filmov

tv

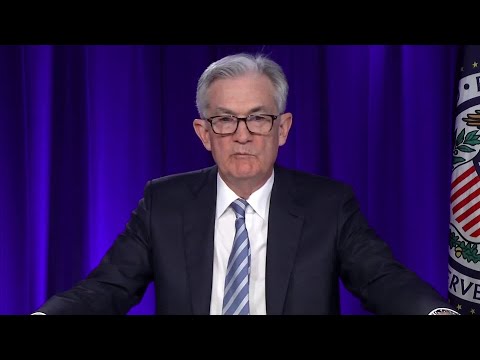

The Fed Isn't Done Raising Rates: Michele

Показать описание

Bob Michele, J.P. Morgan Asset Management CIO and global head of fixed income, says the Federal Reserve isn't done raising rates. He says the last rate hike was unnecessary. He's on "Bloomberg The Open."

Connect with us on...

Connect with us on...

The Fed Isn't Done Raising Rates: Michele

Powell: Fed Isn't Even Thinking of Raising Interest Rates

Fed Won't Raise Rates Until Taper Is Finished: Powell

Powell Says Fed Isn't Even Thinking of Raising Rates

How the Fed's raising of interest rates will impact the economy, consumers

The Fed isn't in a position to cut rates, says NatWest's Michelle Girard

The Fed isn’t done with ‘really aggressive policy,’ investor warns

The Fed 'doesn't have the guts' to raise rates by 6 to 7%: Strategist

How The Federal Reserve's Expected Interest Rate Increase Will Likely Affect You

The Fed Isn't Ready to Pivot: abrdn Says

What the Fed’s interest rate hike means for your wallet

Stocks turn lower after the Fed raises interest rates

It's naive to assume the Fed won't start raising rates until 2023: Young

What is the Fed's path for interest rate hikes?

Here’s how the Fed’s interest rate hike affects you

Interest rates: Don’t expect any surprise from the Fed, says strategist

Markets Analysis: Three Reasons the Fed Is Raising Interest Rates

Did The FED Just Flip The Market?

Why the Fed will raise interest rates in 2022, and how soon consumers will feel hikes

The Fed Probably Won't Raise Rates Seven Times in 2022

Fed raises interest rates again in wake of bank failures

Why Your Bank’s Savings Rate Isn’t Increasing With the Fed’s | WSJ

Canadians aren't impressed with the fed's energy strategy: Nanos

Fed raises rates by 50 basis points, will begin shrinking balance sheet June 1

Комментарии

0:03:04

0:03:04

0:01:01

0:01:01

0:00:47

0:00:47

0:01:18

0:01:18

0:08:26

0:08:26

0:03:59

0:03:59

0:04:59

0:04:59

0:06:32

0:06:32

0:04:25

0:04:25

0:05:05

0:05:05

0:08:30

0:08:30

0:02:21

0:02:21

0:05:38

0:05:38

0:06:20

0:06:20

0:00:51

0:00:51

0:04:45

0:04:45

0:01:38

0:01:38

0:10:11

0:10:11

0:07:17

0:07:17

0:31:34

0:31:34

0:08:04

0:08:04

0:04:17

0:04:17

0:03:51

0:03:51

0:03:38

0:03:38