filmov

tv

T accounts explained

Показать описание

T accounts are awesome! T accounts are the most useful tool in accounting. T accounts are fundamental to your understanding of accounting. T accounts are helpful in solving any accounting problem. T accounts are spectacular! OK, that’s enough praise for T accounts. Let’s get to work. How do you master T accounts? By taking four simple steps. Stay with me, and let’s get this done!

⏱️TIMESTAMPS⏱️

0:00 Introduction to T accounts

0:29 T account definition

0:41 T accounting in 4 steps

2:50 T accounting example

4:20 T account opening and ending balance

5:02 T accounts summary

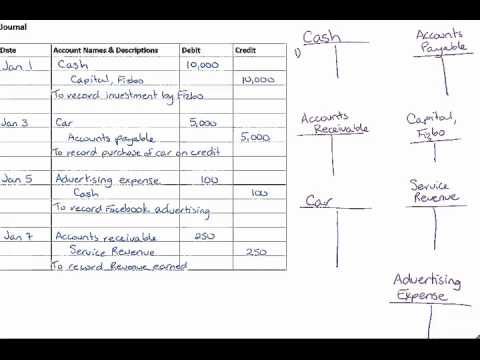

Here’s a very simple definition of a T account: a T account is a visual representation of an account, to think through the journal entries you are going to make to record transactions.

T accounting step two: take a look at this T account and this balance sheet. Looks pretty similar, right? That’s because it’s the same basic idea. Debits on the left, credits on the right.

Asset accounts in their “natural state” have a debit balance, liabilities and equity accounts in their “natural state” have a credit balance. You can think of a T account as a mini balance sheet, for one specific account in the ledger.

Assets go up if you add debits, and down if you book credits. Liabilities and equity go up if you add credits, and down if you book debits.

Here’s a little secret shortcut that very few people realize: the two types of income statement accounts revenue and expense are essentially just a subset of equity. Revenue accounts in their “natural state” have a credit balance, at the end of the accounting period they will roll up into equity and make it grow. Expense accounts in their “natural state” have a debit balance, at the end of the accounting period they will roll up into equity and make it shrink. If revenue is higher than expenses, you generate a positive net income, which adds to the equity balance.

T accounting in four steps:

3) For every journal entry, decide first which type of account you need, and then which specific account in that category

4) To calculate the ending balance for an account, add up the opening balance and the debits and credits for the period.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

0:00 Introduction to T accounts

0:29 T account definition

0:41 T accounting in 4 steps

2:50 T accounting example

4:20 T account opening and ending balance

5:02 T accounts summary

Here’s a very simple definition of a T account: a T account is a visual representation of an account, to think through the journal entries you are going to make to record transactions.

T accounting step two: take a look at this T account and this balance sheet. Looks pretty similar, right? That’s because it’s the same basic idea. Debits on the left, credits on the right.

Asset accounts in their “natural state” have a debit balance, liabilities and equity accounts in their “natural state” have a credit balance. You can think of a T account as a mini balance sheet, for one specific account in the ledger.

Assets go up if you add debits, and down if you book credits. Liabilities and equity go up if you add credits, and down if you book debits.

Here’s a little secret shortcut that very few people realize: the two types of income statement accounts revenue and expense are essentially just a subset of equity. Revenue accounts in their “natural state” have a credit balance, at the end of the accounting period they will roll up into equity and make it grow. Expense accounts in their “natural state” have a debit balance, at the end of the accounting period they will roll up into equity and make it shrink. If revenue is higher than expenses, you generate a positive net income, which adds to the equity balance.

T accounting in four steps:

3) For every journal entry, decide first which type of account you need, and then which specific account in that category

4) To calculate the ending balance for an account, add up the opening balance and the debits and credits for the period.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:11:08

0:11:08

0:05:38

0:05:38

0:02:06

0:02:06

0:10:58

0:10:58

0:06:34

0:06:34

0:14:52

0:14:52

0:20:16

0:20:16

0:02:39

0:02:39

0:34:29

0:34:29

0:05:44

0:05:44

0:03:21

0:03:21

0:03:18

0:03:18

0:08:11

0:08:11

0:09:40

0:09:40

0:15:46

0:15:46

0:05:30

0:05:30

0:14:13

0:14:13

0:49:49

0:49:49

0:04:44

0:04:44

0:15:55

0:15:55

0:07:36

0:07:36

0:07:38

0:07:38

4:50:59

4:50:59

0:09:45

0:09:45