filmov

tv

What Is The Right Way To Buy Rental Property?

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

CGI 3D Animated Short 'The Right Way' - by Elena Zobak Alekperov & Flavia Groba Bandei...

What's The RIGHT Way To Eat This?

PARTYNEXTDOOR - The Right Way [Official Audio]

The Right Way - Powerful Vocal Nasheed

The Right Way

Beating Minecraft The RIGHT Way.

What's The RIGHT Way To Cook This?

Which Car Should Pass The Intersection First | Right of Way Rule | Driving tips.

Is there a right way to regulate AI? A conversation with Helen Toner | Equity Podcast

The Right Way Around

The Right Way

Right of Way Rules and Yielding Rules Explained

Which car has the right of way? Understand and Resolve this common Right-of-way driving rule

The Right Way

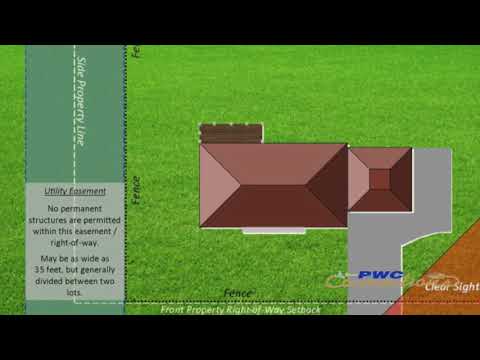

Understanding Right-of-Way & Easements

Basic Right-of-Way Rules and Who Goes First in Road Traffic

Do YOU know the right way to use a can opener?

Driving License Germany, Right of way, Priority, Right Before Left, Theory Test Questions English

The Right Way to Use Your Fork and Knife

Driving Test Germany, Right before left explained in English: Right of way, Priority, Theory Exam

Daughter - The Right Way Around (Life is Strange: Before The Storm)

Right-of-Way in Residential Neighborhoods - Right-of-Way Part 1

This Is The Right Way To Introduce A Hero

Right Way

Комментарии

0:01:50

0:01:50

0:19:49

0:19:49

0:04:42

0:04:42

0:04:11

0:04:11

0:03:27

0:03:27

0:08:01

0:08:01

0:19:07

0:19:07

0:01:51

0:01:51

0:19:17

0:19:17

0:02:41

0:02:41

0:05:05

0:05:05

0:09:58

0:09:58

0:02:35

0:02:35

0:04:10

0:04:10

0:04:08

0:04:08

0:03:38

0:03:38

0:00:24

0:00:24

0:10:01

0:10:01

0:03:18

0:03:18

0:03:35

0:03:35

0:11:14

0:11:14

0:06:40

0:06:40

0:09:11

0:09:11

0:02:22

0:02:22