filmov

tv

Best VXX and UVXY Trading Methods for Consistent Profit

Показать описание

Revealing the best and worst methods to short volatility. In this video we go over 5 live Short VXX trades and determine which one is the best long-term. We compare short VXX with a long VXX Put Option, long VXX Put Vertical, long VXX Put Butterfly, and a short VXX Straddle.

Here's Your Link for a FREE Trial to VTS!

Follow me on Twitter:

---

Brent Osachoff

#volatilitytradingstrategies #optiontrading #shortvolatility #UVXY

Here's Your Link for a FREE Trial to VTS!

Follow me on Twitter:

---

Brent Osachoff

#volatilitytradingstrategies #optiontrading #shortvolatility #UVXY

The Volatility ETF Landscape: UVXY | VXX | Big Profit Potential

Best VXX and UVXY Trading Methods for Consistent Profit

Why I Never Buy VXX (or UVXY)

UVXY explained & When Is It Time To Buy UVXY! The Low Down On Leveraged ETF's!

Hedging SPY & VOO with VIX ETFs - VXX, VXZ, VIXM, UVXY

Awesome Short Volatility Strategy: Short VXX / UVXY with Butterfly Options

What's The Difference Between VXX And UVXY? [Episode 368]

How fast do Volatility ETPs decay? UVXY down how much per week?

ProShares Ultra VIX Short-Term Futures ETF: $UVXY

Guaranteed 15-30% With VIX ETF Trading

VXX | UVXY Put Options DON'T work after a Market Crash

VXX Puts vs Short VXX - Which Short Volatility method is best?

Buy & Hold Short Volatility Does Not Work - VXX, UVXY, TVIX

How to hedge with UVXY and VIX (Make money on any market condition)

How to avoid 'most' Volatility spikes VXX : UVXY

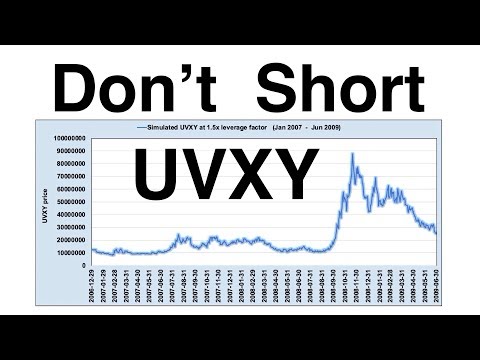

Don't Short UVXY - Volatility ETPs are risky

Make More PROFIT with Less RISK: Short VXX vs Long SVIX

VXX, UVXY oder doch VIXY ?! Welches Volatilitäts-Derivat ist besser?

Double your money in 2 WEEKS with this stock

VXX Trade with Stock Replacement - Reduce Short Vol Risk!

Volatility Strategy Changes for 2019 - VIX, VXX, UVXY, SVXY

Mastering UVXY ETF Trading | Top Tips for Profitable Trades

Seth Golden: VIX Trader Wrecks Haters // shorting UVXY TVIX VXX short volatility strategy

Best Trade Ideas - $UVXY - #UVXY ETF - SHORT ANY POPS. Jan. 24th, 2022.

Комментарии

0:10:11

0:10:11

0:13:14

0:13:14

0:08:36

0:08:36

0:20:54

0:20:54

0:02:47

0:02:47

0:10:52

0:10:52

0:02:56

0:02:56

0:21:58

0:21:58

0:02:56

0:02:56

0:07:48

0:07:48

0:07:51

0:07:51

0:15:18

0:15:18

0:07:36

0:07:36

0:09:31

0:09:31

0:24:13

0:24:13

0:09:31

0:09:31

0:06:44

0:06:44

0:17:51

0:17:51

0:01:00

0:01:00

0:27:25

0:27:25

0:10:30

0:10:30

0:00:33

0:00:33

0:40:51

0:40:51

0:00:59

0:00:59