filmov

tv

Class 12th – Fixed Exchange Rate System | Economics | Tutorials Point

Показать описание

Fixed Exchange Rate System

watch more videos at

Lecture By: Ms. Madhu Bhatia, Tutorials Point India Private Limited

watch more videos at

Lecture By: Ms. Madhu Bhatia, Tutorials Point India Private Limited

Class 12th – Fixed Exchange Rate System | Economics | Tutorials Point

Floating and Fixed Exchange Rates

Foreign Exchange Rate | One shot | Class 12 | Macroeconomics

Fixed Exchange Rate System - Open Economy Macroeconomics | Class 12 Macroeconomics 2022-23

Fixed Exchange Rate System | Class 12 Macroeconomics

Fixed Exchange Rate System | Class 12 Macroeconomics Balance of Payments

EXCHANGE RATE# Fixed, Flexible/ Floating & Managed Floating # Malayalam Explanation.

Class 12th – Changes in Exchange Rate | Economics | Tutorials Point

Foreign Exchange Rate | Detailed ONE SHOT REVISION | Class 12 Macro Economics | Boards exam 2024.

Foreign exchange rate One shot | Complete revision in 10 mins. Class 12 Macro economics Board 2023

Class 12 Macroeconomics Ch 11 | Foreign Exchange Rate | 3 - Fixed Exchange Rate, Bretton Wood System

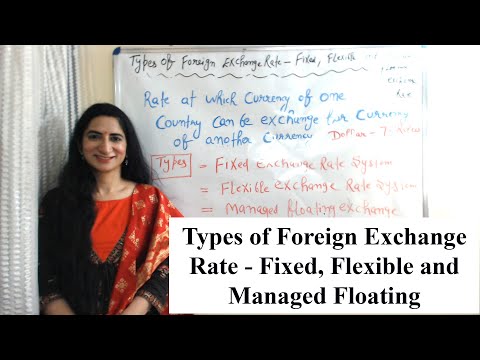

Types of Foreign Exchange Rate - Fixed, Flexible and Managed Floating

Second puc Economics/The Foreign Exchange Market with Fixed exchange rates with help of diagram

12 std - Macroeconomics - Fixed exchange rate - Revaluation -Devaluation -chapter 6 - Open economy

Fixed Exchange Rate System - Foreign Exchange Rate - (Part-3) - Macroeconomics - Creative Economics

Foreign Exchange Rate | One Shot revision in 20 Minutes | Class 12 Macro Economics | Board exam 2024

fixed exchange rate | Foreign Exchange Rate | Class 12th Macro Economics | #shorts #cbseboard2023

Fixed foreign exchange rate system | Foreign Exchange | Macroeconomics Class 12 | EocWorld

What is Fixed Exchange Rate? Explained for UPSC prelims #ias #civilservices #economy #cgpsc #shorts

Supply and demand curves in foreign exchange | AP Macroeconomics | Khan Academy

Floating and Fixed Exchange Rates- Macroeconomics

Fixed Exchange Rate || Fixed exchange rate system class 12 || Economics class 12

Foreign exchange rate part 1 | Fixed exchange rate & Flexible exchange rate. Class 12 Indian eco

Fixed Exchange Rate - Foreign Exchange Rate | Class 12 Economics | CBSE 2023-24

Комментарии

0:08:57

0:08:57

0:15:36

0:15:36

0:38:34

0:38:34

0:25:31

0:25:31

0:13:59

0:13:59

0:14:25

0:14:25

0:19:11

0:19:11

0:03:03

0:03:03

0:53:23

0:53:23

0:11:06

0:11:06

0:11:25

0:11:25

0:03:03

0:03:03

0:06:59

0:06:59

0:14:56

0:14:56

0:07:02

0:07:02

0:19:13

0:19:13

0:01:00

0:01:00

0:12:49

0:12:49

0:01:00

0:01:00

0:06:49

0:06:49

0:03:25

0:03:25

0:08:12

0:08:12

0:31:58

0:31:58

0:17:15

0:17:15