filmov

tv

Algo Trading Trend Vs. Counter-Trend Strategies

Показать описание

Algo Trading Trend Vs. Counter-Trend Strategies

I Found An AMAZING Trend Following Strategy #shorts

Using the Counter Trend ALGO Signal to trade the ES futures

When You Shouldn’t Trade Counter Trend 📉🤷🏻♂️📈

If You Want To Trade With The Trend - DO THIS #shorts

How I Cracked the Futures Market Using a Counter Trend Trading Strategy

Should You Trade Trend Following Or Mean Reversion Strategies?

I Decoded The Liquidity & Manipulation Algorithm In Day Trading

How To Identify Liquidity In Trading (From Beginner To Advanced)

FOREX XAUUSD ALGO TRADING COUNTER TREND FOLLOWING TRADING STRATEGY TO INVEST OR GET FUNDED!

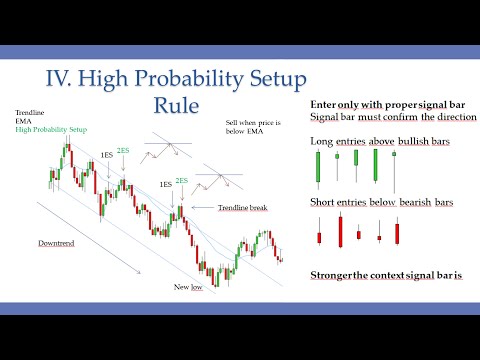

5 Price Action Rules EVERY Trader NEEDS To Know

8 NEW Highly Profitable TradingView Indicators ( Must Have in 2024 )

A rule based system for skipping counter trend trades

Don't keep looking for a Counter Trend Trade

How To Take Counter Trend Day Trades

7 Algo Trading Strategies (Backtest And Rules)

How to Trade a Counter Trend Automated Strategy-CT S1.

Improving a Counter Trend Trading System

NEW FOREX XAUUSD ALGORITHM CRUSHING MARKETS | Counter Trend Following Trading Strategy to Get Funded

Algo Trading Trends - Dec 11, 2020

Mean Reversion Strategy Revealed: Short-Term Counter-Trend Trading Explained

Trend Reversal Trading Strategy

COUNTER TREND ENTRY MODEL

When to fade or fight a trend in trading #cryptotrading #forextrading #indextrading #goldfutures

Комментарии

0:10:41

0:10:41

0:00:54

0:00:54

0:15:39

0:15:39

0:00:28

0:00:28

0:01:00

0:01:00

0:19:45

0:19:45

0:07:31

0:07:31

0:14:47

0:14:47

0:25:19

0:25:19

0:33:06

0:33:06

0:31:16

0:31:16

0:12:26

0:12:26

0:04:25

0:04:25

0:00:38

0:00:38

0:11:24

0:11:24

0:09:24

0:09:24

0:03:10

0:03:10

0:03:26

0:03:26

0:00:48

0:00:48

0:05:38

0:05:38

0:00:26

0:00:26

0:04:44

0:04:44

0:00:20

0:00:20

0:00:56

0:00:56