filmov

tv

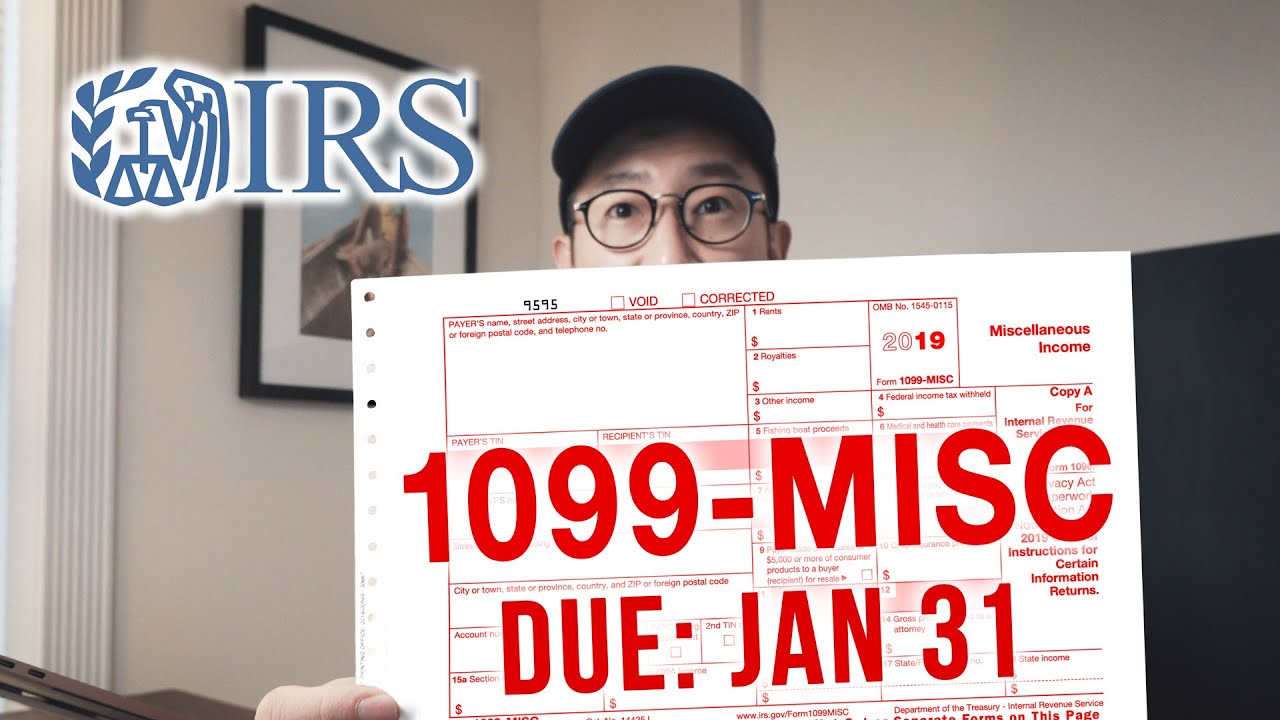

How to File 1099-MISC // Tax for Photographers

Показать описание

***CORRECTIONS***

1. 11:35 [Form 1096, Box 5] Forgot to mention in the video, add the sum total of all your [1099-MISC, Box 7] and enter into [Form 1096, Box 5].

2. 11:35 [Form 1096, Box 7] Mark with an "X" for 2019.

3. 8:49 [1099-MISC, Box 14] amounts are for settlements paid to attorneys. For other "regular" fees paid for attorney services, enter amounts in [Box 7] like you would any other contractor.

******

1099-MISC forms are due by Jan 31, 2020. If you’ve hired people in 2019 as a photographer/videographer/content creator/freelancer... don’t forget to file your 1099-MISC forms. DO NOT WAIT TIL THE LAST MINUTE! You can’t do this the day before, so watch this video to find out why and how to fill it out.

Timestamps:

0:00 Intro

0:26 Why You Should File

1:03 Electronic Filing (FIRE)

2:32 Hard-Copy Filing

3:58 How to Order Form 1099-MISC

5:24 Form 1096

6:20 How to Fill Out Form 1099-MISC

8:58 The $600 Threshold Misconceptions

11:35 How to Fill Out Form 1096

13:15 Which Copy Goes Where

14:00 Tips for Record-Keeping

16:20 Autocrat

17:00 Summary

1099-MISC Instructions:

Electronic filing (FIRE):

Order hard-copies (1099-MISC + 1096) for paper filing HERE:

Where to file by mail:

----------------------

PRODUCT LINKS:

DISCLAIMER:

Amazon Affiliate links above. Same cost to you...I may just earn a small commission, which really helps out the channel. As an Amazon Associate, I earn from qualifying purchases.

==========

SOCIAL:

PODCAST:

Комментарии

0:07:02

0:07:02

0:21:54

0:21:54

0:01:54

0:01:54

0:01:58

0:01:58

0:02:19

0:02:19

0:01:28

0:01:28

0:06:21

0:06:21

0:03:19

0:03:19

0:04:38

0:04:38

0:04:09

0:04:09

0:03:46

0:03:46

0:04:10

0:04:10

0:21:08

0:21:08

0:02:58

0:02:58

0:03:25

0:03:25

0:03:23

0:03:23

0:02:23

0:02:23

0:18:06

0:18:06

0:41:17

0:41:17

0:01:40

0:01:40

0:04:46

0:04:46

0:00:58

0:00:58

0:45:18

0:45:18

0:00:30

0:00:30