stock was still privately held by Peter Thiel’s Privateer holdings, as well as a limited availability of other publicly traded cannabis producers for investors to purchase.

Combining the market’s rabid interest in investing in pot with an artificially limited supply of shares led to Tilray’s rapid ascent. However, as other pot companies began publicly trading, demand waned, and when the lockup for private equity investors expired in January 2019, the number of shares on the public market surged, pushing down the stock. Today, Tilray trades 78% below its highs. The law of supply and demand remains undefeated.

If you can imagine this cycle of supply and demand being repeated over and over again among millions of investors and stocks across the world each and every trading day, you’ll have a working idea of the mechanisms that influence daily fluctuations in stock price. As you can probably guess, investors’ reactions to new information aren’t always rational. As long term investors, we look for opportunities to capitalize on the market’s short term irrationality to create long term wealth.

Thanks for watching guys, if you enjoyed this video please smash the like button down below. We’ve got plenty more like this one on our channel, with more videos being added every week.

------------------------------------------------------------------------

Subscribe to The Motley Fool's YouTube Channel:

Join our Facebook community:

Follow The Motley Fool on Twitter:

Комментарии

0:04:10

0:04:10

0:04:30

0:04:30

0:12:29

0:12:29

0:03:22

0:03:22

0:03:51

0:03:51

0:09:47

0:09:47

0:02:08

0:02:08

0:13:33

0:13:33

0:08:49

0:08:49

0:17:34

0:17:34

0:10:53

0:10:53

0:07:36

0:07:36

0:09:01

0:09:01

0:06:45

0:06:45

0:02:04

0:02:04

0:22:49

0:22:49

0:09:24

0:09:24

0:05:19

0:05:19

0:08:30

0:08:30

0:02:28

0:02:28

0:09:54

0:09:54

0:00:50

0:00:50

0:10:49

0:10:49

0:07:19

0:07:19