filmov

tv

The top 4 most important drawdown pension features to help you retire successfully

Показать описание

4Forty4 S1Ep8

Welcome to the channel. I'm Huw - a retirement specialist and money coach at Proposito Financial Planning based in the heart of the Cotswolds. On this channel we explore the tools, strategies and money habits that can help us maximise our LifeForce - our TIME, ENERGY & ABILITY - so we can live a life with more meaning and more happiness.

In this 4Forty4 Huw compares Flexi-access drawdown (FAD) and uncrystallised funds pension lump sum (UFPLS) when looking to drawdown money from a pension.

00:00 - Intro

2:40 - UFPLS is less flexible

3:43 - UFPLS reduces the annual allowance

4:27 - UFPLS is less effort to administer

5:08 - UFPLS can have a slightly higher lifetime allowance

Huw is a chartered financial planner and certified financial planner.

Risk Warnings

Proposito Financial Planning is authorised and regulated by the Financial Conduct Authority. The value of investments can fall as well as rise. You may not get back the amount originally invested. Capital at risk. Past performance is not a guide to future returns.

This video does not constitute financial advice.

Welcome to the channel. I'm Huw - a retirement specialist and money coach at Proposito Financial Planning based in the heart of the Cotswolds. On this channel we explore the tools, strategies and money habits that can help us maximise our LifeForce - our TIME, ENERGY & ABILITY - so we can live a life with more meaning and more happiness.

In this 4Forty4 Huw compares Flexi-access drawdown (FAD) and uncrystallised funds pension lump sum (UFPLS) when looking to drawdown money from a pension.

00:00 - Intro

2:40 - UFPLS is less flexible

3:43 - UFPLS reduces the annual allowance

4:27 - UFPLS is less effort to administer

5:08 - UFPLS can have a slightly higher lifetime allowance

Huw is a chartered financial planner and certified financial planner.

Risk Warnings

Proposito Financial Planning is authorised and regulated by the Financial Conduct Authority. The value of investments can fall as well as rise. You may not get back the amount originally invested. Capital at risk. Past performance is not a guide to future returns.

This video does not constitute financial advice.

Top 4 MOST Important Lessons I Learned As an Entrepreneur in Tech Sales

Fans Said These Were the Top 10 Most Important Episodes - The Office US

Fans Said These Were the Top 10 Most Important Episodes | Brooklyn Nine-Nine

Top 10 Most Famous School In The World 2023 | Famous Schools | #shorts #short #school

Is it Time For Europe to Ditch America?

TOP 4 Most essential crops in Minecraft

Top 4 Simple diy Projects // Most Essential electronic Tools for all

I Found a Prehistoric Building on Top of America’s Most Famous Mountain

Liberty Lens: Top 4 Most CONTROVERSIAL Trump Cabinet Appointees

Top 4: Most Important Defensive Players to Watch this Spring

Top 10 most beautiful car//famous//#top10 #viral #shorts 2023 cars

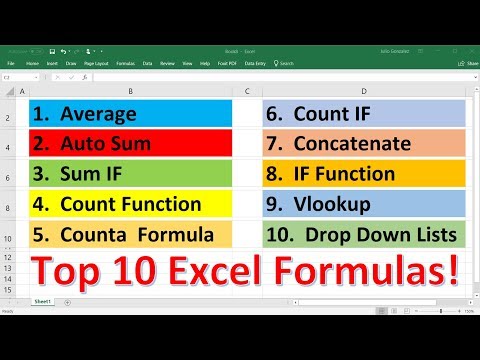

Top 10 Most Important Excel Formulas - Made Easy!

What is the most important influence on child development | Tom Weisner | TEDxUCLA

Class 12 Chemistry | Chapterwise Most Important Topics of Chemistry | Score 95+ in Boards 2025

Top 12 MOST IMPORTANT Macbeth Quotes #macbeth #shakespeare #gcseenglish #gcserevision

Learn German in 45 minutes! The TOP 100 Most Important Words - OUINO.com

Top 4 Useful School Student Gadgets #gadgets #shorts #unboxing #viral

The Most Important Lesson I Can Teach You (Day Trading Secrets)

Top 4 Most Famous K-pop Idols |👆#bts #kpopfactmedia #kpopidols #nancy

top 4 most famous paintings in the world #viral #shortfeed #creatorstudio #aham #youtubeshorts

Top 10 Most Famous Monuments Of India #shorts #shortsfeed #viralshort #india #amazing

The Most Important 2A Video You Will Watch All Week...

TOP 3 USEFUL MINECRAFT WEBSITES!

🔥Top Best Useful Gadgets In The World | Amazon Gadgets #gadgets

Комментарии

0:09:44

0:09:44

0:29:17

0:29:17

0:34:08

0:34:08

0:00:25

0:00:25

0:09:16

0:09:16

0:00:43

0:00:43

0:04:49

0:04:49

0:22:18

0:22:18

0:54:49

0:54:49

0:04:42

0:04:42

0:00:37

0:00:37

0:27:19

0:27:19

0:08:42

0:08:42

0:21:26

0:21:26

0:13:19

0:13:19

0:44:19

0:44:19

0:00:36

0:00:36

0:17:01

0:17:01

0:01:01

0:01:01

0:00:13

0:00:13

0:00:23

0:00:23

0:17:50

0:17:50

0:00:27

0:00:27

0:00:24

0:00:24