filmov

tv

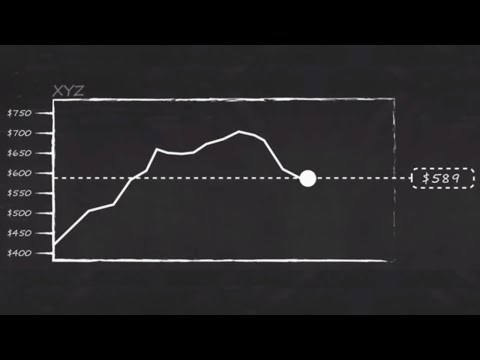

How to Set a Trailing Stop Loss

Показать описание

In this video, I’m going to explain how to set a trailing stop loss. I'll also show you the difference between an ATR trailing stop and a percentage based stop. The difference in potential profit will probably surprise you.

Of all the professional exit strategies, the most widely used would have to be the trailing stop loss. This is the best way I know to make triple digit gains. The trailing stop is ideal for letting a profit run, while at the same time, giving you a clear-cut exit point for when a stock turn lower. And in this video, I'll show you how to set your stop like a pro.

00:00 Intro

00:26 What you'll learn about the trailing stop loss?

01:10 Question: What determines a stops width?

02:00 Using a stock's trading range to set your stop

02:35 The pros calculate an ATR to set stops

04:27 How an ATR trailing stop responds to volatility

06:50 Which is better: An ATR stop or a percentage stop?

08:29 Example of a percentage based stop

09:18 Advantages of a percentage trailing stop

👇 SUBSCRIBE TO MOTION TRADER'S YOUTUBE CHANNEL NOW FOR MORE FREE TIPS AND SECRETS 👇

If you want a no b.s. approach to trading shares, investing in the stock market, and managing your share portfolio, then learn from Jason McIntosh at Motion Trader. It could change the way you invest forever.

★☆★ Follow Motion Trader Online★☆★

#trailingstoploss #howtosellshares #MotionTrader #ASXstocks

GENERAL ADVICE WARNING

This video is about

Of all the professional exit strategies, the most widely used would have to be the trailing stop loss. This is the best way I know to make triple digit gains. The trailing stop is ideal for letting a profit run, while at the same time, giving you a clear-cut exit point for when a stock turn lower. And in this video, I'll show you how to set your stop like a pro.

00:00 Intro

00:26 What you'll learn about the trailing stop loss?

01:10 Question: What determines a stops width?

02:00 Using a stock's trading range to set your stop

02:35 The pros calculate an ATR to set stops

04:27 How an ATR trailing stop responds to volatility

06:50 Which is better: An ATR stop or a percentage stop?

08:29 Example of a percentage based stop

09:18 Advantages of a percentage trailing stop

👇 SUBSCRIBE TO MOTION TRADER'S YOUTUBE CHANNEL NOW FOR MORE FREE TIPS AND SECRETS 👇

If you want a no b.s. approach to trading shares, investing in the stock market, and managing your share portfolio, then learn from Jason McIntosh at Motion Trader. It could change the way you invest forever.

★☆★ Follow Motion Trader Online★☆★

#trailingstoploss #howtosellshares #MotionTrader #ASXstocks

GENERAL ADVICE WARNING

This video is about

Комментарии

0:10:06

0:10:06

0:10:39

0:10:39

0:02:05

0:02:05

0:02:36

0:02:36

0:03:23

0:03:23

0:11:35

0:11:35

0:10:30

0:10:30

0:07:33

0:07:33

0:09:28

0:09:28

0:08:22

0:08:22

0:06:17

0:06:17

0:00:58

0:00:58

0:04:17

0:04:17

0:00:20

0:00:20

0:05:44

0:05:44

0:00:17

0:00:17

0:02:08

0:02:08

0:01:00

0:01:00

0:08:36

0:08:36

0:07:14

0:07:14

0:11:28

0:11:28

0:04:53

0:04:53

0:00:58

0:00:58

0:00:50

0:00:50