filmov

tv

How To Calculate Find The Sales Tax Rate Or Percentage - Formula For Calculating Sales Tax Rate

Показать описание

In this video we cover how to calculate the sales tax rate on something you purchase. We go through an example and go through the formula for calculating the sales tax rate.

Transcript/notes

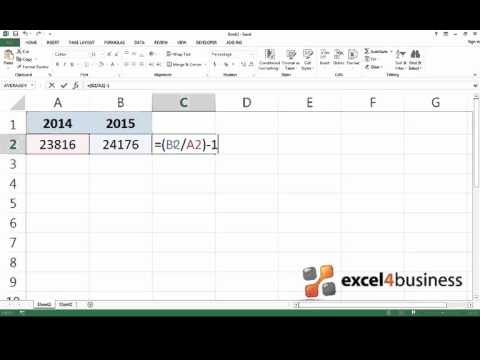

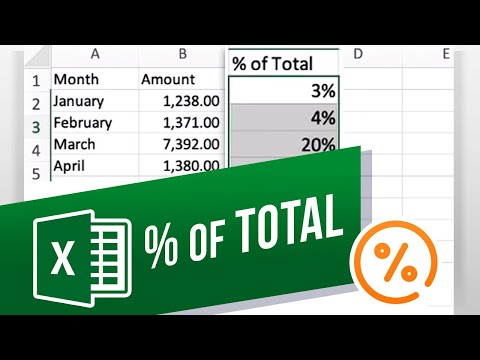

The formula for calculating the sales tax rate on an item or items is sales tax rate equals sales tax paid divided the pre tax cost of the item, or items. And we can write this as sales tax paid over the pre tax cost of the item, or items.

For example lets say that you buy a new pair of shoes, and the total cost of the shoes was $84.00. The subtotal, or pre tax total was $76 and the sales tax was $8.00. What is the sales tax rate?

To find the rate, we use the formula of sales tax rate equals sales tax paid divided the pre tax cost of the shoes. So, we have $8, the sales tax paid, divided by $76, the pre tax cost of the shoes.

Using a calculator, 8 divided by 76 gives us an answer of 0.1053 rounding off. Next we need to convert the decimal to a percent, and we do this by moving the decimal 2 places to the right and attaching a percent sign, and we have 10.53% as a final answer of the rate of sales tax paid for the shoes.

Timestamps

0:00 Formula for calculating the sales tax rate

0:10 Example of calculating the sales tax rate

0:42 Convert the decimal to a percent

Transcript/notes

The formula for calculating the sales tax rate on an item or items is sales tax rate equals sales tax paid divided the pre tax cost of the item, or items. And we can write this as sales tax paid over the pre tax cost of the item, or items.

For example lets say that you buy a new pair of shoes, and the total cost of the shoes was $84.00. The subtotal, or pre tax total was $76 and the sales tax was $8.00. What is the sales tax rate?

To find the rate, we use the formula of sales tax rate equals sales tax paid divided the pre tax cost of the shoes. So, we have $8, the sales tax paid, divided by $76, the pre tax cost of the shoes.

Using a calculator, 8 divided by 76 gives us an answer of 0.1053 rounding off. Next we need to convert the decimal to a percent, and we do this by moving the decimal 2 places to the right and attaching a percent sign, and we have 10.53% as a final answer of the rate of sales tax paid for the shoes.

Timestamps

0:00 Formula for calculating the sales tax rate

0:10 Example of calculating the sales tax rate

0:42 Convert the decimal to a percent

Комментарии

0:00:30

0:00:30

0:32:02

0:32:02

0:05:18

0:05:18

0:00:59

0:00:59

0:01:44

0:01:44

0:12:11

0:12:11

0:03:44

0:03:44

0:00:56

0:00:56

0:01:12

0:01:12

0:05:42

0:05:42

0:00:31

0:00:31

0:02:43

0:02:43

0:04:07

0:04:07

0:10:16

0:10:16

0:03:18

0:03:18

0:13:35

0:13:35

0:00:39

0:00:39

0:16:21

0:16:21

0:00:36

0:00:36

0:06:15

0:06:15

0:05:48

0:05:48

0:07:14

0:07:14

0:14:11

0:14:11

0:01:13

0:01:13