filmov

tv

Calculating Hourly Rates for a Contractor or Small Business

Показать описание

Calculating Hourly Rates for a Contractor or Small Business

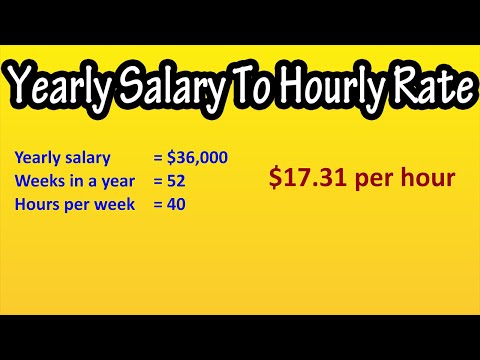

How to Calculate Hourly Rate From Salary

Calculating Hourly Rates for a Contractor or Small Business

IV Flow Rates Infusion Drips Hourly Rate mL/hr Dosage Calculations Nursing

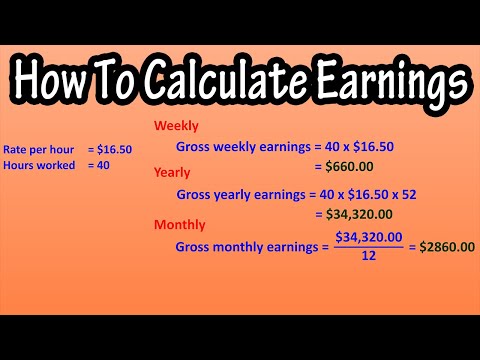

How To Calculate Gross Weekly, Yearly And Monthly Salary, Earnings Or Pay From Hourly Pay Rate

How do you calculate hourly rate from monthly salary?

HOW TO CALCULATE YOUR YEARLY SALARY BASED ON YOUR HOURLY RATE. SUBSCRIBE AND LIKE FOR MORE!

Determining Your Hourly Rate - Part 1

How much Money will an Indianapolis Rental Property make per year? | HoltonWiseTV Highlights

Calculate Hourly Rates for Plumbers, HVAC and Electricians

how to figure out your hourly rates as a freelancer (step-by-step walkthrough!)

How To Calculate Hourly Pay Rate From Salary - Formula For Salary To Hourly Pay Rate

How do I calculate my hourly rate? | KVK

How to calculate your hourly rate as an entrepreneur

How to calculate your hourly rate #salary #careertips

Calculating Weekly Wages

How to calculate PROFIT / OVERHEAD / LABOR COST the EASY way!

How much does an hour of tradesmen's labor cost?

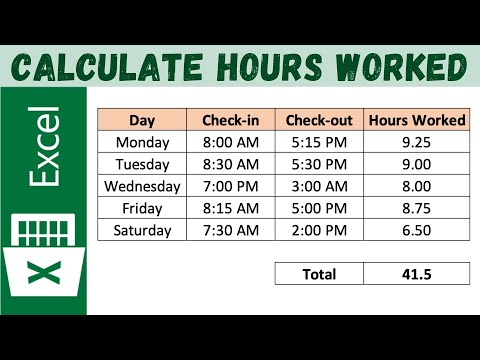

How to Calculate Hours Worked in Excel

How to Calculate Gross Pay

How To Calculate Overtime Earnings From Hourly Pay Rate - Formula For Calculating Overtime Pay

How to Calculate your Hourly Rate for Freelancing (animated)

Introduction Calculating Wages from Hourly Rate

How to Price Consulting Services: What’s Your Hourly Rate?

Комментарии

0:07:46

0:07:46

0:01:06

0:01:06

0:08:24

0:08:24

0:10:32

0:10:32

0:01:36

0:01:36

0:00:42

0:00:42

0:01:46

0:01:46

0:11:23

0:11:23

0:00:50

0:00:50

0:03:55

0:03:55

0:14:02

0:14:02

0:01:23

0:01:23

0:02:30

0:02:30

0:12:36

0:12:36

0:00:09

0:00:09

0:01:35

0:01:35

0:08:44

0:08:44

0:14:18

0:14:18

0:03:26

0:03:26

0:05:50

0:05:50

0:01:26

0:01:26

0:06:22

0:06:22

0:02:53

0:02:53

0:05:28

0:05:28