filmov

tv

Roth Conversions + IRMAA: How to Plan Correctly (Part 1)

Показать описание

Timestamps:

0:00 Roth Conversions + IRMAA

0:17 What is IRMAA?

1:18 2025 IRMAA Brackets

2:05 Step #1 in Retirement Tax Planning

4:21 Difficulties with IRMAA

5:17 A Common IRMAA Mistake

5:54 IRMAA Calculations the Right Way

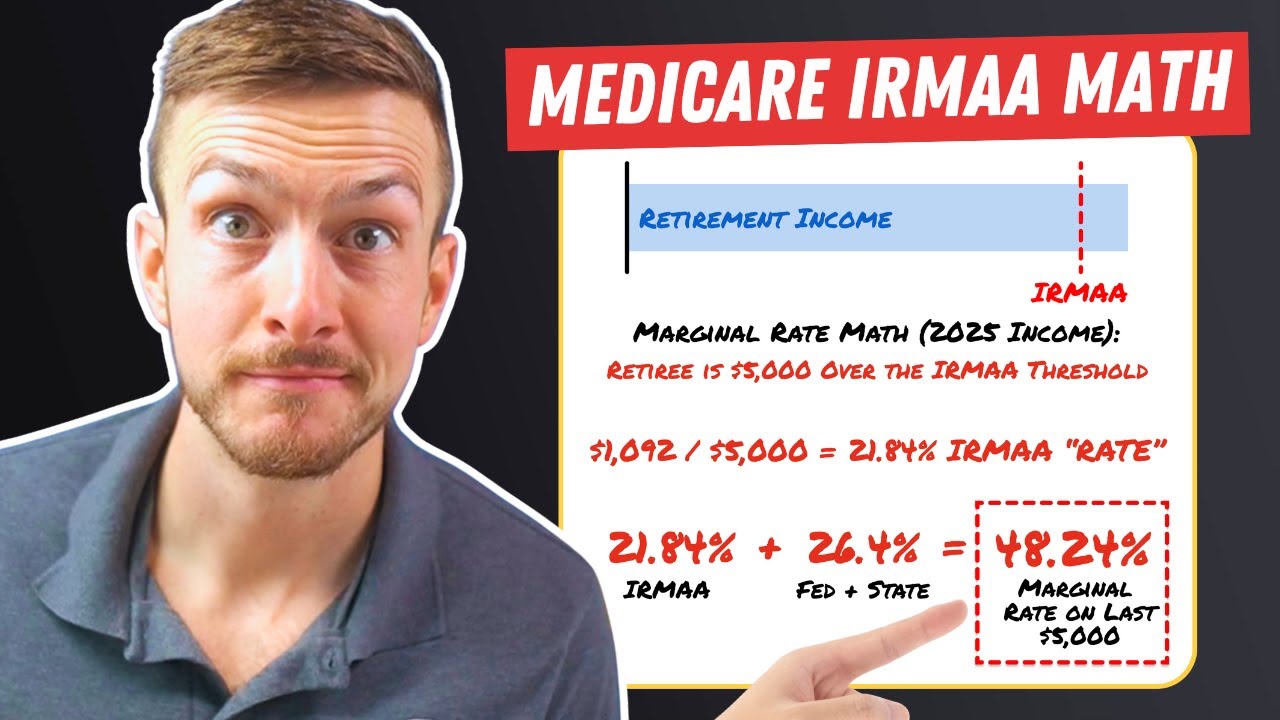

8:07 The Marginal Cost of Each IRMAA Zone

9:18 Best IRMAA Practices

- - - - - - - - - - - - - - - - -

Always remember, "You Don't Need More Money; You Need a Better Plan"

Roth Conversions + IRMAA: How to Plan Correctly (Part 1)

The Trickiest Variable In Roth Conversion Planning | The IRMAA Trap

Roth Conversions and Medicare Surcharges IRMAA

Can I Avoid IRMAA When Doing a Roth Conversion?

A Complete Guide to IRMAA Surcharges & Impact On Roth Conversions

Impact of Roth IRA Conversion on Social Security Benefits and Medicare IRMAA

What Types of Income is IRMAA Based on? How to Avoid the Medicare Surcharge

How to Avoid IRMAA the Right Way! | Medicare IRMAA Calculation Explained

Roth Conversion: Revealing IRMAA Implications

Roth Conversions to a Higher Tax Bracket Than in Retirement? What About IRMAA?

Roth IRA Conversion (Part 4) 2024 Tax Planning Strategies | IRMAA & Stock Trading

Why You SHOULD Take a Medicare Increase Penalty in this Scenario

Watch This Before Roth Converting in 2024…trust me.

Should You Roth Convert into the 32% Bracket for a More Tax Efficient Retirement?

Roth Conversions and IRMAA Explained

Watch This Before Roth Converting in 2023… | Roth Conversion Timing (Part 1)

What if a Roth Conversion causes you to owe a Medicare Penalty?

Is A Roth Conversion Right for You? New Retirement's New Tool Can Help You Decide

What Is IRMAA?: Roth Conversions

Roth Convert 100% of Your IRAs?! 3 Situations Where it Makes Sense...

Roth conversions can help reduce Medicare IRMAA premium surcharges

Should I Convert My Retirement To Roth?

I'm 58. When Should I Do Roth Conversions? [Case Study] ᴴᴰ

Live with Larry: IRMAA & Roth Conversions

Комментарии

0:11:20

0:11:20

0:09:41

0:09:41

0:09:38

0:09:38

0:05:19

0:05:19

0:15:28

0:15:28

0:04:21

0:04:21

0:01:52

0:01:52

0:12:30

0:12:30

0:08:16

0:08:16

0:12:34

0:12:34

1:50:03

1:50:03

0:09:10

0:09:10

0:14:50

0:14:50

0:15:23

0:15:23

0:00:59

0:00:59

0:11:09

0:11:09

0:15:27

0:15:27

0:22:39

0:22:39

0:00:51

0:00:51

0:11:13

0:11:13

0:01:00

0:01:00

0:05:35

0:05:35

0:10:09

0:10:09

0:34:31

0:34:31