filmov

tv

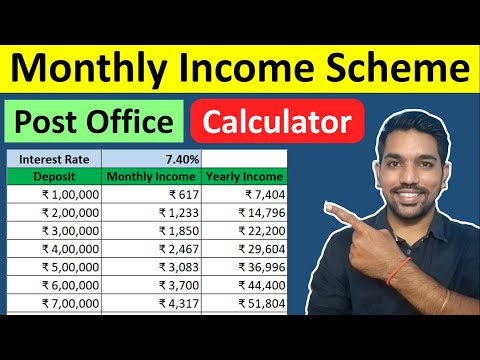

post office monthly income scheme/post office MIS calculator,interest rate, benifits/pomis 2024

Показать описание

The Post Office Monthly Income Scheme (MIS) is a type of term deposit account offered by India Post. The MIS scheme pays interest each month and is suited for those who seek regular or supplementary income from their investments. This is a type of investment plan that is offered by the Department of Posts (DoP), also known as India Post. Those who would like to invest in Post Office monthly income schemes can do so at any post office in their respective locality. As of 1 Jan 2024, the interest rate offered on the Post Office Monthly Income Scheme is 7.4% p.a

post office automatic MIS plus RD:

(a)Who can open:-

(i) a single adult

(ii) Joint Account (up to 3 adults) (Joint A or Joint B))

(iii) a guardian on behalf of minor/ person of unsound mind

(iv) a minor above 10 years in his own name.

(b)Deposit:-

(i) Account can be opened with minimum of Rs. 1000 and in multiple of Rs. 1000.

(ii) A maximum of Rs. 9 lakh can be deposited in a single account and 15 lakh in Joint account.

(iii) In a joint account, all the joint holders shall have equal share in investment.

(iv) Deposits/shares in all MIS accounts opened by an individual shall not exceed Rs. 9 lakh.

(iv) Limit for account opened on behalf of a minor as guardian shall be separate.

(c)Interest:-

From 01.01.2024, interest rates are as follows:-

7.4 % per annum payable monthly.

(i) Interest shall be payable on completion of a month from the date of opening and so on till maturity.

(ii) If the interest payable every month is not claimed by the account holder such interest shall not earn any additional interest.

(iii) In case any excess deposit made by the depositor, the excess deposit will be refunded back and only PO Savings Account interest will be applicable from the date of opening of account to the date of refund.

(iv) Interest can be drawn through auto credit into savings account standing at same post office, or ECS.

(v) Interest is taxable in the hand of depositor.

(d)Pre-mature closure of account:-

(i) No deposit shall be withdrawn before the expiry of 1 year from the date of deposit.

(ii) If account is closed after 1 year and before 3 year from the date of account opening, a deduction equal to 2% from the principal will be deducted and remaining amount will be paid.

(iii) If account closed after 3 year and before 5 year from the date of account opening, a deduction equal to 1% from the principal will be deducted and remaining amount will be paid.

(iv) Account can be prematurely closed by submitting prescribed application form with pass book at concerned Post Office.

(e)Maturity:-

(i) Account may be closed on expiry of 5 years from the date of opening by submitting prescribed application form with pass book at concerned Post Office.

(ii) In case the account holder dies before the maturity, the account may be closed and amount will be refunded to nominee/legal heirs. Interest will be paid up to the preceding month, in which refund is made.

keywords:

Post office monthly income scheme in telugu,

post office monthly income scheme 2023,

post office monthly income scheme account,

post office monthly income scheme account will earn 7.4%,

best post office monthly income scheme,

post office monthly income scheme calculator,

post office monthly income scheme details,

post office monthly income scheme details in telugu,

post office scheme for monthly income,

how to open post office monthly income scheme account online,

how to invest in post office monthly income scheme in telugu,

post office mis scheme 2023,

post office best scheme 2023,

post office monthly income scheme new update 2023,

Post office monthly income scheme advantages,

Post office MIS calculator,

Post office MIS interest rate,

Post office MIS in telugu,

Post office scheme for monthly income,

Post office mis details,

#VDMTelugu

#postofficemonthlyincomescheme

Queries solved in this video:

post office monthly income scheme,

post office MIS calculator,

post office monthly income scheme benifits,

post office monthly income scheme interest rate,

pomis 2024

Note:

Posting any content from this channel is all are about my personal views.These videos are intended only for informational purpose or educational purpose.This channel do not promote any products discussed herein.Viewers are subjected to use this information on their own risk.Please contact experts before taking any decisions.

Disclaimer :

post office automatic MIS plus RD:

(a)Who can open:-

(i) a single adult

(ii) Joint Account (up to 3 adults) (Joint A or Joint B))

(iii) a guardian on behalf of minor/ person of unsound mind

(iv) a minor above 10 years in his own name.

(b)Deposit:-

(i) Account can be opened with minimum of Rs. 1000 and in multiple of Rs. 1000.

(ii) A maximum of Rs. 9 lakh can be deposited in a single account and 15 lakh in Joint account.

(iii) In a joint account, all the joint holders shall have equal share in investment.

(iv) Deposits/shares in all MIS accounts opened by an individual shall not exceed Rs. 9 lakh.

(iv) Limit for account opened on behalf of a minor as guardian shall be separate.

(c)Interest:-

From 01.01.2024, interest rates are as follows:-

7.4 % per annum payable monthly.

(i) Interest shall be payable on completion of a month from the date of opening and so on till maturity.

(ii) If the interest payable every month is not claimed by the account holder such interest shall not earn any additional interest.

(iii) In case any excess deposit made by the depositor, the excess deposit will be refunded back and only PO Savings Account interest will be applicable from the date of opening of account to the date of refund.

(iv) Interest can be drawn through auto credit into savings account standing at same post office, or ECS.

(v) Interest is taxable in the hand of depositor.

(d)Pre-mature closure of account:-

(i) No deposit shall be withdrawn before the expiry of 1 year from the date of deposit.

(ii) If account is closed after 1 year and before 3 year from the date of account opening, a deduction equal to 2% from the principal will be deducted and remaining amount will be paid.

(iii) If account closed after 3 year and before 5 year from the date of account opening, a deduction equal to 1% from the principal will be deducted and remaining amount will be paid.

(iv) Account can be prematurely closed by submitting prescribed application form with pass book at concerned Post Office.

(e)Maturity:-

(i) Account may be closed on expiry of 5 years from the date of opening by submitting prescribed application form with pass book at concerned Post Office.

(ii) In case the account holder dies before the maturity, the account may be closed and amount will be refunded to nominee/legal heirs. Interest will be paid up to the preceding month, in which refund is made.

keywords:

Post office monthly income scheme in telugu,

post office monthly income scheme 2023,

post office monthly income scheme account,

post office monthly income scheme account will earn 7.4%,

best post office monthly income scheme,

post office monthly income scheme calculator,

post office monthly income scheme details,

post office monthly income scheme details in telugu,

post office scheme for monthly income,

how to open post office monthly income scheme account online,

how to invest in post office monthly income scheme in telugu,

post office mis scheme 2023,

post office best scheme 2023,

post office monthly income scheme new update 2023,

Post office monthly income scheme advantages,

Post office MIS calculator,

Post office MIS interest rate,

Post office MIS in telugu,

Post office scheme for monthly income,

Post office mis details,

#VDMTelugu

#postofficemonthlyincomescheme

Queries solved in this video:

post office monthly income scheme,

post office MIS calculator,

post office monthly income scheme benifits,

post office monthly income scheme interest rate,

pomis 2024

Note:

Posting any content from this channel is all are about my personal views.These videos are intended only for informational purpose or educational purpose.This channel do not promote any products discussed herein.Viewers are subjected to use this information on their own risk.Please contact experts before taking any decisions.

Disclaimer :

Комментарии

0:14:14

0:14:14

0:16:32

0:16:32

0:13:08

0:13:08

0:09:37

0:09:37

0:05:15

0:05:15

0:10:39

0:10:39

0:04:06

0:04:06

0:07:47

0:07:47

0:07:33

0:07:33

0:08:43

0:08:43

0:07:00

0:07:00

0:09:04

0:09:04

0:06:57

0:06:57

0:04:24

0:04:24

0:10:39

0:10:39

0:20:20

0:20:20

0:05:03

0:05:03

0:08:16

0:08:16

0:08:49

0:08:49

0:09:49

0:09:49

0:08:50

0:08:50

0:05:21

0:05:21

0:04:43

0:04:43

0:08:24

0:08:24