filmov

tv

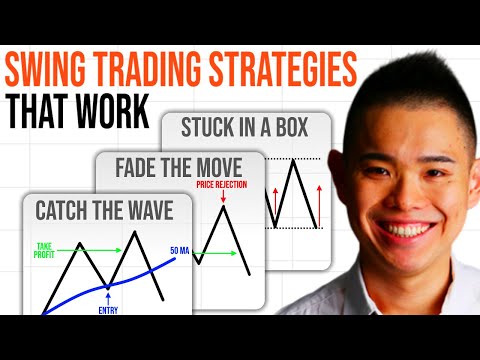

Swing Trading Strategy: 3-5 Bar Sweet Spot

Показать описание

Join this channel to get access to perks:

I dive into the core principles of swing trading, focusing on the importance of identifying the sweet spot for trades, which typically ranges between 3 to 5 bars. I also discuss how to adjust your strategy based on the market's behavior, specifically when dealing with moving averages and recognizing when a market is poised for a significant move. Whether you're trading on an hourly or daily chart, understanding these concepts is key to maximizing your trading profits

💁🏻If you need support or personalized attention, please contact my team through:

📲 WhatsApp: +1 (786) 477-7942

FOLLOW ME ON MY OTHER NETWORKS

🏬Oliver Velez Store

🧑🏿 GET TO KNOW ALL MY PROGRAMS

⚠️ DISCLAIMER

Oliver Velez will never ask you for money

Oliver Velez Trading & Ifundtraders its members, directors, employees and collaborators do not collect money from the public or manage third party accounts.

All content on this channel is for educational purposes and does not constitute investment advice.

Strategies and investments involve risk of loss. None of the information found in this video should be construed as a guarantee of results.

Any decision made by the viewer is solely and expressly their responsibility.

#olivervelez #oliverveleztrading #tradingstrategies #daytrading #tradeforaliving #tradeforprofit

I dive into the core principles of swing trading, focusing on the importance of identifying the sweet spot for trades, which typically ranges between 3 to 5 bars. I also discuss how to adjust your strategy based on the market's behavior, specifically when dealing with moving averages and recognizing when a market is poised for a significant move. Whether you're trading on an hourly or daily chart, understanding these concepts is key to maximizing your trading profits

💁🏻If you need support or personalized attention, please contact my team through:

📲 WhatsApp: +1 (786) 477-7942

FOLLOW ME ON MY OTHER NETWORKS

🏬Oliver Velez Store

🧑🏿 GET TO KNOW ALL MY PROGRAMS

⚠️ DISCLAIMER

Oliver Velez will never ask you for money

Oliver Velez Trading & Ifundtraders its members, directors, employees and collaborators do not collect money from the public or manage third party accounts.

All content on this channel is for educational purposes and does not constitute investment advice.

Strategies and investments involve risk of loss. None of the information found in this video should be construed as a guarantee of results.

Any decision made by the viewer is solely and expressly their responsibility.

#olivervelez #oliverveleztrading #tradingstrategies #daytrading #tradeforaliving #tradeforprofit

Комментарии

0:18:15

0:18:15

0:09:50

0:09:50

0:11:03

0:11:03

0:18:15

0:18:15

0:13:12

0:13:12

0:08:09

0:08:09

0:00:53

0:00:53

0:01:00

0:01:00

0:08:49

0:08:49

0:11:34

0:11:34

0:00:39

0:00:39

0:26:02

0:26:02

0:04:44

0:04:44

0:11:27

0:11:27

0:23:21

0:23:21

0:00:59

0:00:59

0:07:37

0:07:37

0:10:25

0:10:25

0:08:58

0:08:58

0:10:30

0:10:30

0:01:13

0:01:13

0:10:39

0:10:39

0:00:59

0:00:59

0:01:00

0:01:00