filmov

tv

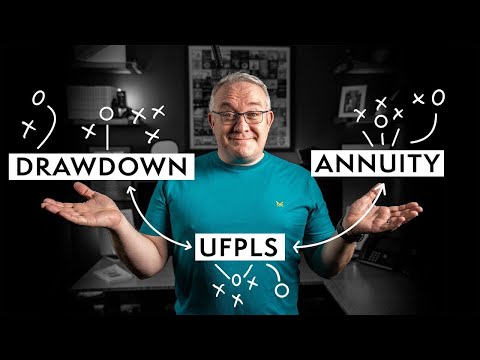

Drawdown or Annuity which is Best - Retirement Planning UK

Показать описание

*Book a call:*

*Website:*

Drawdown or annuity which is Best - Retirement Planning UK

We have a comparison of drawdown versus annuity and the pros and cons of each. This probably can be best summarised by saying that we are pitting guarantees and security versus flexibility and superior death benefits, but we’ll delve a bit deeper into both.

And to be clear the two products aren’t mutually exclusive and where I see it working well is a combination of both annuity and drawdown together and both products bringing something different to the table. Also as previously mentioned in my other videos there is the ability to take fixed term annuities which sits between both annuity and drawdown and can be a good bridge between those products. However, for this video I’m keeping it super simple and we’ll just focus on annuity and drawdown.

Link to the Government Money Helper Website:

🗒 Please note:

The information provided is based on the current understanding of the relevant legislation and regulations and may be subject to alteration as a result of changes in legislation or practice. Also it may not reflect the options available under a specific product which may not be as wide as legislations and regulations allow.

All references to taxation are based on my understanding of current taxation law and practice and may be affected by future changes in legislation and the individual circumstances.

This channel is for information and education purposes only. Any information or guidance given does not act as financial advice. Please consult a financial adviser if you are unsure in anyway.

Keep in mind that the value of your investments can go down as well as up, so you could get back less than you invest.

⭐ My aim is to provide education and guidance to help individuals understand pensions, investments and protection.

#pension #retirementplanning #financialplanninguk

*Website:*

Drawdown or annuity which is Best - Retirement Planning UK

We have a comparison of drawdown versus annuity and the pros and cons of each. This probably can be best summarised by saying that we are pitting guarantees and security versus flexibility and superior death benefits, but we’ll delve a bit deeper into both.

And to be clear the two products aren’t mutually exclusive and where I see it working well is a combination of both annuity and drawdown together and both products bringing something different to the table. Also as previously mentioned in my other videos there is the ability to take fixed term annuities which sits between both annuity and drawdown and can be a good bridge between those products. However, for this video I’m keeping it super simple and we’ll just focus on annuity and drawdown.

Link to the Government Money Helper Website:

🗒 Please note:

The information provided is based on the current understanding of the relevant legislation and regulations and may be subject to alteration as a result of changes in legislation or practice. Also it may not reflect the options available under a specific product which may not be as wide as legislations and regulations allow.

All references to taxation are based on my understanding of current taxation law and practice and may be affected by future changes in legislation and the individual circumstances.

This channel is for information and education purposes only. Any information or guidance given does not act as financial advice. Please consult a financial adviser if you are unsure in anyway.

Keep in mind that the value of your investments can go down as well as up, so you could get back less than you invest.

⭐ My aim is to provide education and guidance to help individuals understand pensions, investments and protection.

#pension #retirementplanning #financialplanninguk

Комментарии

0:09:44

0:09:44

0:11:19

0:11:19

0:11:51

0:11:51

0:07:20

0:07:20

0:07:31

0:07:31

0:05:32

0:05:32

0:06:35

0:06:35

0:10:06

0:10:06

0:12:17

0:12:17

0:13:45

0:13:45

0:02:46

0:02:46

0:05:15

0:05:15

0:01:00

0:01:00

0:04:12

0:04:12

0:13:58

0:13:58

0:01:00

0:01:00

0:10:08

0:10:08

0:09:39

0:09:39

0:09:39

0:09:39

0:08:21

0:08:21

0:03:38

0:03:38

0:11:42

0:11:42

0:05:27

0:05:27

0:10:32

0:10:32