filmov

tv

Audit Risk Model Explained

Показать описание

In this video, we explain the audit risk model:

Understanding the Audit Risk Model

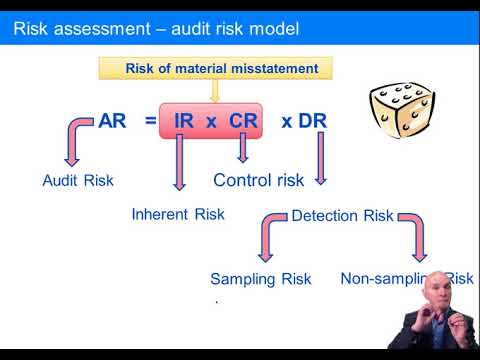

The Audit Risk Model is a fundamental concept used in the field of auditing to help auditors assess and manage the risk of material misstatement in financial statements. The model provides a framework for understanding the various components that contribute to audit risk, enabling auditors to plan and execute audits more effectively.

1. Components of the Audit Risk Model

The Audit Risk Model is represented by the equation:

Audit Risk (AR)

=

Inherent Risk (IR)

×

Control Risk (CR)

×

Detection Risk (DR)

Audit Risk (AR)=Inherent Risk (IR)×Control Risk (CR)×Detection Risk (DR)

Each component of the model is defined as follows:

Inherent Risk (IR): This is the susceptibility of an assertion about a transaction or account balance to be materially misstated before considering any related controls. Inherent risk is higher in complex transactions or those involving significant estimates that are subject to uncertainty.

Control Risk (CR): This is the risk that a material misstatement that could occur in an assertion will not be prevented, or detected and corrected, on a timely basis by the entity's internal control. Control risk is a function of the effectiveness of the design and operation of internal control.

Detection Risk (DR): This is the risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists and that could be material, either individually or when aggregated with other misstatements.

2. Application of the Audit Risk Model

The Audit Risk Model helps auditors to:

Identify Risks: Understand where the financial statements are most at risk for misstatements.

Assess Control Environment: Evaluate the effectiveness of a company’s internal controls and the likelihood that these controls could fail to prevent or detect errors.

Determine Nature, Timing, and Extent of Tests: Based on the assessed levels of inherent and control risks, auditors decide how much reliance they can place on the company’s controls and determine the extent of substantive testing required.

3. Practical Implications

High Inherent and Control Risks: Require auditors to perform more extensive substantive testing to mitigate the high level of detection risk.

Low Inherent and Control Risks: Allow for less extensive substantive testing, relying more on the controls of the entity.

4. Adjusting the Model

Auditors adjust the model based on the context of the audit:

Entity-Specific Factors: Such as the complexity of transactions, the size of the company, and the industry in which it operates.

External Factors: Including economic conditions and regulatory changes.

Historical Performance: Past errors or issues discovered in prior audits.

5. Limitations of the Audit Risk Model

While useful, the model has limitations:

Quantification Challenges: It is often difficult to precisely quantify levels of inherent risk, control risk, and detection risk.

Dynamic Environment: Changes in the business environment or sudden shifts in a company’s operations can alter risk levels quickly, which may not be immediately apparent to an auditor.

Human Judgment: The effectiveness of the model relies heavily on the professional judgment of the auditor, which can vary widely.

Conclusion

The Audit Risk Model is a crucial tool in the auditor's toolkit, guiding the audit process through careful risk assessment and management. By effectively applying this model, auditors can better plan their audit to focus efforts where the risk of material misstatement is highest, thereby enhancing the overall quality and effectiveness of the audit.

#accountingmajor #accountingstudents #accountingexam

Understanding the Audit Risk Model

The Audit Risk Model is a fundamental concept used in the field of auditing to help auditors assess and manage the risk of material misstatement in financial statements. The model provides a framework for understanding the various components that contribute to audit risk, enabling auditors to plan and execute audits more effectively.

1. Components of the Audit Risk Model

The Audit Risk Model is represented by the equation:

Audit Risk (AR)

=

Inherent Risk (IR)

×

Control Risk (CR)

×

Detection Risk (DR)

Audit Risk (AR)=Inherent Risk (IR)×Control Risk (CR)×Detection Risk (DR)

Each component of the model is defined as follows:

Inherent Risk (IR): This is the susceptibility of an assertion about a transaction or account balance to be materially misstated before considering any related controls. Inherent risk is higher in complex transactions or those involving significant estimates that are subject to uncertainty.

Control Risk (CR): This is the risk that a material misstatement that could occur in an assertion will not be prevented, or detected and corrected, on a timely basis by the entity's internal control. Control risk is a function of the effectiveness of the design and operation of internal control.

Detection Risk (DR): This is the risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists and that could be material, either individually or when aggregated with other misstatements.

2. Application of the Audit Risk Model

The Audit Risk Model helps auditors to:

Identify Risks: Understand where the financial statements are most at risk for misstatements.

Assess Control Environment: Evaluate the effectiveness of a company’s internal controls and the likelihood that these controls could fail to prevent or detect errors.

Determine Nature, Timing, and Extent of Tests: Based on the assessed levels of inherent and control risks, auditors decide how much reliance they can place on the company’s controls and determine the extent of substantive testing required.

3. Practical Implications

High Inherent and Control Risks: Require auditors to perform more extensive substantive testing to mitigate the high level of detection risk.

Low Inherent and Control Risks: Allow for less extensive substantive testing, relying more on the controls of the entity.

4. Adjusting the Model

Auditors adjust the model based on the context of the audit:

Entity-Specific Factors: Such as the complexity of transactions, the size of the company, and the industry in which it operates.

External Factors: Including economic conditions and regulatory changes.

Historical Performance: Past errors or issues discovered in prior audits.

5. Limitations of the Audit Risk Model

While useful, the model has limitations:

Quantification Challenges: It is often difficult to precisely quantify levels of inherent risk, control risk, and detection risk.

Dynamic Environment: Changes in the business environment or sudden shifts in a company’s operations can alter risk levels quickly, which may not be immediately apparent to an auditor.

Human Judgment: The effectiveness of the model relies heavily on the professional judgment of the auditor, which can vary widely.

Conclusion

The Audit Risk Model is a crucial tool in the auditor's toolkit, guiding the audit process through careful risk assessment and management. By effectively applying this model, auditors can better plan their audit to focus efforts where the risk of material misstatement is highest, thereby enhancing the overall quality and effectiveness of the audit.

#accountingmajor #accountingstudents #accountingexam

Комментарии

0:07:47

0:07:47

0:07:15

0:07:15

0:26:10

0:26:10

0:27:15

0:27:15

0:11:01

0:11:01

0:08:12

0:08:12

0:12:24

0:12:24

0:21:38

0:21:38

0:02:40

0:02:40

1:02:39

1:02:39

0:17:37

0:17:37

0:06:58

0:06:58

0:13:34

0:13:34

0:16:05

0:16:05

0:02:15

0:02:15

0:25:15

0:25:15

0:06:27

0:06:27

0:11:01

0:11:01

0:00:30

0:00:30

0:08:14

0:08:14

0:22:47

0:22:47

0:10:42

0:10:42

0:06:37

0:06:37

0:09:10

0:09:10