filmov

tv

Furlough Job retention scheme due to Coronavirus UK

Показать описание

Please watch: "Save Business & Investment Costs & Tax - 28-day trial free trial"

Furlough Job retention scheme due to Coronavirus UK (Covid 19)

=====

=====

Book a Finance & Tax consultation with Simon Misiewicz. Use the coupon code “YouTube25” to get the 25% discount

=====

In this video you will learn from Simon Misiewicz, your property tax specialist, of Optimise Accountants and Cheryl Wiley of Peak HR the following about Furlough of employees from a financial and employment law perspective.

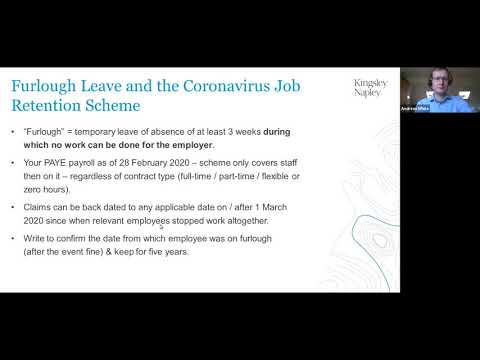

▶ What Furlough is and why it has been introduced since the pandemic outbreak of Coronavirus

▶ What the legal responsibilities of employers are in regard to Furlough and what processes they need to follow. This will keep them free from legal issues

▶ When Furlough was introduced and the time frame in which the HMRC furlough grant will be available

▶ The video will outline the employees that will benefit from Furlough and which employees will unfortunately not benefit. We will go into details about this in the video

▶ The time frames in which payments will be made from HMRC and what must be done by employers in the meantime in regard to the payment of wages.

=====

Book a Finance & Tax consultation with Simon Misiewicz, the co found of Optimise Accountants the property tax specialists. Use the coupon code “YouTube25” to get the 25% discount

The tax support will take the form of:

1.You book the Finance & Tax Director call and upload your questions with relevant documentation

2.Simon will spend up to 60 minutes to go through your situation and identify the very best solution

3.You and Simon will then spend the 60 minutes call to discuss which solution works for you best and to work out the practical application

4.Simon will leave the call and spend up to another 60 minutes to write up the notes and to do further research

5.Simon will provide additional 15 minutes email support to deal with any clarification questions that you may have

#Coronaviru #Furlough #JobRetentionScheme

Furlough Job retention scheme due to Coronavirus UK (Covid 19)

=====

=====

Book a Finance & Tax consultation with Simon Misiewicz. Use the coupon code “YouTube25” to get the 25% discount

=====

In this video you will learn from Simon Misiewicz, your property tax specialist, of Optimise Accountants and Cheryl Wiley of Peak HR the following about Furlough of employees from a financial and employment law perspective.

▶ What Furlough is and why it has been introduced since the pandemic outbreak of Coronavirus

▶ What the legal responsibilities of employers are in regard to Furlough and what processes they need to follow. This will keep them free from legal issues

▶ When Furlough was introduced and the time frame in which the HMRC furlough grant will be available

▶ The video will outline the employees that will benefit from Furlough and which employees will unfortunately not benefit. We will go into details about this in the video

▶ The time frames in which payments will be made from HMRC and what must be done by employers in the meantime in regard to the payment of wages.

=====

Book a Finance & Tax consultation with Simon Misiewicz, the co found of Optimise Accountants the property tax specialists. Use the coupon code “YouTube25” to get the 25% discount

The tax support will take the form of:

1.You book the Finance & Tax Director call and upload your questions with relevant documentation

2.Simon will spend up to 60 minutes to go through your situation and identify the very best solution

3.You and Simon will then spend the 60 minutes call to discuss which solution works for you best and to work out the practical application

4.Simon will leave the call and spend up to another 60 minutes to write up the notes and to do further research

5.Simon will provide additional 15 minutes email support to deal with any clarification questions that you may have

#Coronaviru #Furlough #JobRetentionScheme

Комментарии

0:18:25

0:18:25

0:03:27

0:03:27

0:22:50

0:22:50

0:06:01

0:06:01

0:58:05

0:58:05

0:04:49

0:04:49

0:02:36

0:02:36

0:02:58

0:02:58

0:14:02

0:14:02

0:10:07

0:10:07

0:20:23

0:20:23

0:08:10

0:08:10

0:04:22

0:04:22

0:54:07

0:54:07

0:07:46

0:07:46

0:08:33

0:08:33

0:01:44

0:01:44

0:10:36

0:10:36

0:09:08

0:09:08

0:01:07

0:01:07

0:05:51

0:05:51

0:05:08

0:05:08

0:03:09

0:03:09

0:13:43

0:13:43