filmov

tv

Working Capital Formula | How to Calculate Working Capital (with Example)

Показать описание

In this video on Working Capital formula, we will look at how you can find out the Working Capital formula of a company.

𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐟𝐨𝐫𝐦𝐮𝐥𝐚

---------------------------------------------

This is one of the most common concepts every business owner should understand.

Each and every investor must know how to find how liquid a firm is at any given moment of time.

Below is the formula Working Capital.

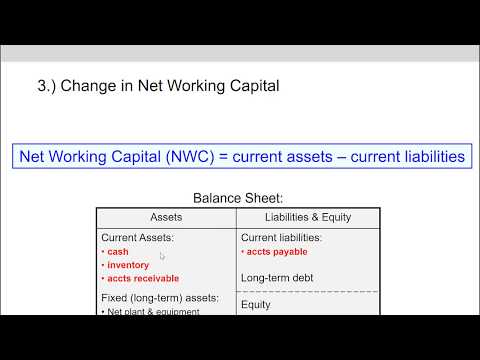

Working Capital = Current Assets - Current Liabilities

𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐄𝐱𝐚𝐦𝐩𝐥𝐞

---------------------------------------------

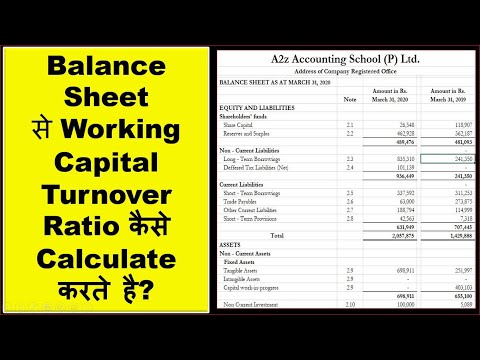

Shield Company has the following information

Current Assets –

Accounts Receivables – $60,000

Cash – $25,000

Inventories – $54,000

Marketable Securities – $55,000

Prepaid Expenses – $6000

Current Liabilities –

Accounts Payables – $45,000

Notes Payables – $25,000

Accrued Expenses – $22,000

Short term debt – $44,000

Now we need to find out the Working Capital of Shield Company

Total Current Assets = ($60,000 + $25,000 + $54,000 + $55,000 + $6000) = 200000

Total Current Liabilities = ($45,000 + $25,000 + $22,000 + $44,000) = 136000

By using Working Capital Formula, we get

WC = Current Assets - Current Liabilities

= 200000 - 136000 = 64000

Working Capital = 64000

𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐟𝐨𝐫𝐦𝐮𝐥𝐚

---------------------------------------------

This is one of the most common concepts every business owner should understand.

Each and every investor must know how to find how liquid a firm is at any given moment of time.

Below is the formula Working Capital.

Working Capital = Current Assets - Current Liabilities

𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐄𝐱𝐚𝐦𝐩𝐥𝐞

---------------------------------------------

Shield Company has the following information

Current Assets –

Accounts Receivables – $60,000

Cash – $25,000

Inventories – $54,000

Marketable Securities – $55,000

Prepaid Expenses – $6000

Current Liabilities –

Accounts Payables – $45,000

Notes Payables – $25,000

Accrued Expenses – $22,000

Short term debt – $44,000

Now we need to find out the Working Capital of Shield Company

Total Current Assets = ($60,000 + $25,000 + $54,000 + $55,000 + $6000) = 200000

Total Current Liabilities = ($45,000 + $25,000 + $22,000 + $44,000) = 136000

By using Working Capital Formula, we get

WC = Current Assets - Current Liabilities

= 200000 - 136000 = 64000

Working Capital = 64000

Комментарии

0:04:46

0:04:46

0:05:41

0:05:41

0:00:53

0:00:53

0:09:31

0:09:31

0:00:58

0:00:58

0:14:02

0:14:02

0:00:18

0:00:18

0:04:02

0:04:02

0:14:39

0:14:39

0:04:43

0:04:43

0:03:25

0:03:25

0:05:05

0:05:05

0:08:52

0:08:52

0:03:23

0:03:23

0:21:58

0:21:58

0:15:50

0:15:50

0:05:18

0:05:18

0:06:06

0:06:06

0:07:32

0:07:32

0:05:40

0:05:40

0:01:55

0:01:55

0:03:14

0:03:14

0:34:42

0:34:42

0:37:03

0:37:03