filmov

tv

Difference between GSTR 2A and GSTR 3B | Mismatch in GSTR 2A & 3B |

Показать описание

Mismatch in GSTR 2A and 3B |

Join this channel to get access to perks:

#CARAHULGOYAL

Please subscribe

Please follow us on Linkedin

Twitter handle

Please follow our Facebook page

The contents of this video are for information purposes only and do not constitute any advice or a legal opinion and are personal views of the creator. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Viewers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above video. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that the creator is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors, or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Join this channel to get access to perks:

#CARAHULGOYAL

Please subscribe

Please follow us on Linkedin

Twitter handle

Please follow our Facebook page

The contents of this video are for information purposes only and do not constitute any advice or a legal opinion and are personal views of the creator. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Viewers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above video. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that the creator is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors, or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

What is GSTR 2A and 2B? What is the difference between 2A and 2B? By Sudhanshu Singh.

Difference between GSTR2A v/s GSTR2B | GSTR2A and GSTR2B big Changes in GST

GSTR 2A and 2B Difference in Hindi - 2A, 2B Kya Hai? Kaunsa GST Return File Kare?

Difference in GSTR 2A & GSTR 2B | When should you Claim ITC ? | CA Nikunj Goenka

What is the difference between GSTR2A and GSTR2B | How to claim correct ITC | GSTR2A | GSTR2B

What is difference between GSTR2A and GSTR2B l GSTR2A and GSTR2B me kya difference hota hai l

GSTR 3B Vs 2A Malayalam | GST Notice|CA Srilakshmi Subin

What Is GSTR 1, GSTR 2A/2B, GSTR 3B | GSTR 1 Vs 3B | GSTR 2A Vs 2B | ITC | GST For Online Sellers

GST ITC #GSTR-2A #Input tax credit #ITC #gst #goods and services tax #itc

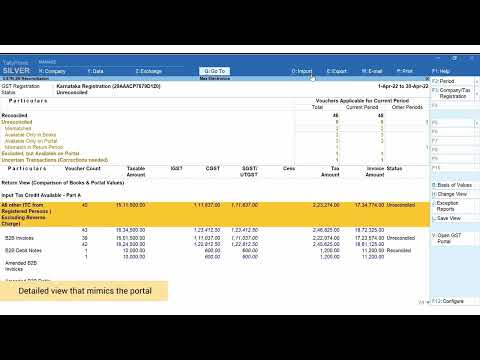

GSTR 2A and GSTR 2B Reconciliation | TallyPrime Walkthrough

GSTR 2B IN MALAYALAM

Difference in GSTR 2A & 2B & 8A in Easy Language| 2A or 2B me kya fark hai? #gst

What is GSTR 2 GSTR 2A GSTR 2B || How to claim ITC in GSTR 3B || ITC Claim in Hindi.

DIFFERENCE BETWEEN GSTR 2A AND GSTR 2B | UPDATED 2022 | WEBTEL

Difference Between GSTR 2A & GSTR 2B

GSTR 2A Vs GSTR 2B | Difference between GSTR2A & 2B | GSTR 2A Vs 2B Which one for ITC Claim | Ta...

Difference between GSTR 2A and GSTR 3B | Mismatch in GSTR 2A & 3B |

GST Returns Scrutiny - GSTR 2A and 2B with 3B

121. What are GSTR-2A & GSTR-2B with Full Details under GST Act | TELUHGU | Smart Tally Prime

Difference Between GSTR-2A and GSTR-2B? #Short #viralshort

Claim ITC as per GSTR 2A or GSTR 2B

GSTR 2A Vs 2B Differences | ITC Gstr2a & Gstr2b | Detail Analysis of GST2A , GSTR2B | Gstr2a vs ...

Difference between GSTR2A v/s GSTR2B|GSTR2A and GSTR2B big Changes|GSTR2B big changes

GSTR 2B | Difference between GSTR 2A and GSTR 2B | CA Nikita Punjabi

Комментарии

0:07:00

0:07:00

0:03:54

0:03:54

0:08:01

0:08:01

0:13:30

0:13:30

0:06:06

0:06:06

0:05:28

0:05:28

0:02:38

0:02:38

0:16:28

0:16:28

0:01:00

0:01:00

0:01:30

0:01:30

0:04:29

0:04:29

0:02:34

0:02:34

0:17:18

0:17:18

0:23:15

0:23:15

0:00:52

0:00:52

0:05:42

0:05:42

0:09:33

0:09:33

0:05:19

0:05:19

0:28:33

0:28:33

0:01:01

0:01:01

0:09:49

0:09:49

0:05:39

0:05:39

0:08:01

0:08:01

0:10:14

0:10:14