filmov

tv

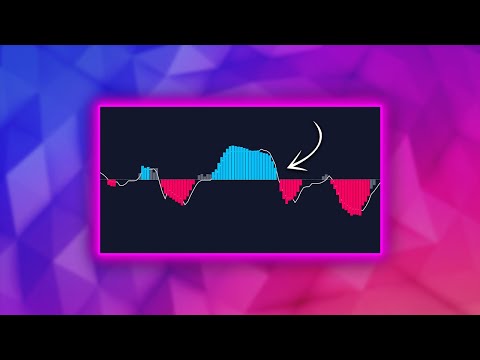

Backtesting Stock Trading Strategies in Python

Показать описание

In this video, we learn how to backtest and evaluate our stock trading strategies in Python.

DISCLAIMER: None of this is financial advice. I am not a financial professional and this is a tutorial about programming in Python. I am not responsible for any financial or investing decisions you make.

◾◾◾◾◾◾◾◾◾◾◾◾◾◾◾◾◾

📚 Programming Books & Merch 📚

🌐 Social Media & Contact 🌐

DISCLAIMER: None of this is financial advice. I am not a financial professional and this is a tutorial about programming in Python. I am not responsible for any financial or investing decisions you make.

◾◾◾◾◾◾◾◾◾◾◾◾◾◾◾◾◾

📚 Programming Books & Merch 📚

🌐 Social Media & Contact 🌐

How to Backtest a Trading Strategy on Tradingview

How to Backtest PROPERLY

How To Backtest Trading Strategy & Improve Trading Win Rate

How to Properly Backtest Your Trading Strategy

Backtesting Stock Trading Strategies in Python

How to backtest your trading strategy even if you don't know coding

Backtest Any Stock Strategy In thinkorswim

I Reveal My Day Trading Strategy

Top 3 Trading Strategies | 95% Win Rate! | For Beginners #trading

Does Back Testing a Trading Strategy Work?

8 Quantitative Trading Strategies | (Backtests, Settings and Rules)

'Highly Profitable Trading Strategy' TESTED 411,000 Times!! Ultimate Backtest!

Best Trading Indicator To Build A Strategy Upon (100 Year Back Test!)

I Let ChatGPT Backtest My Trading Strategy (Results Revealed)

I Tested This Trading Strategy & It Made 310%

I Found An AMAZING Trend Following Strategy #shorts

Backtest Your Trading Strategy For FREE! #shorts #trading #backtesting

How I Backtest My Trading Strategy | Price Action

BEST Scalping Trading Strategy For Beginners (How To Scalp Forex, Stocks, and Crypto)

Highly Profitable DEMA + SuperTrend Trading Strategy

My Incredible Easy Scalping Strategy To Make $500/Day (Back Tested Results)

Backtesting 101: Ensure Your Trading Strategies Work Before You Trade | Quantra Course 📊🚀

BEST Trend Line Breakout Strategy on TradingView 📈

How to Backtest a Trading Strategy

Комментарии

0:07:57

0:07:57

0:18:36

0:18:36

0:25:26

0:25:26

0:09:10

0:09:10

0:17:48

0:17:48

0:10:32

0:10:32

0:17:10

0:17:10

0:06:40

0:06:40

0:08:56

0:08:56

0:03:28

0:03:28

0:08:58

0:08:58

0:06:09

0:06:09

0:10:26

0:10:26

0:13:28

0:13:28

0:01:00

0:01:00

0:00:54

0:00:54

0:00:55

0:00:55

0:18:29

0:18:29

0:07:22

0:07:22

0:08:24

0:08:24

0:12:05

0:12:05

0:02:33

0:02:33

0:00:47

0:00:47

0:19:24

0:19:24