filmov

tv

Authorising, Clearing and Settlement

Показать описание

Here’s a look behind the scenes of how electronic payments work in the world of eCommerce. It can seem complicated, but we’ll take care of everything for you. Still, so you know, here’s how it works:

There are three stages called;

1. Authorisation

2. Clearing

3. Settlement

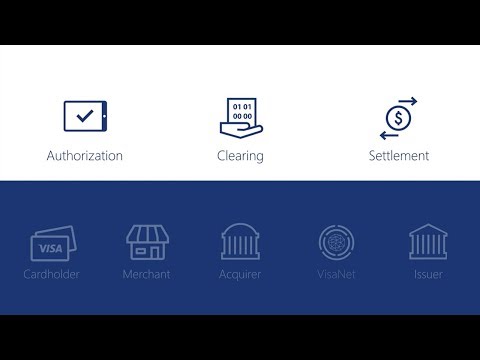

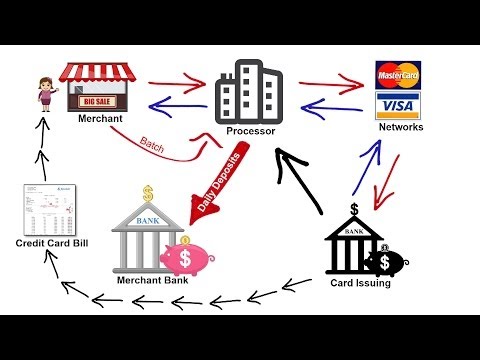

Authorisation is the first step and starts after a cardholder makes a transaction and successfully authenticates themselves using 2 factor authentication if your business is using EMV 3D Secure, this adds in additional criteria to confirm the identity of the cardholder.

A digital message is transmitted and checked at each stage; from the merchant to the acquirer, then on to the card scheme and finally sent to the issuing bank - which checks the funds in the cardholder’s account. Once funds are available a message is sent back to the merchant that the payment is approved.

Clearing is all the activities that happen behind the scenes and is the time period from when the acquirer sends a message to the card schemes, which is then forwarded to the issuing banks to confirm that the transaction has been completed successfully.

At the end of the day the merchant will send a file called a ‘batch’ to the acquirer for the funds to be deposited into their account, this is called ‘Settlement’.

Look out for acquirers that offer ‘Next day funding’ and ‘Faster payment’ facilities to improve cash flow in your business.

This video includes information on:

0:01 What is authorisation, clearing and settlement?

0:28 How does it work?

1:36 Acquirers to look out for?

The video is part of our online solutions playlist and you can view the entire playlist here:

For more information on taking payments online, visit our websites:

Contact us

If you’ve any questions, don’t hesitate to call us:

For service:

UK - 0345 850 0195

IE - 0818 202 120

For sales:

UK - 0800 028 1662

IE - 1800 995 085

Follow us on social media

U.S. Bank Europe DAC, trading as Elavon Merchant Services, is regulated by the Central Bank of Ireland.

U.S. Bank Europe DAC, trading as Elavon Merchant Services, is a credit institution authorised and regulated by the Central Bank of Ireland. Authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

There are three stages called;

1. Authorisation

2. Clearing

3. Settlement

Authorisation is the first step and starts after a cardholder makes a transaction and successfully authenticates themselves using 2 factor authentication if your business is using EMV 3D Secure, this adds in additional criteria to confirm the identity of the cardholder.

A digital message is transmitted and checked at each stage; from the merchant to the acquirer, then on to the card scheme and finally sent to the issuing bank - which checks the funds in the cardholder’s account. Once funds are available a message is sent back to the merchant that the payment is approved.

Clearing is all the activities that happen behind the scenes and is the time period from when the acquirer sends a message to the card schemes, which is then forwarded to the issuing banks to confirm that the transaction has been completed successfully.

At the end of the day the merchant will send a file called a ‘batch’ to the acquirer for the funds to be deposited into their account, this is called ‘Settlement’.

Look out for acquirers that offer ‘Next day funding’ and ‘Faster payment’ facilities to improve cash flow in your business.

This video includes information on:

0:01 What is authorisation, clearing and settlement?

0:28 How does it work?

1:36 Acquirers to look out for?

The video is part of our online solutions playlist and you can view the entire playlist here:

For more information on taking payments online, visit our websites:

Contact us

If you’ve any questions, don’t hesitate to call us:

For service:

UK - 0345 850 0195

IE - 0818 202 120

For sales:

UK - 0800 028 1662

IE - 1800 995 085

Follow us on social media

U.S. Bank Europe DAC, trading as Elavon Merchant Services, is regulated by the Central Bank of Ireland.

U.S. Bank Europe DAC, trading as Elavon Merchant Services, is a credit institution authorised and regulated by the Central Bank of Ireland. Authorised by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

0:08:55

0:08:55

0:01:49

0:01:49

0:04:02

0:04:02

0:11:22

0:11:22

0:22:43

0:22:43

0:04:57

0:04:57

0:02:33

0:02:33

0:00:14

0:00:14

0:28:15

0:28:15

0:00:06

0:00:06

0:11:28

0:11:28

0:00:24

0:00:24

0:05:39

0:05:39

1:23:12

1:23:12

0:06:50

0:06:50

0:09:44

0:09:44

0:02:36

0:02:36

0:00:19

0:00:19

0:00:39

0:00:39

0:03:33

0:03:33

0:03:01

0:03:01

0:02:25

0:02:25

0:08:10

0:08:10

0:01:00

0:01:00