filmov

tv

How to Calculate Realized & Implied Volatility and Why it's Important - Christopher Quill

Показать описание

JOIN THE 2024 ITPM END OF YEAR ONLINE CONFERENCE

GET MASSIVE DISCOUNTS ON ITPM ONLINE PROGRAMS CLICK HERE;-

Quantitative analyst Christopher Quill discusses the importance of understanding volatility, and shows how to calculate both realized and implied volatility values for yourself.

|| Filmed at the ITPM New York Super Conference, September 2016 ||

GET MASSIVE DISCOUNTS ON ITPM ONLINE PROGRAMS CLICK HERE;-

Quantitative analyst Christopher Quill discusses the importance of understanding volatility, and shows how to calculate both realized and implied volatility values for yourself.

|| Filmed at the ITPM New York Super Conference, September 2016 ||

How to Calculate Realized & Implied Volatility and Why it's Important - Christopher Quill

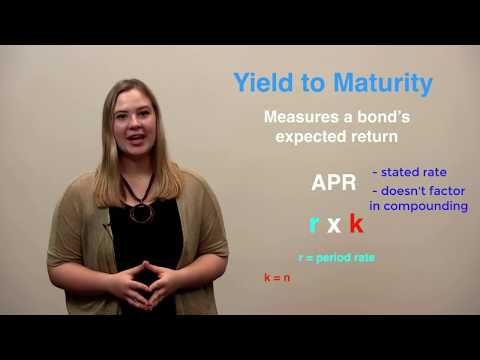

Video 13 - Calculating a Bond's Realized Return

FIN-101 Module 10: Realized Return

Amount Realized

Realized and Recognized Gain/Loss Explained

Find the realized compound yield on the bond (Example Problem)

What is a Realized Gain? (and Unrealized Gain)

Lecture 66: what is the Realized Yield Method?

How to Find Bitcoin's Realized Price

Implied VS Realized Volatility

How Income Tax Calculated on Unrealized & Realized Profit & Loss

Capital Gains Explained for Beginners // Realized vs Unrealized Gains (Stock Market Tips)

Amount Realized Property Transaction Gain Loss

Fixed Income: Gross versus net realized return (FRM T4-27)

UnRealized vs Realized GAINS EXPLAINED! (On Bybit for Beginners!)

Implied volatility | Finance & Capital Markets | Khan Academy

Cost of Equity - Realized Yield Approach - CMA/CA Inter - Financial Management

Realized versus Recognized gain/Loss. CPA/EA Exam

How to calculate realized heritability

Implied Vs. Realized Volatility

Realized Vol Tab

Excel - Realized Foreign Exchange Gain / Loss Calculation Template

Realized Return Over One Year

GVol: Realized Volatility

Комментарии

0:40:07

0:40:07

0:14:02

0:14:02

0:07:25

0:07:25

0:06:48

0:06:48

0:05:54

0:05:54

0:00:55

0:00:55

0:02:23

0:02:23

0:03:25

0:03:25

0:03:00

0:03:00

0:07:56

0:07:56

0:02:41

0:02:41

0:02:04

0:02:04

0:18:06

0:18:06

0:15:08

0:15:08

0:03:28

0:03:28

0:05:00

0:05:00

0:22:02

0:22:02

0:11:49

0:11:49

0:12:17

0:12:17

0:02:22

0:02:22

0:08:58

0:08:58

0:10:08

0:10:08

0:02:57

0:02:57

0:04:19

0:04:19