filmov

tv

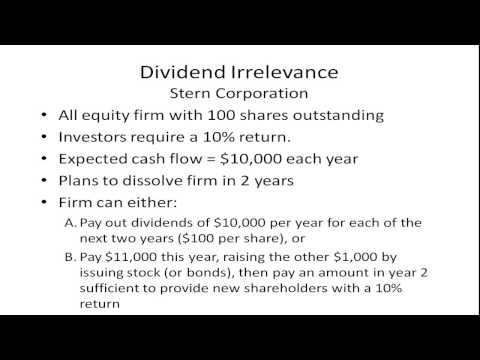

The Irrelevance of Dividends

Показать описание

Even in a stock-picking environment, there is no reason to believe that dividends, or the growth of dividends, would be an indication of a good stock to own.

Referenced in this video:

Catch up on the latest investing advice, insights and white papers here.

------------------

Follow me on

Follow PWL Capital on:

You can find the Rational Reminder podcast that I co-host with Cameron Passmore on

#investing #dividends #investors

The Irrelevance of Dividends

The Relevance of Dividend Irrelevance

Dividends Are Irrelevant (Sort Of...)

Dividends are Garbage

The Irrelevance of Bad Theories: The Dividend Irrelevance Theory | Ep. 45

Why Dividends Are IRRELEVANT? (Most People Don't Get It)

Why Investors Love Dividends (And Why They Can Be Dangerous)

irrelevance concept of dividend

Are Dividends Important? Dividend Irrelevance Theory Debunked

RR #201 - The Relevance of Dividend Irrelevance

The Dividend Irrelevance Theory (Secrets & Truths You Need To Know)

The Truth About The Dividend Snowball - What They Don't Tell You

Irrelevance of Dividends (Rebuttal!)

Dividend Irrelevance Theory: Definition and Investing Strategies

Do Dividends even matter? - Dividend Irrelevance theory

M.M. Theory (Irrelevance of Dividend) in English

M&M Dividend Irrelevance

Theories of Dividend (Part-1) | Theory of Irrelevance (Residual approach & MM approach)

3 Reasons Selling Stock is Better than Dividend Income (In Retirement)

Dividends are not investment returns. They are not free money, and do not offer downside protection.

35. Dividend Theories - Irrelevance Theories from Financial Management Subject

Dividend Models, Dividend Theories, Walter Model, Gordon Model, MM Approach, Financial Management

The Irrelevance of Bad Theories: The Dividend Irrelevance Theory | Ep. 45

Watch Me Buy $450,000 Of Dividend Stocks In My $2,000,000+ Portfolio!

Комментарии

0:12:05

0:12:05

0:11:08

0:11:08

0:16:39

0:16:39

0:05:48

0:05:48

0:25:11

0:25:11

0:05:38

0:05:38

0:08:28

0:08:28

0:04:10

0:04:10

0:08:00

0:08:00

1:09:12

1:09:12

0:20:49

0:20:49

0:12:56

0:12:56

0:09:00

0:09:00

0:03:10

0:03:10

0:06:59

0:06:59

0:08:53

0:08:53

0:08:52

0:08:52

0:06:54

0:06:54

0:09:59

0:09:59

0:01:18

0:01:18

0:15:08

0:15:08

0:28:15

0:28:15

0:24:12

0:24:12

0:40:26

0:40:26