filmov

tv

QuickBooks Online for Real Estate Brokers - The Essentials

Показать описание

Register for the course here:

Index

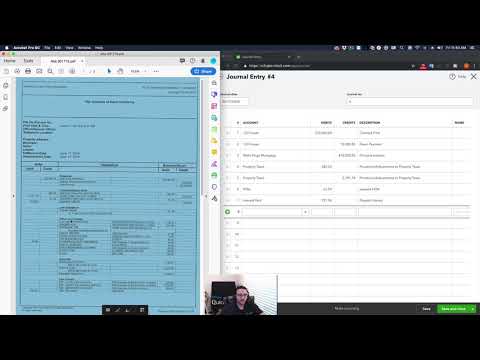

2:00 Lots of issues if a broker ignores the right process to record the transaction when getting a commission.

2:55 Right way to record the commission and paying the agent.

3:28 Putting in the correct customer on the invoice.

4:58 Setting up the broker commission as product and service in the invoice.

5:46 Setting up royalties as COGS in expense account

7:00 Agent commissions payable created as a service item in liability account

8:38 You can write in agent commission in the percentage instead

9:23 Record the agent commission so we can 1099 them

9:42 Running a profit and loss and filter to the one customer

10:41 Create a bill

11:08 Picking up the expense for the agent, adding in the service as agents commission paid

12:58 Adding in agents commission payable as -18k to zero out the bill

13:25 Checking P&L and filtering for one customer

15:00 Fixing chart of accounts Commission paid as COGS

15:21 Showing commissions in COGS

16:16 Back to balance sheet to check work

17:29 The recap of video

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Nerd Enterprises, Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Nerd Enterprises, Inc. does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published. Readers and viewers should verify statements before relying on them.

Index

2:00 Lots of issues if a broker ignores the right process to record the transaction when getting a commission.

2:55 Right way to record the commission and paying the agent.

3:28 Putting in the correct customer on the invoice.

4:58 Setting up the broker commission as product and service in the invoice.

5:46 Setting up royalties as COGS in expense account

7:00 Agent commissions payable created as a service item in liability account

8:38 You can write in agent commission in the percentage instead

9:23 Record the agent commission so we can 1099 them

9:42 Running a profit and loss and filter to the one customer

10:41 Create a bill

11:08 Picking up the expense for the agent, adding in the service as agents commission paid

12:58 Adding in agents commission payable as -18k to zero out the bill

13:25 Checking P&L and filtering for one customer

15:00 Fixing chart of accounts Commission paid as COGS

15:21 Showing commissions in COGS

16:16 Back to balance sheet to check work

17:29 The recap of video

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Nerd Enterprises, Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Nerd Enterprises, Inc. does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published. Readers and viewers should verify statements before relying on them.

Комментарии

0:18:51

0:18:51

1:04:21

1:04:21

0:18:02

0:18:02

0:35:13

0:35:13

0:20:47

0:20:47

0:14:33

0:14:33

0:07:25

0:07:25

0:05:45

0:05:45

0:23:16

0:23:16

0:08:39

0:08:39

0:05:54

0:05:54

0:59:33

0:59:33

0:20:56

0:20:56

0:04:01

0:04:01

0:22:48

0:22:48

0:06:27

0:06:27

0:03:10

0:03:10

0:15:00

0:15:00

![[ENROLL NOW] End](https://i.ytimg.com/vi/wBnvZQ33Rj0/hqdefault.jpg) 0:01:24

0:01:24

0:12:06

0:12:06

0:01:00

0:01:00

0:03:21

0:03:21

0:22:39

0:22:39

0:10:04

0:10:04