filmov

tv

TIME VALUE OF MONEY and Why it is Important in Financial Management.

Показать описание

Time Value of Money and its importance in Financial Management

TVM (Time Value of Money) is a concept used in finance, referring to an amount of money or capital that is actually worth more than the identical sum of capital in the future due to its potential earning capacity. This financial core principle simply refers to that, provided money today is able to earn interest, therefore any amount of money would be worth more the sooner it would be received.

Importance of Time Value of Money in financial management is mainly due to the fact that TVM draws from the idea that most investors prefer to receive money today rather than the same amount of money in the future because the money received today may have potential growth rather than the money received after 1 year. For example, a sum of money deposited into a savings account will earn a specific percentage of interest rate and therefore be said to be compounding in value. Suppose John wins USD 100.000 in a lottery today, before accepting his prize he has to make a decision to receive the prize now, or to collect it in 1 year. The following must be considered by John: If the money is collected now, he can deposit it in an interest saving account in a Bank that offers 10 percent annual interest rate. But if John decides not to take money today, he has to wait a full year with no money and no interest. When deposited money will be withdrawn after 1 year it is grown to USD 110.000, meaning that by taking money early John benefited an extra USD 10.000.

Another factor that explains Time Value of Money is inflation. Inflation in finance refers to a term of overall increase of goods and services’ prices over a period of time. Normally, it is measured by Financists, by monitoring how a basket of commonly used products or services is increasing in price. For Example: Due to increased prices, we have declined purchasing power. Spending USD 100 at a grocery shop, buys fewer goods over time, due to increased prices. Thus, payments we receive in the future would have less value, because with the cash we receive in the future we will be able to buy fewer products and services compared to that if we receive cash today.

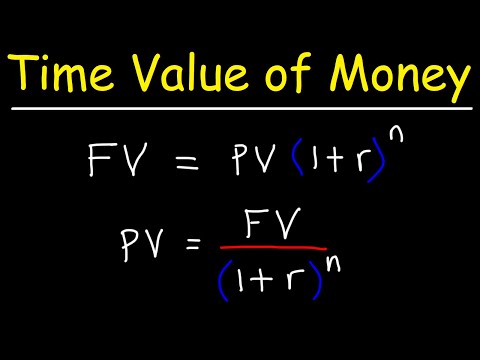

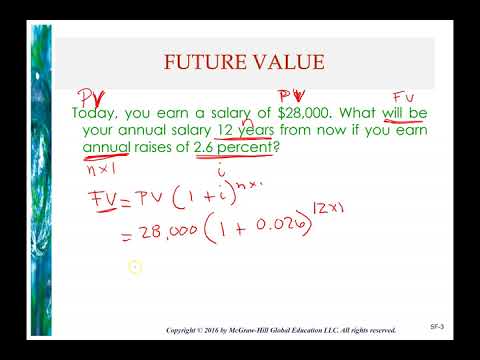

To calculate the Time Value of Money following factors must be considered: Present Value of money (PV), Future Value of Money (FV), Interest Rate (i), time (t) and number of compounding periods per year (n).

Based on this compounds the Time Value of Money formula is:

FV = PV x [ 1 + (i / n) ] (n x t)

#tvm #timevalueofmoney #timeandmoney #timeismoney

TVM (Time Value of Money) is a concept used in finance, referring to an amount of money or capital that is actually worth more than the identical sum of capital in the future due to its potential earning capacity. This financial core principle simply refers to that, provided money today is able to earn interest, therefore any amount of money would be worth more the sooner it would be received.

Importance of Time Value of Money in financial management is mainly due to the fact that TVM draws from the idea that most investors prefer to receive money today rather than the same amount of money in the future because the money received today may have potential growth rather than the money received after 1 year. For example, a sum of money deposited into a savings account will earn a specific percentage of interest rate and therefore be said to be compounding in value. Suppose John wins USD 100.000 in a lottery today, before accepting his prize he has to make a decision to receive the prize now, or to collect it in 1 year. The following must be considered by John: If the money is collected now, he can deposit it in an interest saving account in a Bank that offers 10 percent annual interest rate. But if John decides not to take money today, he has to wait a full year with no money and no interest. When deposited money will be withdrawn after 1 year it is grown to USD 110.000, meaning that by taking money early John benefited an extra USD 10.000.

Another factor that explains Time Value of Money is inflation. Inflation in finance refers to a term of overall increase of goods and services’ prices over a period of time. Normally, it is measured by Financists, by monitoring how a basket of commonly used products or services is increasing in price. For Example: Due to increased prices, we have declined purchasing power. Spending USD 100 at a grocery shop, buys fewer goods over time, due to increased prices. Thus, payments we receive in the future would have less value, because with the cash we receive in the future we will be able to buy fewer products and services compared to that if we receive cash today.

To calculate the Time Value of Money following factors must be considered: Present Value of money (PV), Future Value of Money (FV), Interest Rate (i), time (t) and number of compounding periods per year (n).

Based on this compounds the Time Value of Money formula is:

FV = PV x [ 1 + (i / n) ] (n x t)

#tvm #timevalueofmoney #timeandmoney #timeismoney

Комментарии

0:08:17

0:08:17

0:05:14

0:05:14

0:04:57

0:04:57

0:02:50

0:02:50

0:21:53

0:21:53

0:03:37

0:03:37

0:30:52

0:30:52

0:13:11

0:13:11

0:00:58

0:00:58

0:06:37

0:06:37

0:54:18

0:54:18

0:13:49

0:13:49

0:21:21

0:21:21

0:15:33

0:15:33

0:53:03

0:53:03

0:11:13

0:11:13

0:44:48

0:44:48

0:43:47

0:43:47

0:29:05

0:29:05

0:11:03

0:11:03

0:18:34

0:18:34

0:28:51

0:28:51

0:31:22

0:31:22

0:09:35

0:09:35