filmov

tv

How to solve Gstr 2A & Gstr 2B Mismatch in Tamil | Is Auto generated value wrong in GST Portal ?

Показать описание

#GSTinTamil #GstnewUpdatesinTamil #GSTR2A #GSTR2B #MismatchError

GSTR-2B provides eligible and ineligible Input Tax Credit (ITC) for each month, similar to GSTR-2A but remains constant for a period. The statement will clearly show document wise details of ITC eligibility. ITC information will be covered from the filing date of GSTR-1 for the preceding month (M-1) up to the filing date of GSTR-1 for the current month (M)

GSTR-2A is Dynamic in nature which can be changed time to time whereas GSTR-2B is static in nature, once GSTR-2B generated can’t be changed.

For Gstr 2A Source of Information is GSTR-1,GSTR-5,GSTR-6,GSTR-7,GSTR-8,and ICES whereas in GSTR-2B Source of information is GSTR-1,GSTR-5,GSTR-6 and ICES that’s why GSTR-2B does not contains data of TDS and TCS

How to solve Mismatch error in Gstr 9

GST Refund RFD 01 Form

GST - Different type of Supply in GST

GST Input Tax Credit on Car Purchase

GSTR-2B provides eligible and ineligible Input Tax Credit (ITC) for each month, similar to GSTR-2A but remains constant for a period. The statement will clearly show document wise details of ITC eligibility. ITC information will be covered from the filing date of GSTR-1 for the preceding month (M-1) up to the filing date of GSTR-1 for the current month (M)

GSTR-2A is Dynamic in nature which can be changed time to time whereas GSTR-2B is static in nature, once GSTR-2B generated can’t be changed.

For Gstr 2A Source of Information is GSTR-1,GSTR-5,GSTR-6,GSTR-7,GSTR-8,and ICES whereas in GSTR-2B Source of information is GSTR-1,GSTR-5,GSTR-6 and ICES that’s why GSTR-2B does not contains data of TDS and TCS

How to solve Mismatch error in Gstr 9

GST Refund RFD 01 Form

GST - Different type of Supply in GST

GST Input Tax Credit on Car Purchase

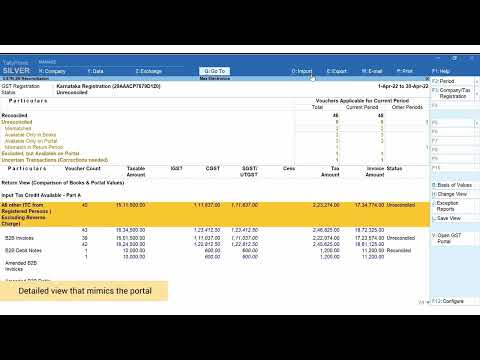

GSTR 2A and GSTR 2B Reconciliation | TallyPrime Walkthrough

Free Tool| Easy steps to identify mismatch of GSTR 2A & Book| How to reconcile purchase with GST...

How to Clean GSTR 2A (Remove Double Amount Row & Remove Blank Row) in Excel

How to solve Gstr 2A & Gstr 2B Mismatch in Tamil | Is Auto generated value wrong in GST Portal ?

GSTR 2A RECONCILIATION WITH EXCEL IN 10 MINUTES VERY EASY, HOW TO RECONCILE PURCHASE WITH GSTR 2A,

GSTR-2A Reconciliation | 5 Minute Process to Reconcile Purchase Data with GSTR-2A

GSTR-2A/2B With PURCHASE RECONCILIATION in Excel

Easy solution -20% ITC Rule| Issue in GSTR 2A Matching| Problem in GST-2A Reconciliation| What to do

Most Important Gk Questions ssc gd #gk #gkgs #gkquestion #uppolicegkgs #upsc #uppolice

What is GSTR 2A and 2B //Input credit in GSTR 2A & 2B //GSTR 2A Reconciliation

GSTR 2A and 2B Difference in Hindi - 2A, 2B Kya Hai? Kaunsa GST Return File Kare?

GSTR 2A Reconciliation in few Easy Steps in Excel in 5 minutes

GSTR 2A or GSTR 2B for ITC Reconciliation ? 🔥 Practical Problems in GST Return Filing

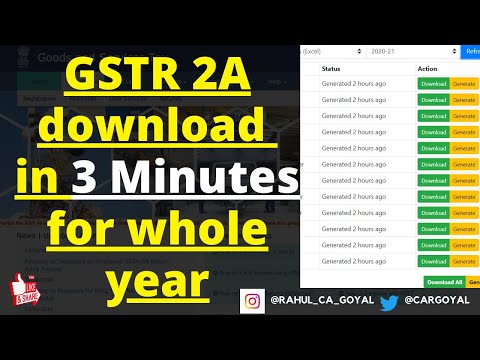

How to download GSTR 2A for whole year | GSTR 2A download | GST return download for a year |

VijaySoft Solution GSTR 2A

Party wise GSTR 2A Reconciliation in Excel | GSTR 2A Reconciliation |2A reconciliation in excel 2022

GST Update Directly download GSTR2A in Excel format

GSTR2A reconciliation In tally prime 3.0 | how to reconcile gstr 2A in tally prime

What is GSTR 2 GSTR 2A GSTR 2B || How to claim ITC in GSTR 3B || ITC Claim in Hindi.

GSTR 2A Reconciliation in Less Than 60 Seconds, Even if Invoice Mismatch

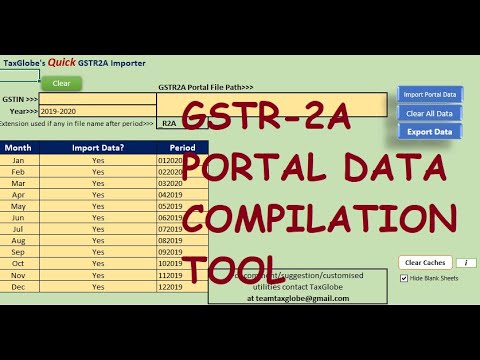

How to use GSTR-2A Portal Data Compilation Tool?

How to resolve differences in GSTR 2A vs. GSTR 3B & Solution || CA (Adv) Bimal Jain

Enhanced Form GSTR 2A PART-A B & C. Simply click on Tabs & directly visit the segment Watch ...

REASON OF MISMATCH BETWEEN GSTR2A/2B & GSTR3B | HOW TO AVOID ITC MISMATCH NOTICES

Комментарии

0:01:30

0:01:30

0:13:11

0:13:11

0:06:14

0:06:14

0:03:48

0:03:48

0:14:46

0:14:46

0:09:48

0:09:48

0:06:41

0:06:41

0:08:39

0:08:39

0:00:06

0:00:06

0:08:16

0:08:16

0:08:01

0:08:01

0:31:39

0:31:39

0:08:42

0:08:42

0:07:35

0:07:35

0:00:09

0:00:09

0:20:59

0:20:59

0:01:42

0:01:42

0:19:46

0:19:46

0:17:18

0:17:18

0:19:57

0:19:57

0:04:24

0:04:24

0:12:44

0:12:44

0:01:10

0:01:10

0:13:43

0:13:43