filmov

tv

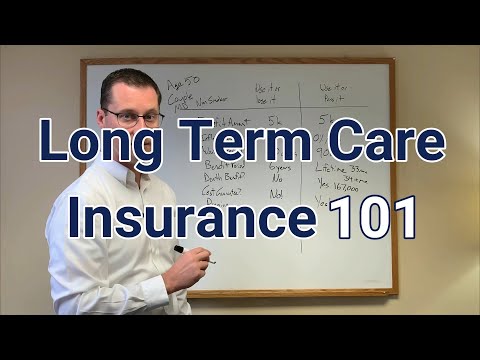

Long-Term Care Insurance is a Waste of Money

Показать описание

Thinking about getting long-term care insurance? You don’t want to miss this episode where Mike Ballew exposes the truth about long-term care insurance.

This video was produced by Eggstack which is solely responsible for its content.

Disclaimer

This video is general in nature and should not be considered suitable for anyone’s particular situation. Content is intended for informational and entertainment purposes only and is not a professional service or advice.

While every effort is made to present accurate and up-to-date information, no warranty, expressed or implied, is provided that this video is current, accurate, complete, or suitable for any particular purpose. You view this video at your own risk. In no case shall Eggstack or its owners, officers, directors, or employees be liable for any direct, indirect, incidental, special or consequential damages arising from the use of the information in this video.

Intellectual Property

This video is copyrighted. Unauthorized use is strictly prohibited. Eggstack is a registered trademark of Eggstack LLC.

Music Credits: YouTube Audio Library

Summer of 1984 by RKVC

This video was produced by Eggstack which is solely responsible for its content.

Disclaimer

This video is general in nature and should not be considered suitable for anyone’s particular situation. Content is intended for informational and entertainment purposes only and is not a professional service or advice.

While every effort is made to present accurate and up-to-date information, no warranty, expressed or implied, is provided that this video is current, accurate, complete, or suitable for any particular purpose. You view this video at your own risk. In no case shall Eggstack or its owners, officers, directors, or employees be liable for any direct, indirect, incidental, special or consequential damages arising from the use of the information in this video.

Intellectual Property

This video is copyrighted. Unauthorized use is strictly prohibited. Eggstack is a registered trademark of Eggstack LLC.

Music Credits: YouTube Audio Library

Summer of 1984 by RKVC

Комментарии

0:01:01

0:01:01

0:03:12

0:03:12

0:21:37

0:21:37

0:21:10

0:21:10

0:08:57

0:08:57

0:04:34

0:04:34

0:00:46

0:00:46

0:19:50

0:19:50

0:03:31

0:03:31

0:31:21

0:31:21

0:02:45

0:02:45

0:24:54

0:24:54

0:01:44

0:01:44

0:06:26

0:06:26

0:05:53

0:05:53

0:41:14

0:41:14

0:37:23

0:37:23

0:01:05

0:01:05

0:00:55

0:00:55

0:11:17

0:11:17

0:03:24

0:03:24

0:11:32

0:11:32

0:03:52

0:03:52

0:05:20

0:05:20