filmov

tv

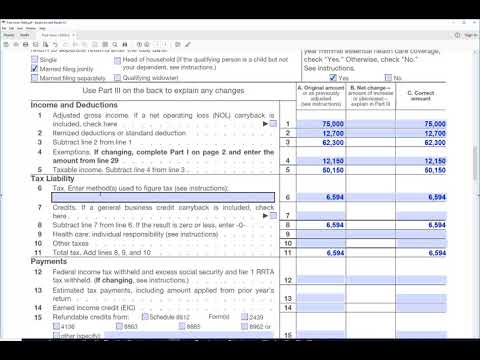

How To Fill Out IRS Form 1040 For 2021 / Text “ENROLL” to 904-752-0766 for Tax Preparation

Показать описание

We are assisting individuals with tax preparation services! Please be sure to book early for $100 for personnl state and deferal returns on our website! $250 for small businesses! CALL Customer Service Number: (904) 752-0766 help with tax preparation! We have lots of deals available so be sure to book on www.TinaesWM.net!

Disclaimer: I am not a CPA/Accountant. I am a PTIN holder and this does not consist as tax advice!

Da’zjon Tinae, the owner of Tinae’s Wealth Management, is the author of 8 amazing books that were written and published by himself on Amazon. Please take the time to check out the content as it can help you with life, credit, finances, and business. I promise that this will be a great decision for you !

The Benefits of Starting a Small Business

Financial Management For Couples

The Principles of Stock Market Investing

The Essentials of Good Credit by Da’zjon Tinae, MBA

Life, Finances & Opportunity by Da’zjon Tinae, MBA

The Importance of Budgeting

The Power of Investments

The Finance Alphabet

Disclaimer: I am not a CPA/Accountant. I am a PTIN holder and this does not consist as tax advice!

Da’zjon Tinae, the owner of Tinae’s Wealth Management, is the author of 8 amazing books that were written and published by himself on Amazon. Please take the time to check out the content as it can help you with life, credit, finances, and business. I promise that this will be a great decision for you !

The Benefits of Starting a Small Business

Financial Management For Couples

The Principles of Stock Market Investing

The Essentials of Good Credit by Da’zjon Tinae, MBA

Life, Finances & Opportunity by Da’zjon Tinae, MBA

The Importance of Budgeting

The Power of Investments

The Finance Alphabet

How to fill out the IRS Form W4 2023

How to Fill out IRS Form 941: Simple Step-by-Step Instructions

How to fill out IRS form W4 Married Filing Jointly 2023

How to Fill out IRS Form SS-4

How to fill out IRS Form 433-A OIC - 2022

How to fill out IRS form W4 SINGLE 2023

How to Fill out IRS Form 2553: Easy-to-Follow Instructions

Filing Information Returns Electronically with the IRS

How to STOP a Wage Garnishment Immediately

How to File Taxes For the First Time: Beginners Guide from a CPA

First Time Filing a Tax Return?

IRS Form 1040-X | How to File an Amended Tax Return

How to fill out IRS Form W-4P

How to Fill out IRS Form 2553 | S Corp Election | Complete Instructions

Fill IRS Manually Step by Step in Portugal ! For single or married person

Filling out IRS Form 8832: An Easy-to-Follow Guide

How to fill out IRS FORM W4 Multiple jobs 2022

How to fill out IRS Form W 4 Exempt

How the IRS catches you for Tax Evasion

How to fill out IRS Form W4 2022 with a SECOND JOB

1040sr for Seniors. Step by Step Walkthrough of Senior Tax Return 1040SR. New IRS Form 1040-SR

IRS Form W4 TAX ADJUSTMENT

How to Fill Out IRS Form 2553

How to fill out Form 1040X, Amended Tax Return

Комментарии

0:14:33

0:14:33

0:15:15

0:15:15

0:10:56

0:10:56

0:13:01

0:13:01

0:27:49

0:27:49

0:14:39

0:14:39

0:10:36

0:10:36

0:00:42

0:00:42

0:08:59

0:08:59

0:09:38

0:09:38

0:03:40

0:03:40

0:08:37

0:08:37

0:14:50

0:14:50

0:26:42

0:26:42

0:09:55

0:09:55

0:09:29

0:09:29

0:05:11

0:05:11

0:06:09

0:06:09

0:00:54

0:00:54

0:13:59

0:13:59

0:10:32

0:10:32

0:09:13

0:09:13

0:05:44

0:05:44

0:05:41

0:05:41